Analysis of the Strong Performance of Feiwo Technology (301232): Driven by Earnings Growth and Concept Resonance

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the strong stock pool information from tushare_strong_pool [0]. Feiwo Technology (301232) has recently seen strong stock price performance, rising from around 47 yuan to 58.15 yuan [0]. The core driving factors include better-than-expected Q3 earnings growth, increased popularity of robot and nuclear power concepts, and continuous market capital inflow, forming a resonance effect of fundamentals, themes, and sentiment.

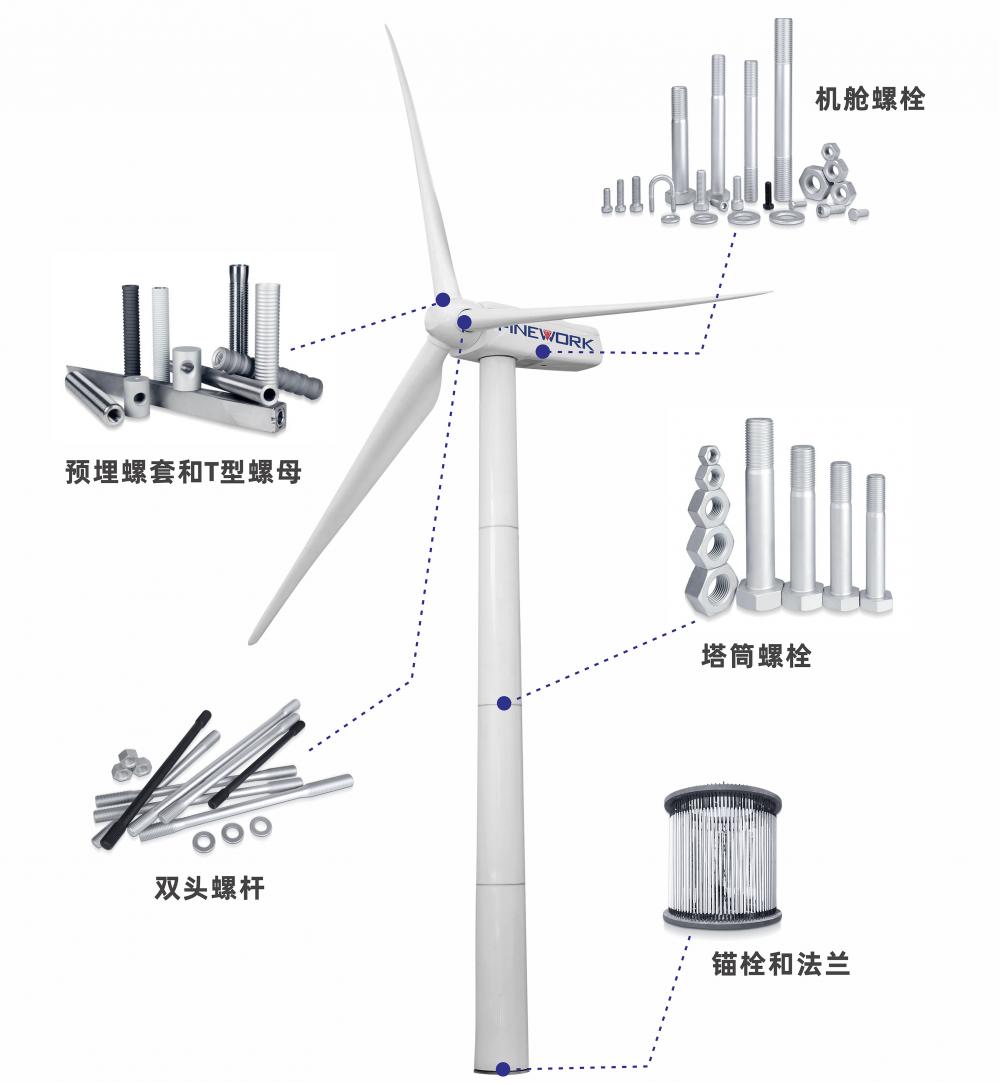

Feiwo Technology’s 2025 Q3 report shows that revenue increased by 57.46% year-on-year to 1.898 billion yuan, and net profit increased by 163.26% year-on-year to 45.9932 million yuan [0]. The performance growth rate is significantly higher than the industry average. As a leader in wind power fasteners, the company’s technical accumulation in high-end manufacturing has laid the foundation for its expansion into robot and nuclear power businesses [0].

The company benefited from the outbreak of the robot concept, achieving a 20cm limit-up on October 20 and becoming one of the core targets in the sector [4]; at the same time, the nuclear power concept continued to strengthen, and the company’s technical advantages and market position in the nuclear power equipment manufacturing field further increased its attention [0]. The superposition of the two popular concepts drove the stock price to rise rapidly [1].

Recently, market capital inflow has been obvious, with a net financing purchase of 6.1132 million yuan on November 21 [2], and transaction activity has increased significantly. Institutional attention has increased, investor relations activities are frequent, and market expectations are positive [0].

- Resonance Effect: The resonance of earnings growth (fundamentals), concept popularity (themes), and capital inflow (sentiment) is the core logic behind the strong stock price.

- Business Expansion Potential: Business expansion in the robot and nuclear power fields is expected to become an important engine for the company’s future earnings growth [0].

- Valuation and Risk Balance: The stock price has risen significantly in the short term, so attention should be paid to the sustainability of performance and the risk of concept fading [0].

- Concept Fading Risk: If the robot and nuclear power concepts cool down, it may lead to a stock price correction [1][4].

- Valuation Pressure: The stock price has risen significantly in the short term, and valuation needs continuous performance verification [0].

- Increased Industry Competition: Competition in the high-end fastener field may affect the company’s profit margin [0].

- Policy Dividends: Policies related to new energy and high-end manufacturing may bring additional benefits to the company [6].

- Business Expansion: The growth in market demand in the robot and nuclear power fields is expected to promote the expansion of the company’s business scale [0].

The strong performance of Feiwo Technology (301232) is the result of the combined effect of fundamental improvement and market sentiment. Investors should pay attention to the sustainability of Q3 earnings, changes in the popularity of concept themes, and valuation levels, and make rational investment decisions based on their own risk preferences.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.