Liquidity-Driven Trading vs. Indicator Reliance: Analysis of Gold Futures (XAUUSD) Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

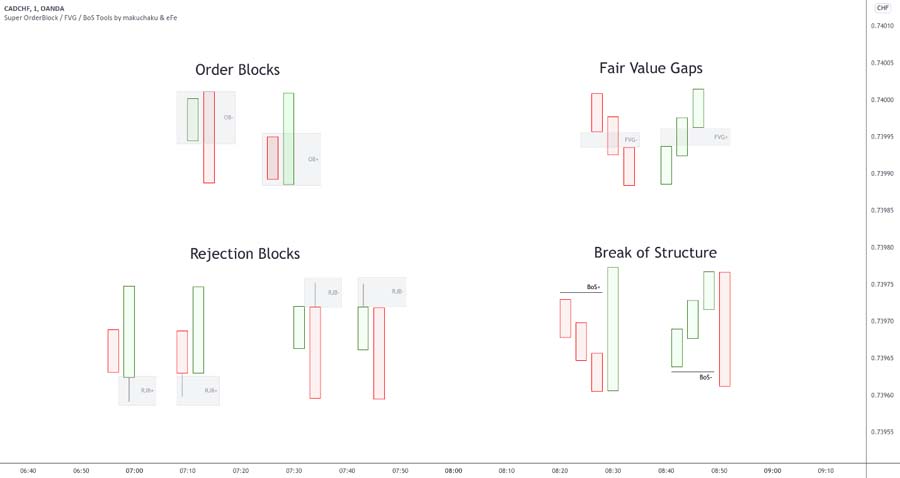

A Reddit trader specializing in XAUUSD (gold futures) argues that price movement is driven by institutional liquidity dynamics rather than lagging indicators like RSI or MACD. This approach aligns with ICT (Inner Circle Trader) concepts, which are valid for gold futures due to their institutional dominance [1][2]. Liquidity-driven strategies (e.g., break of structure + liquidity sweeps) provide strict rules for entries, stops, and targets, eliminating guesswork [4][5]. Fair Value Gaps (FVG) are price inefficiencies signaling temporary imbalance [6], while Order Blocks are zones where large institutional orders are executed [7]. Combining these concepts increases setup probability [8].

- ICT principles are market-agnostic and work across futures, forex, and crypto [3], but are particularly effective for gold futures due to institutional influence [2].

- Liquidity strategies are fractal, applicable across all timeframes (1-minute to daily) [4].

- Confluence of multiple structure-based concepts (FVG + Order Block + liquidity sweep) yields high-probability setups [8].

- Indicators like RSI are lagging and can lead to unfounded biases, but may serve as filters [5].

- Risks: Over-reliance on anecdotal evidence (Reddit trader’s experience), lack of quantitative backtesting data for gold futures, and potential for misinterpreting ICT concepts due to “cultishness” [2][3].

- Opportunities: Applying liquidity strategies to other liquid assets [3], combining FVG + Order Blocks for high-probability setups [8], and using indicators as filters (not predictors) [5].

Core liquidity/structure concepts for XAUUSD include liquidity sweeps, break of structure, FVG, Order Blocks, and session highs/lows. These strategies reduce random entries and tighten risk compared to indicator-based approaches. ICT concepts are relevant but require avoiding dogmatic adherence. Further research is needed to validate the long-term performance of these strategies in gold futures.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.