AI Stocks Drive S&P 500 Higher Amid Market Concentration Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Barrons report [1] published on November 3, 2025, which highlighted AI stocks powering the S&P 500 higher amid market concerns about concentration and the return of special purpose vehicles.

The market rally on November 3, 2025, was primarily driven by artificial intelligence developments, creating a notable divergence between major indices. The S&P 500 gained 0.17% to close at 6,851.97, while the Nasdaq Composite advanced 0.46% to 23,834.72 [0]. However, the Dow Jones Industrial Average fell 0.48% to 47,336.69 [0], indicating uneven market participation.

The primary catalyst was Amazon’s announcement of a seven-year, $38 billion agreement with OpenAI to provide cloud computing services through AWS [2][3]. This deal allows OpenAI to access hundreds of thousands of Nvidia graphics processors for AI model training and deployment [2]. Amazon’s stock surged 4.0% to close at a record high of $254.00 [0][4], while NVIDIA shares rose 2.17% to $206.88 following geopolitical developments regarding AI chip exports [2][3].

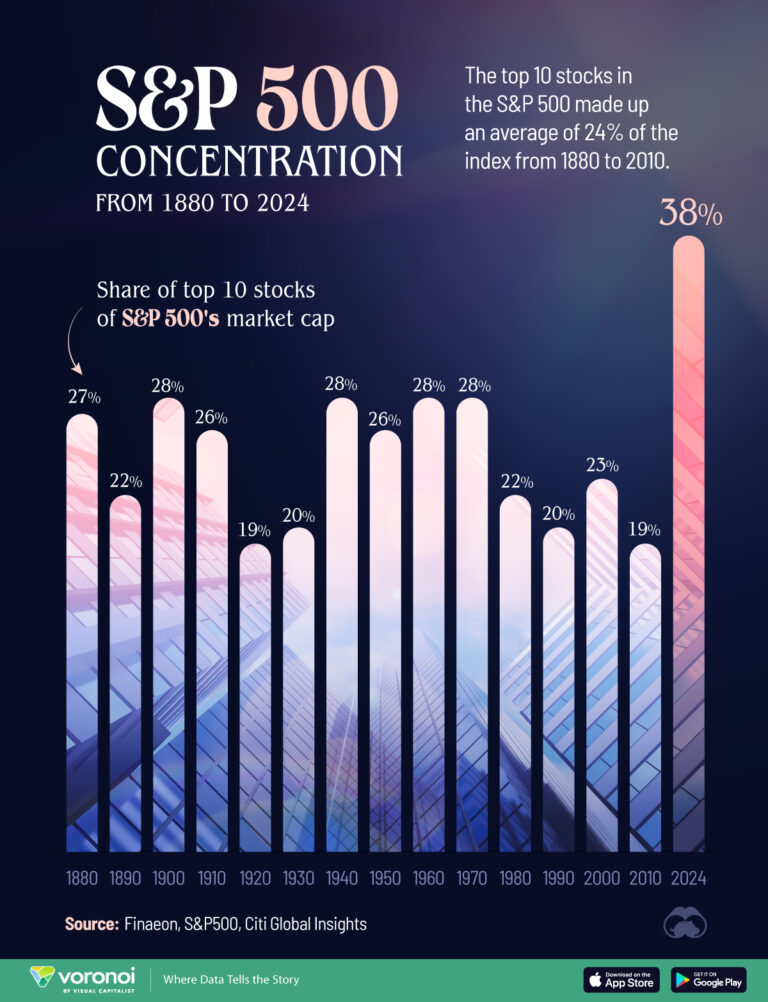

Despite headline gains, market internals revealed significant weakness. More than 300 stocks in the S&P 500 ended the day lower [5], indicating that the rally was driven by a narrow segment of AI-related stocks. This concentration suggests limited market participation and potential vulnerability if AI momentum falters.

Sector performance showed mixed results [0]:

- Consumer Defensive: +1.39%

- Healthcare: +0.43%

- Consumer Cyclical: +0.27%

- Technology: -0.74%

- Basic Materials: -2.05%

- Communication Services: -2.97%

- AI Sustainability Concerns:Massive AI infrastructure spending without clear return on investment raises bubble concerns [3]

- Market Breadth Weakness:With over 300 S&P 500 stocks declining, the rally’s narrow base increases correction risk [5]

- Regulatory Scrutiny:Potential antitrust review of big tech dominance in AI could emerge

- Economic Data Gaps:Ongoing government shutdown limits access to official economic indicators [2]

- Cloud Infrastructure Demand:The Amazon-OpenAI deal validates the critical role of cloud providers in AI development [2][3]

- Semiconductor Growth:Continued AI chip demand supported by geopolitical factors and enterprise adoption

- Diversification Benefits:Consumer Defensive sector’s strong performance (+1.39%) suggests rotation opportunities [0]

The November 3 market session demonstrated AI’s continued influence on market dynamics, with the Amazon-OpenAI deal serving as a key catalyst [2][3]. Amazon’s record-high close at $254.00 reflects strong market confidence in the company’s AI strategy and AWS positioning [4]. The divergent performance between indices highlights market concentration risk, with technology sector underperformance (-0.74%) despite AI gains suggesting broader tech weakness [0].

The combination of high valuations, uncertain economic data due to the government shutdown, and geopolitical tensions creates a complex risk environment. While AI infrastructure spending continues to drive growth for select companies, the narrow market participation and below-average trading volume suggest caution regarding the sustainability of the current rally [2][5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.