2025 November Market Insights: Index Valuation, Real Estate Acquisition & Baijiu Export to Russia

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- A-share overall valuation is moderately low (PE 30-50% percentile), with CSI 300 and SSE 50 valuations reasonable; ChiNext and STAR 50 have obvious corrections and are worth allocating.

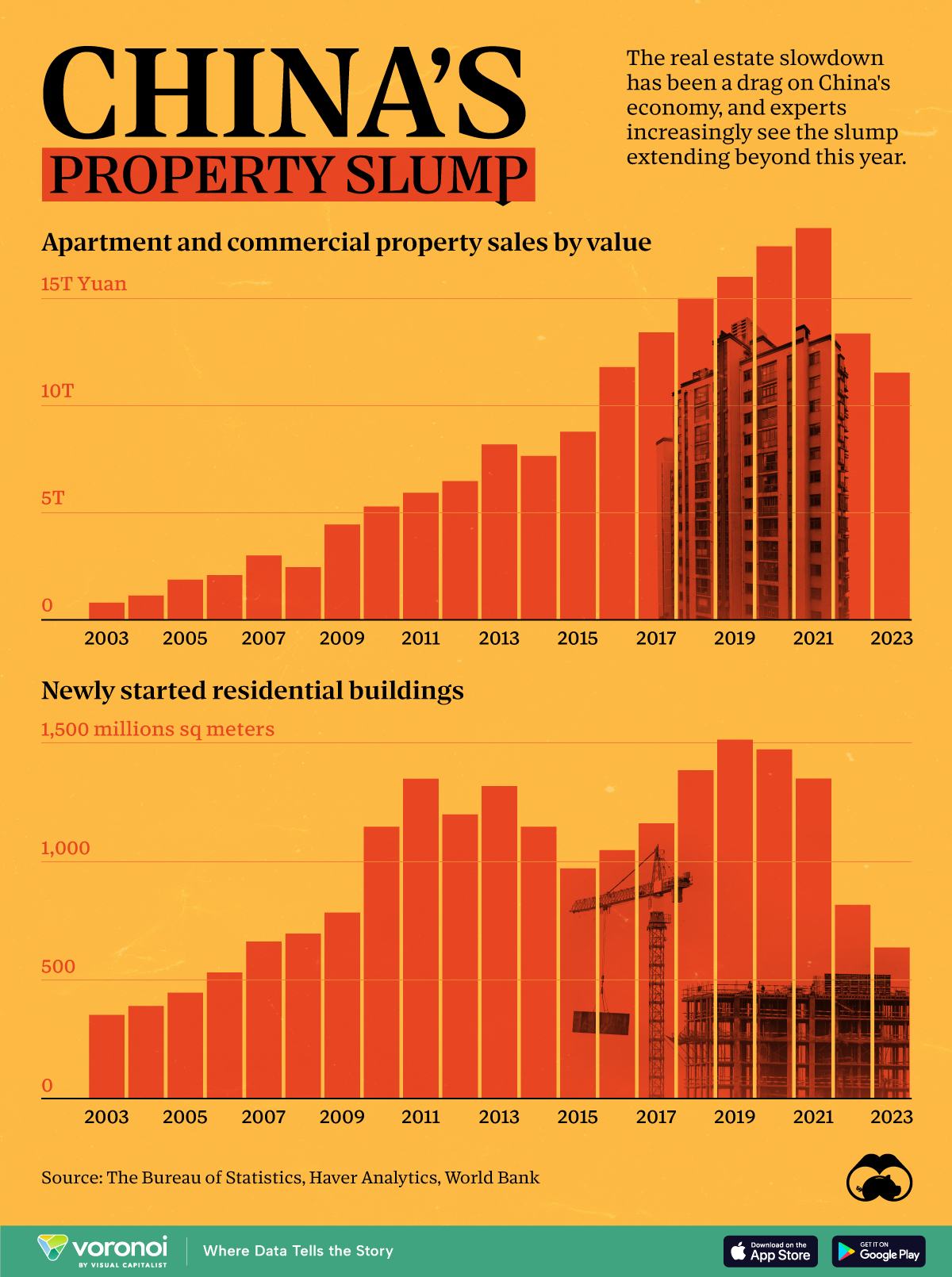

- Real estate acquisition policies are accelerating: 11 provinces have launched commercial housing acquisition, the central bank has set up 300B yuan affordable housing reloan, Guangzhou relaxed acquisition conditions, and Shanghai implemented housing ticket system.

- Baijiu export to Russia: Russia is an important market; 2023 saw significant growth; 2025 Jan-Oct Sino-Russian trade growth supports exports; leading brands include Moutai, Wuliangye.

- Reddit Users: This week’s A-share correction (ChiNext/STAR led with >9% drop) has no obvious negative news; main reason is short-term overvaluation. Strategy: Low position, add to low-valued targets on dips, oppose full-position bull bet, prefer structural market.

- Xueqiu User (巍巍昆仑侠): This week CSI300 dropped 4.8%, CSI500 7%, ChiNext/STAR 9%+/9.2%; strategy: Low position (retracement below market), add to long-term framework targets on dips; real estate acquisition accelerates; Baijiu export to Russia progresses positively (channel penetration, cultural recognition).

Both research and social media agree on short-term market correction due to overvaluation, real estate policy support, and Baijiu export potential to Russia. Investment implications: Focus on low-valued blue chips (CSI300/SSE50), real estate stocks benefiting from acquisition policies, and Baijiu brands with strong overseas presence (e.g., Moutai SH600519).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.