Split Consumer Economy Analysis: Q3 2025 Earnings Reveal Income-Based Spending Divergence

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the PYMNTS report [1] published on November 3, 2025, which examines Q3 2025 earnings data revealing a bifurcated U.S. consumer economy. While headline retail sales and credit data appear solid, significant divergence exists between income segments [1].

The data reveals approximately 60 million U.S. workers earning $25 per hour or less (generally under $50,000 annually) account for 36.5% of all employment but only 15.1% of total consumer spending, approximately $1.7 trillion annually [1]. This demographic faces severe financial constraints with average liquid savings of just $5,737 compared to $9,869 for typical U.S. consumers, and fewer than one in three able to cover a $2,000 emergency within 30 days [1].

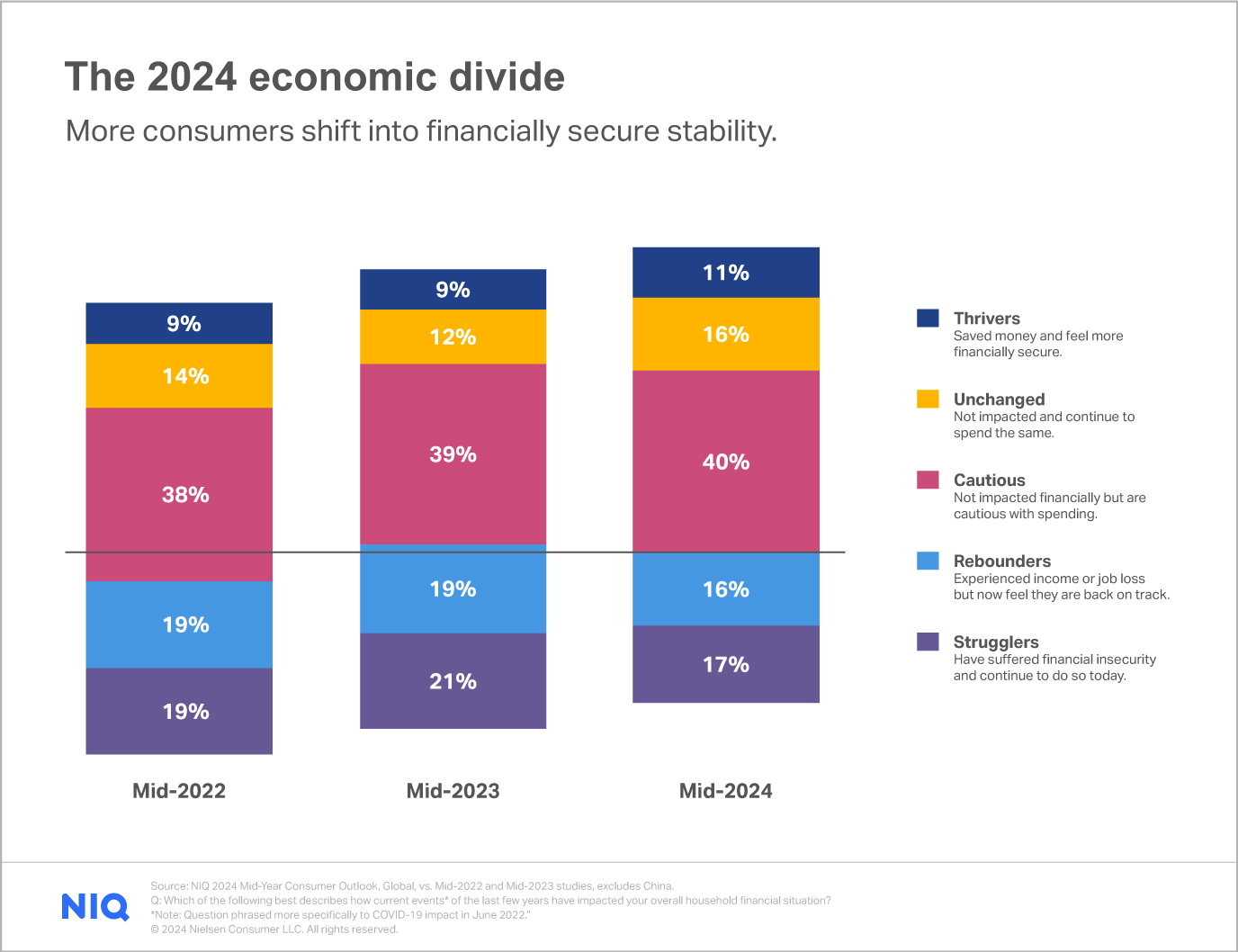

Spending behavior patterns show clear income-based segmentation:

- Higher-income householdscontinue supporting travel, dining, and discretionary retail

- Lower-income householdsfocus on groceries, necessities, and debt management [1]

- Nearly 60% of lower-income households report buying lower-priced goods, 54% wait for sales, and about 60% have reduced non-essential spending [1]

The current bifurcation may represent more than cyclical patterns:

- Income continuity sensitivity: Small disruptions in hours worked or paycheck delays create immediate ripple effects, with wage softening potentially cutting $30-40 billion in annualized consumer outlays across this cohort [1]

- Consumer sentiment divergence: Lower-income households show sentiment scores of 49.2 versus 54.7 for the general population [1]

- Age-based vulnerability: The 25-35 year age group faces particular challenges from unemployment and slower real wage growth [2]

Current market data [0] reflects these underlying trends:

- CMG trading at $31.75 (+0.19%) with a 52-week range of $31.01-$66.74, showing significant year-to-date pressure

- AMZN trading at $255.22 (+4.50%) near its 52-week high of $258.60

- Consumer Cyclical stocks up 0.34% while Consumer Defensive stocks show modest gains of 0.20%

- Major indices showing mixed performance: S&P 500 down 0.46%, NASDAQ down 0.48%, Dow Jones down 0.58%

- Consumer debt vulnerability: High debt burdens among lower-income households could trigger more severe spending cuts if economic conditions worsen

- Employment volatility sensitivity: The labor economy’s sensitivity to job stability could amplify economic shocks

- Inflation persistence impact: Continued price pressures could further strain lower-income budgets

- Policy differential effects: Shifts in monetary or fiscal policy could disproportionately affect different income segments

The bifurcation creates distinct opportunities:

- Essential goods providers: Companies like Amazon benefit from the shift to groceries and household essentials

- Value optimization strategies: Businesses serving lower-income segments can enhance value propositions

- Segment-specific approaches: Differentiated strategies for different income segments may prove advantageous

Decision-makers should track:

- Real wage growth for workers earning under $50,000 annually

- Household savings rate changes signaling future spending patterns

- Consumer credit performance deterioration as potential leading indicator

- Corporate guidance for insights into consumer trend sustainability

- Retail sales data by segment and income level

The Q3 2025 earnings cycle reveals a structurally bifurcated consumer economy where aggregate data masks significant divergence between income segments. Lower-income consumers (36.5% of workforce) demonstrate reduced spending power and shifting priorities toward essentials, creating divergent impacts across consumer-facing businesses. Companies serving value-conscious segments face traffic pressure while essential goods providers show resilience. The duration and persistence of this bifurcation remains uncertain, requiring continued monitoring of wage growth, savings rates, and credit performance across income segments. Historical patterns suggest sustained income inequality typically leads to increased market volatility and sector rotation, which should be factored into ongoing analysis.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.