Analysis of Retail Trader's 0DTE SPY Options Experience and Market Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit post [4] published on November23,2025, detailing a new trader’s experience with 0DTE SPY options.

The Reddit user (OP) started trading a month ago with $3k, added $3.5k after losses, and experienced extreme swings (from $20k to $5k back to $20k) via 0DTE SPY puts before losing most again. Currently, the OP holds $4k in SPY weekly660 puts, betting on a market dip in a historically green week [4]. This experience reflects broader trends in retail participation in high-risk 0DTE options: recent data shows that on November21, the SPY Nov21-25650 Put (0DTE) traded114,961 contracts (4.8% of total SPY options volume) [1], and on November18, the SPY Nov18-25660 Put (0DTE) saw108,685 contracts traded [2]. SPY’s recent performance includes a1.36% decline over 22 days (Oct23-Nov21) to close at $659.03 [0], with a price range of $650.85-$689.70 [0]. Sector performance is mixed: Healthcare is up1.73% while Utilities are down0.89% [0], indicating that the OP’s bearish bets contrast with some positive sector trends.

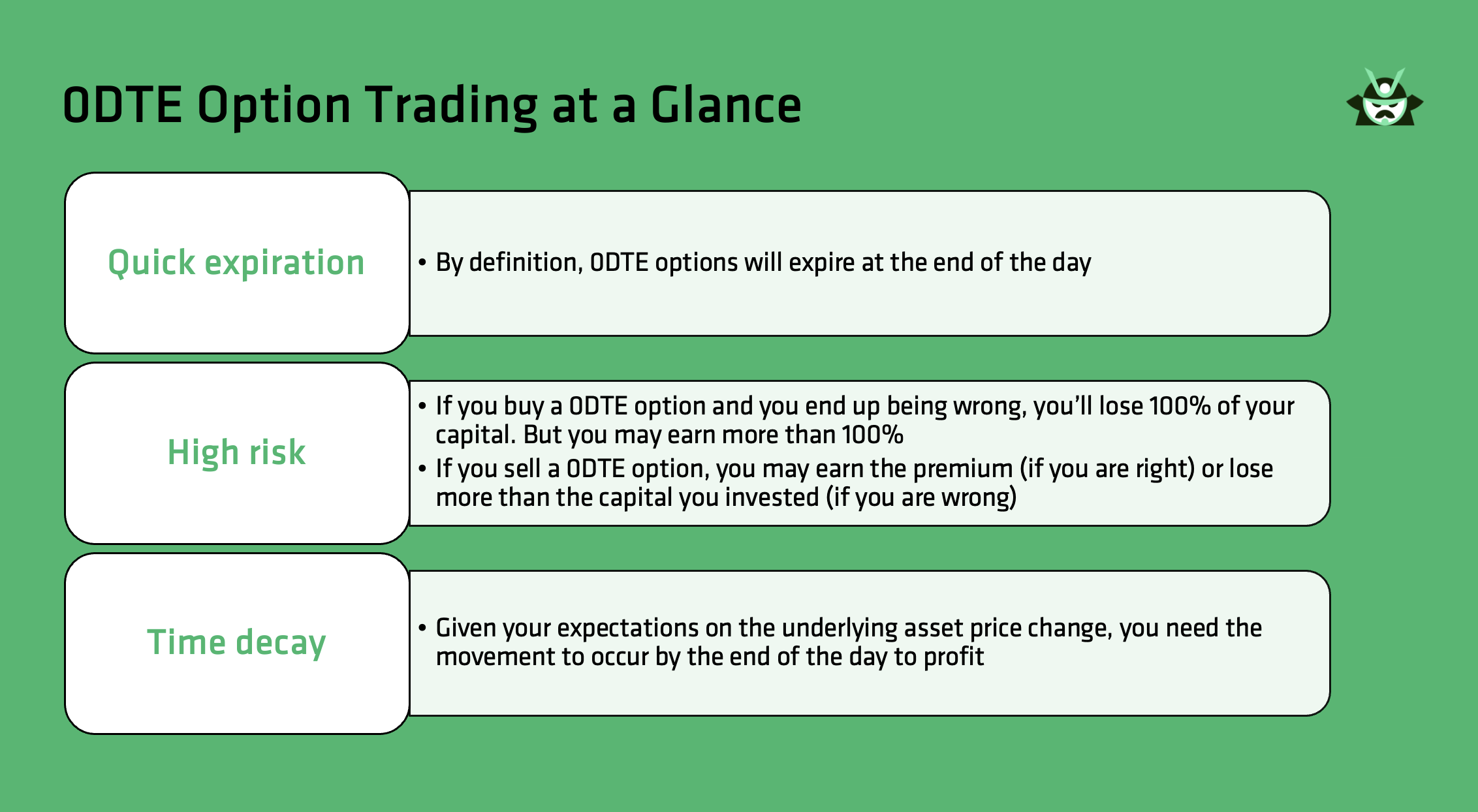

- Retail participation in0DTE options amplifies intraday volatility: Charles Schwab notes that0DTE options are subject to significant volatility and can lead to rapid losses with small price movements [3].

- Platform accessibility risks: The OP’s admission of a compulsive trading problem since using Robinhood highlights the need for platforms to implement stricter risk warnings for new users accessing high-risk derivatives.

- Mixed market sentiment: The OP’s bearish bets (on SPY puts) contrast with SPY’s0.72% gain on November21 [0] and positive Healthcare sector performance [0], suggesting divided retail and institutional sentiment.

- Compulsive trading as a systemic risk: The Reddit comments’ focus on therapy (53 upvotes) and addictive behavior (28 upvotes) indicates that high-frequency, high-risk trading can lead to behavioral health issues for inexperienced traders [4].

- Compulsive trading: The OP’s admission of a problem and Reddit comments’ recommendations for therapy highlight the risk of addictive behavior in high-frequency trading [4].

2.0DTE options volatility:0DTE options have rapid time decay and sensitivity to intraday price movements, which can lead to total loss for inexperienced traders [3]. - Lack of diversification: The OP’s concentrated bets on SPY puts expose them to total loss if the market rises.

- Regulatory review: The case underscores the need for regulators to evaluate0DTE options access for new traders.

- Platform improvements: Robinhood and other retail platforms can enhance risk disclosures and limit access to high-risk derivatives for new users.

- Education: Increased focus on financial literacy for new traders to understand the risks of0DTE options.

The analysis summarizes a new trader’s volatile journey with0DTE SPY options, including their $3k initial investment, extreme swings, and current $4k position in SPY weekly660 puts [4]. Market data shows significant 0DTE put volume in recent weeks [1][2], SPY’s recent decline [0], and mixed sector performance [0]. Critical risks include compulsive trading behavior [4], high volatility of0DTE options [3], and lack of diversification. This information provides context for understanding retail trading trends and associated risks without prescriptive investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.