Comprehensive Analysis of Popular Driving Factors and Risks for Accelink Technologies (300620.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the popular list information from tushare_hot_stocks [0]. Accelink Technologies (300620.SZ) has recently become a market focus. On November 25, 2025, its stock price hit the daily limit (+20%) to 147 yuan, with a turnover of 6.545 billion yuan and a turnover rate of 19.11% [0]. Core driving factors include the sharp rise in the CPO concept sector, surging demand for optical modules in AI data centers, quantum technology concept support, and high performance growth (106.61% year-on-year increase in net profit in the first three quarters) [0].

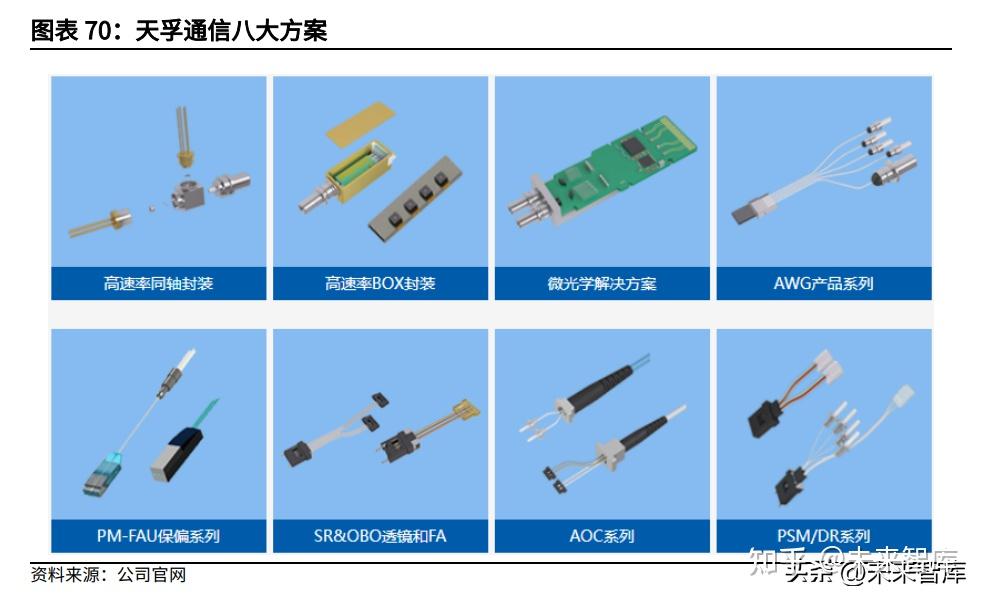

Accelink Technologies is a leading domestic enterprise in the field of optical fiber devices and lidar. Its main business covers fiber laser devices, optical communication devices, and lidar light source modules [0]. Recent popularity stems from multiple catalysts:

- CPO concept boom: As a CPO leader, it benefits from the growth of the optical module market driven by AI computing power demand. The OFC2025 report points out strong demand for 400G/800G optical modules [3];

- AI data center demand: AI data center construction drives surging demand for optical modules [3];

- Quantum technology concept: Included in quantum technology concept stocks, increasing market attention [0];

- Performance support: Net profit in the first three quarters was 115 million yuan, up 106.61% year-on-year [0].

- Cross-domain collaboration: Cross-demand in AI, 5G/6G, autonomous driving and other fields promotes the expansion of the company’s product application scenarios [0];

- Technical barriers: Mastering internationally advanced technologies such as lithium niobate modulator chip manufacturing processes, consolidating industry position [0];

- Sector rotation effect: Active rotation of CPO and computing power hardware sectors drives the overall rise of the optical communication sector [0].

- Risk points:

- High Valuation Risk: Dynamic P/E ratio of 198.54x; if performance growth is lower than expected, it may face a correction [0];

- Industry Competition: Intensified competition in optical communication and lidar fields, rapid technological iteration [0];

- Market Volatility: As a popular concept stock, its price is easily affected by capital flows [0].

- Opportunities:

- AI and New Infrastructure Dividends: Digital economy and intelligent manufacturing policies drive demand growth [0];

- Lidar Market: Demand expansion in autonomous driving and robot fields [0].

Accelink Technologies deeply benefits from emerging industry trends such as AI, optical communication, and quantum technology, with strong recent performance. However, attention should be paid to high valuation and industry competition risks. Investors should make decisions based on their own risk tolerance and long-term industry trends.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.