Analytical Report: Lower vs Higher Time Frame Trading Debate and Key Considerations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

A Reddit discussion examines the advantages and disadvantages of lower time frame trading (e.g., 1-minute,5-minute charts) compared to higher time frames (e.g., daily, weekly). Participants highlight faster feedback loops and tighter stop losses as key benefits of lower time frames, while liquidity constraints and scaling challenges are major drawbacks. The debate also emphasizes personal suitability (schedule, temperament), the need for strict rules to mitigate noise in lower time frames, and non-time-based charts (range, tick) as potential alternatives to time-based frames.

- Faster Feedback & Frequent Trades: Lower time frames enable more trades daily, allowing a trader’s edge (win rate + risk-reward ratio) to play out quicker and reduce randomness in results [1].

- Tighter Stop Losses: Shorter holding periods allow closer stop losses, enabling profitability even with more losing trades [1].

- Liquidity Constraints: Lower time frames face liquidity bottlenecks, limiting scaling potential and capping income [1,2].

- Personal Suitability: Time frame choice depends on individual factors like work schedule and patience—five-minute charts suit those comfortable with quick decisions [1,4].

- Strict Rules Requirement: Successful lower time frame trading needs well-defined rules and discipline to filter noise and false signals [1].

- Non-Time-Based Alternatives: Range, tick, or point-and-figure charts (ignoring time) better represent market structure than time-based frames [1,3].

##3. In-Depth Analysis

Lower time frames (e.g., scalping) execute more trades daily, so a trader’s edge (e.g.,55% win rate with1:2 risk-reward) plays out over hours instead of days/weeks. This reduces the impact of random market movements, leading to fewer “red days” [1].

Shorter holding periods allow stop losses to be placed closer to entry prices, lowering risk per trade. Even with a40% win rate, a1:3 risk-reward ratio (enabled by tight stops) can yield net profits [1]. Investopedia notes scalping relies on tight bid-ask spreads and quick exits to maximize small gains [2].

Lower time frame strategies require high liquidity to enter/exit positions without slippage. As traders scale positions, larger orders can move the market, eroding profits. This caps income for scalpers—no major scalper achieves seven-figure annual returns due to liquidity limits [1,2].

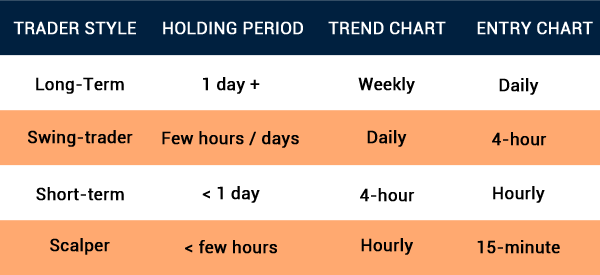

Time frame choice aligns with temperament: Intraday traders (lower time frames) need to act quickly, while swing traders (higher time frames) require patience. Investopedia links five-minute charts to traders who prefer immediate decision-making [4].

Lower time frames have more false signals (noise). Strict rules (e.g., only trading in the direction of the higher time frame trend, using volume filters) are essential to avoid emotional decisions and overtrading [1].

Range charts create bars based on price changes, tick charts on trade counts—both ignore time. This better represents market structure, as time is not a fundamental driver of price movement. Point-and-figure charts (a non-time-based type) focus solely on price, helping identify clear trends without time-induced noise [3].

##4. Impact Assessment

- Performance: Lower time frames offer quicker profits but demand constant attention and discipline. Higher time frames reduce stress but require longer holding periods [1,4].

- Scaling: Scalpers face income caps due to liquidity—scaling beyond $100k in capital becomes impractical for most lower time frame strategies [2].

- Alternative Strategies: Non-time-based charts balance quick feedback (like lower time frames) with reduced noise (like higher time frames), but have a steep learning curve [3].

- Liquidity Demand: Lower time frame traders concentrate on highly liquid assets (e.g., S&P500 futures, major currency pairs) to minimize slippage [2].

- Rule-Based Trading: The debate underscores that automated or semi-automated systems are more effective in lower time frames, as they eliminate emotional bias [1].

##5. Key Information Points & Context

- No Universal Best Time Frame: Success depends on aligning time frame with individual preferences and constraints.

- Risk Management: Tighter stops in lower time frames reduce per-trade risk but require more trades to achieve meaningful returns.

- Noise Filtering: Lower time frame traders must use technical indicators (e.g.,RSI,MACD) or price action rules to filter false signals [1].

##6. Information Gaps Identified

- Empirical Success Rates: No data on long-term success rates of lower vs higher time frame traders.

- Asset Class Differences: Insufficient info on how asset classes (stocks vs forex vs crypto) influence time frame suitability.

- Non-Time-Based Performance: No comparative metrics for non-time-based charts vs time-based frames.

- Scaling Limits: Lack of specific data on liquidity thresholds for scaling lower time frame strategies.

[1] Reddit Post: “Are there any advantages to trading lower time frames as compared to higher ones?” (Event Content,2025).

[2] Investopedia. “Scalping Strategies: Mastering Quick Profits in the Market.” URL: https://www.investopedia.com/articles/trading/05/scalping.asp.

[3] Investopedia. “Understanding Point and Figure Charts: A Guide to Long-Term Investing.” URL: https://www.investopedia.com/articles/technical/03/081303.asp.

[4] Investopedia. “Top4 Things Successful Forex Traders Do.” URL: https://www.investopedia.com/articles/forex/09/5-important-forex-attributes.asp.

[5] Investopedia. “Master Trading With Multiple Time Frames.” URL: https://www.investopedia.com/articles/trading/07/timeframes.asp.

Note: References [2-5] are from web search results cited in the analysis.

Reddit post is Tier3 (user-generated content) and should be interpreted with caution.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.