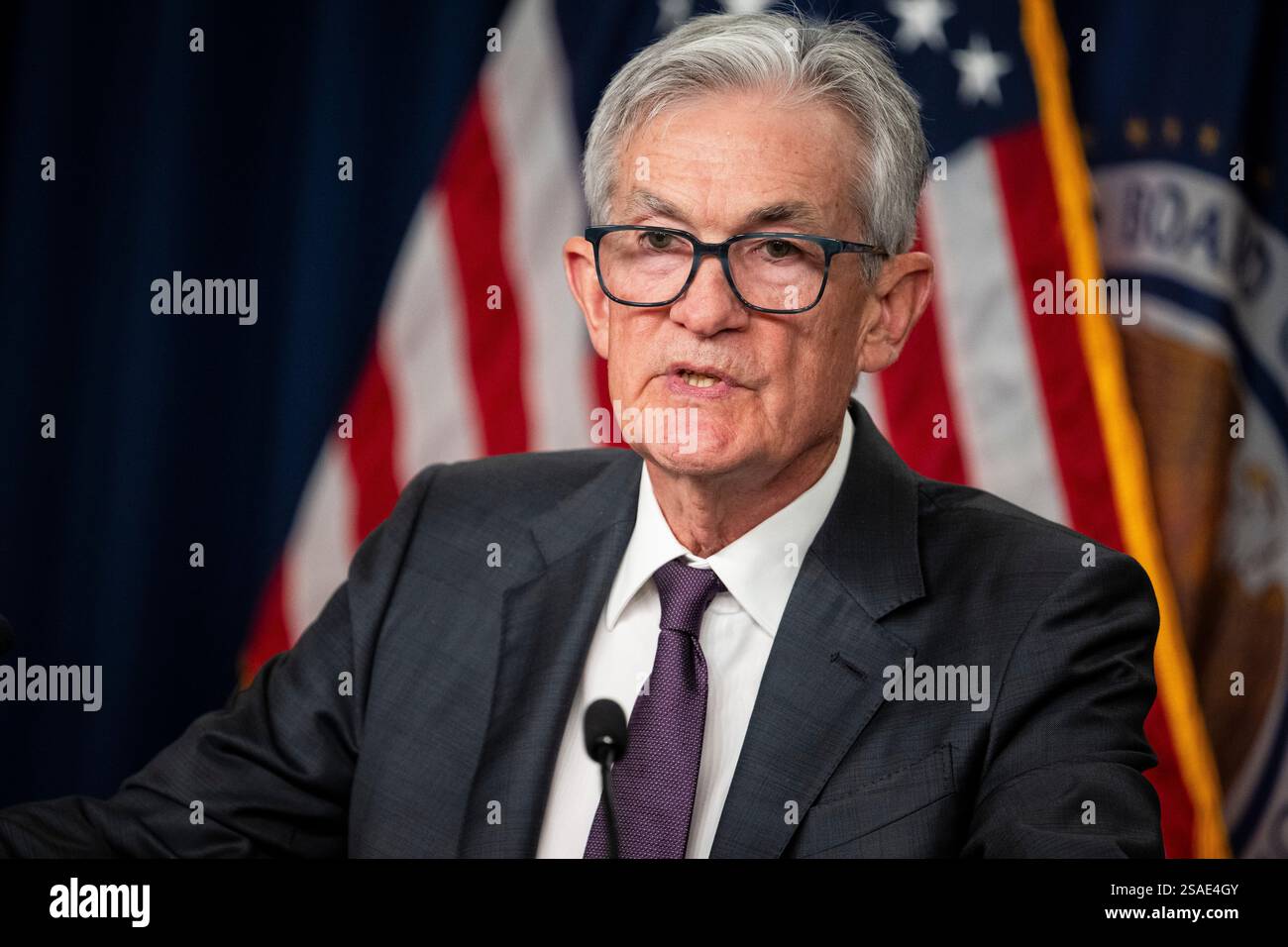

Fed Policy Mistake Fears Fuel Market Volatility: 2025 Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The analysis is rooted in the Seeking Alpha report [1] highlighting Federal Reserve policy mistake fears as a top driver of recent market swings. Neuberger Berman [2] notes that December 2025 rate cut expectations have dropped from 100% to <40% in four weeks, fueling uncertainty. Internal market data [0] shows significant volatility: S&P500 fell -2.96% on Nov20 then recovered +0.72% Nov21, while ARKK (growth-focused ETF) dropped -6.00% Nov20 and rebounded +1.75% Nov21. Defensive sectors like Healthcare (+1.73%) outperformed, while interest-sensitive Utilities (-0.89%) lagged [0]. Mixed economic signals from S&P Global [3] and MUFG Research [4] add to policy ambiguity.

Cross-domain connections emerge: growth stocks (ARKK) are more volatile due to their sensitivity to rate changes; defensive sector rotation indicates investor flight to safety; the rapid shift in rate cut expectations is a primary volatility trigger. The late 2018 comparison underscores concerns about Fed over-tightening amid potential economic weakening.

Policy mistake fears are a leading volatility driver; market indices and ETFs show extreme swings; defensive sectors outperform; rate cut expectations dropped sharply. No prescriptive recommendations—focus on monitoring Fed signals and economic indicators to navigate uncertainty.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.