Trillion-Dollar Tech Valuations: Research Optimism vs. Social Media Skepticism

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

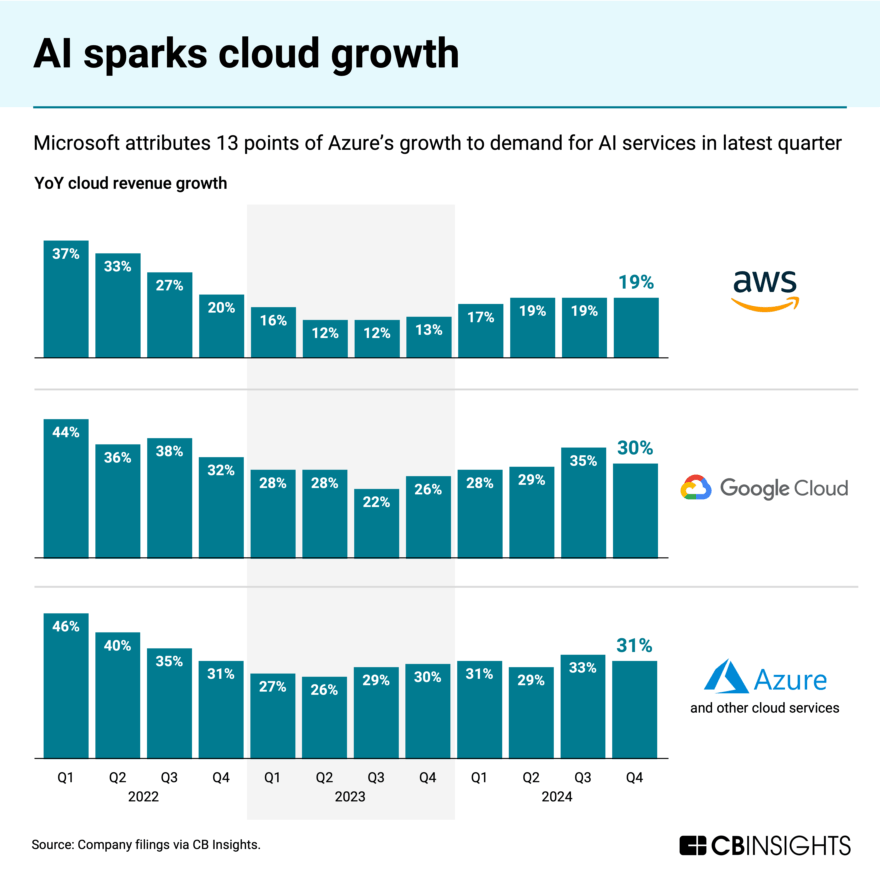

- According to Companies Market Cap [1], seven tech firms (led by Nvidia at $4.4T, Apple at $4.035T [1], Microsoft at $3.53T [7], Alphabet at $3.4T [6], Amazon at $2.36T [5], Meta at $1.497T [4]) have $1T+ valuations, with growth driven by AI and cloud investments.

- Global Growth Insights [10] projects IaaS to reach $4.4T by2035 (45.26% CAGR), while IDC (via Channel Impact [13]) estimates AI infrastructure spending at $758B by2029.

- AINvest [11] reports tech giants issued $121B in debt in2025 to fund AI infrastructure, and Hotbot [12] notes 55% of enterprises invest in AI innovations.

- Reddit user CaesarLinguini [15]: “Windows11 is broke! Meanwhile, let’s stop support for Windows10!” (criticizing Microsoft’s product quality).

- Electrical-You-6575 [15]: "Our company incorporated AI and since then we have constant software crashes… they blame us versus the AI.

- princetrunks [15]: "Big tech are paper tigers… upper management bloat where people are embarrassingly tech illiterate.

- WaterAdventurous6718 [15]: "Using our own brains less in the long term isn’t going to bode well for humanity.

- Calber4 [15]: "Switched to Linux instead of upgrading to Windows11… pretty happy with it.

Research highlights strong macro growth drivers (AI/cloud) for trillion-dollar tech firms, but social media exposes ground-level issues (product quality gaps, AI integration teething problems, leadership incompetence) that may not yet reflect in valuations. Investors should balance optimistic growth trends with user feedback to assess sustainable performance.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.