Rob Lowe's Beverly Hills Home Sale: Analysis of Price Adjustments and Market Context (2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

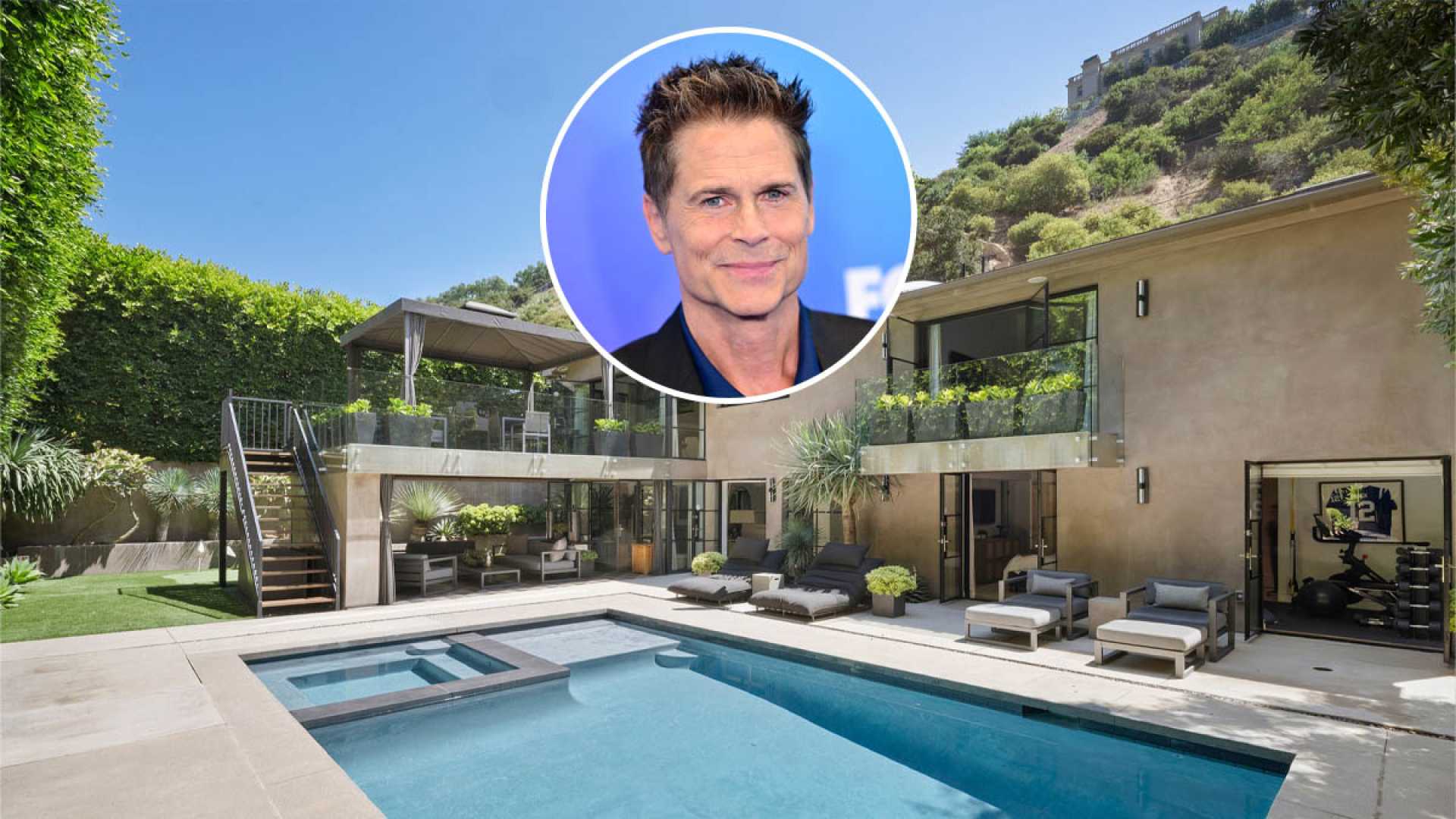

Actor Rob Lowe sold his Beverly Hills estate for $4 million in November 2025 after over a year on the market, a $2.6 million reduction from his original $6.6 million asking price [1][4]. The sale process included a series of price adjustments: initial listing at $6.6M → December 2024 cut to $5.5M → January 2025 increase to $5.6M → subsequent cuts in March, May, July → removal from market in August → relisting in September with new agents at $4.195M → final sale at $4M [5]. The agent change to Lori Harris (Keller Williams) and Shana Tavangarian (Carolwood Estates) was a key turning point, leading to a realistic price reset and a pending sale within a month [5].

The modest ~$250k profit over five years represents a ~6.6% return, below historical Beverly Hills appreciation rates (8-10% annually), indicating potential market softening or initial overpricing [4]. This sale underscores that even celebrity-owned luxury properties face challenges in a market where buyers resist overvalued listings [1][5].

- Pricing Strategy Criticality: Aggressive price adjustments (36% below original ask) and agent change were essential to unlocking the sale, demonstrating alignment with market realities is non-negotiable in 2025 luxury real estate.

- Market Trend Reflection: The long time on market and modest profit signal headwinds in the Beverly Hills luxury segment, where even high-profile properties require adaptive strategies.

- Opportunity Cost: The below-expected returns highlight the cost of mispricing, as funds could have yielded higher returns in alternative investments.

- Risks: Luxury property sellers face extended time on market and opportunity cost if initial pricing misaligns with market conditions. Overpricing may lead to significant reductions and modest returns [4][5].

- Opportunities: Strategic agent changes and listing resets can unlock sales in challenging markets— the new agent team secured a sale within two months of relisting at a realistic price [5].

- Timeline: Listed ~November 2024 → sold November 6, 2025 (1+ year on market).

- Financials: Original ask $6.6M → final sale $4M (36% reduction); ~$250k profit over five years [4].

- Property Features: Pool/spa, covered patio with fireplace, private putting green, fire pit [5].

- Agent Change: Switched to Harris/Tavangarian in September 2025, leading to relisting and sale [5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.