US Auto Sales Slowdown Analysis: Economic Implications and Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the MarketWatch report [1] published on November 4, 2025, which indicates that American consumers who had boosted the economy during spring and summer by purchasing new cars to beat U.S. tariffs and take advantage of expiring tax breaks are now showing reduced automotive purchasing activity.

The market reaction was immediate and significant across the automotive sector. Ford Motor (F) declined 1.65% to $12.79, General Motors (GM) fell 1.61% to $67.12, and Tesla (TSLA) dropped 4.05% to $449.42 on November 4, 2025 [0]. The broader market also showed weakness, with the S&P 500 down 0.13%, NASDAQ Composite down 0.04%, and Dow Jones Industrial down 0.21% [0]. The Consumer Cyclical sector showed minimal positive movement of only 0.10%, suggesting weakness in consumer discretionary spending [0].

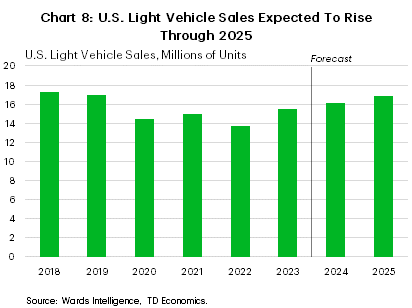

However, industry forecasts present a more complex picture. J.D. Power-GlobalData projects November 2024 new-vehicle sales to reach 1,361,200 units, a 6.7% increase from November 2023 on a selling-day adjusted basis [2]. Cox Automotive expected a steady SAAR of 16.0 million units for November 2024 [3], and J.D. Power anticipated consumers would spend nearly $50 billion on new vehicles in November 2024, a 13.7% increase year-over-year [2].

The automotive sector serves as a crucial leading economic indicator due to several factors. Auto sales represent significant discretionary purchases that reflect consumer confidence and financial health, while impacting employment across multiple sectors including manufacturing, finance, and retail. The previous surge in car buying was driven by consumers attempting to beat impending U.S. tariffs on imported vehicles and take advantage of expiring tax breaks, particularly EV tax credits [1].

This aligns with recent developments showing Hyundai and Ford reported declines in EV sales after tax credits ended [4]. Ford’s CEO has mentioned that $30,000 EVs are “right around the corner” [5], suggesting the company is adjusting to the new incentive landscape without government subsidies.

The mixed signals between current market weakness and positive industry forecasts create uncertainty about the trajectory. While immediate market sentiment appears negative, the underlying fundamentals may still support growth, albeit at a moderated pace compared to the tariff-driven surge.

The analysis reveals several risk factors that warrant attention. A sustained auto sales slowdown could signal broader consumer confidence decline and weakness in consumer spending, which accounts for approximately 70% of U.S. economic activity. Auto industry employment could be affected by reduced production needs, and banks and financing companies with auto loan concentrations may face increased credit risk if economic conditions deteriorate [0].

The technical indicators [0] show warning signals that historically correlate with broader market weakness when automotive sector leadership falters. The significant decline in Tesla shares (4.05%) compared to traditional automakers suggests particular concern about the EV market transition without tax incentives.

Despite the current slowdown, several factors present potential opportunities. The industry’s projected growth of 6.7% year-over-year [2] indicates underlying demand strength. Manufacturers adapting to the post-incentive environment, such as Ford’s focus on $30,000 EVs [5], may capture market share. The record spending projection of nearly $50 billion [2] suggests consumers maintain significant purchasing power for major purchases.

Auto sales are transitioning from a period of policy-driven surge to market-normal demand levels. The spring and summer boost was artificially inflated by consumers rushing to beat tariffs and expiring tax breaks [1]. Current market weakness reflects this normalization rather than necessarily indicating fundamental economic deterioration.

Critical monitoring indicators include monthly auto sales reports for November and December 2025, dealer inventory levels, manufacturer incentive spending, interest rate environment, and consumer confidence indices [0]. The automotive sector’s performance will be crucial for economic growth assessment, monetary policy considerations, and investment allocation strategies.

The data [0] suggests that while immediate market sentiment is negative, the longer-term outlook may be more balanced as the industry adjusts to new policy realities and consumer preferences evolve in the post-incentive environment.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.