Nvidia CEO's 'No-Win' Situation: Market Impact Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

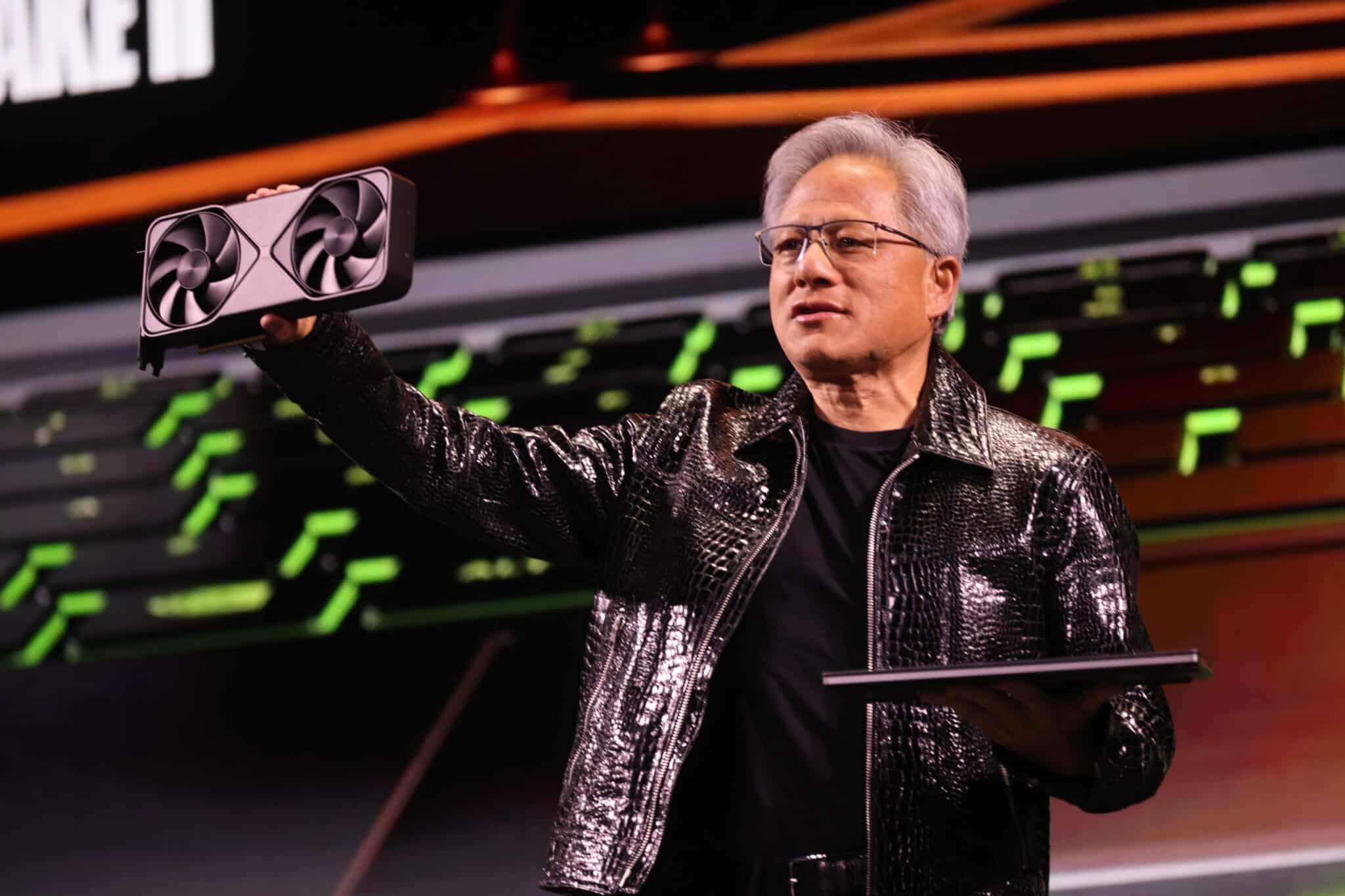

On November 21, 2025, Fortune and other major financial outlets reported that Nvidia CEO Jensen Huang told employees in a leaked internal meeting the company faces a “no-win” dynamic amid growing AI bubble chatter [2][3]. Huang stated:

“If we delivered a bad quarter, it is evidence there’s an AI bubble. If we delivered a great quarter, we are fueling the AI bubble” [1][3].

This came shortly after Nvidia公布 record-breaking earnings and a $500 billion revenue backlog for 2025–2026 [2][4], but the stock sold off sharply despite these strong fundamentals [0].

NVDA stock declined 1.30% on November 21, 2025, closing at $178.88—following a 7.81% drop the previous day [0]. This dual decline reflects investor concern over the AI bubble narrative, even with robust earnings.

The Technology sector underperformed other sectors on November 21, gaining only 0.146% (vs. healthcare’s 1.73% gain) [0]. This suggests broader caution toward AI-related tech stocks amid bubble fears.

The market’s reaction indicates high expectations are creating headwinds: Nvidia’s strong results were not rewarded, aligning with Huang’s “no-win” observation [1][0].

| Metric | Details | Source |

|---|---|---|

| NVDA Nov 20 Close | $180.64 (down 7.81%) | [0] |

| NVDA Nov 21 Close | $178.88 (down 1.30%) | [0] |

| Nov 21 Trading Volume | 346.93M shares | [0] |

| Tech Sector Nov21 Gain | 0.146% | [0] |

| Backlog Guidance | $500B (2025–2026) | [2][4] |

- Directly Impacted: NVDA (Nvidia Corporation)

- Related Sectors: Semiconductors, Artificial Intelligence, Technology

- Supply Chain: Upstream (TSMC, chip component suppliers); Downstream (AWS, Google Cloud, AI startups relying on Nvidia GPUs)

- Exact Q3 2025 earnings metrics (revenue, EPS, margins)

- Full transcript of the leaked internal meeting

- Breakdown of the $500B backlog (customer segments, timeline)

- Bull Case: Strong backlog and record earnings confirm robust AI demand [4].

- Bear Case: Bubble chatter and high expectations create valuation risk [1][2].

- Earnings execution and backlog conversion rates

- Competitor moves (e.g., AMD’s MI300X chip adoption)

- Regulatory scrutiny of Nvidia’s market dominance

- Shifts in the AI bubble narrative

- Valuation Risk: The “no-win” scenario highlights that even strong results may not support current valuations [1][2].

- Volatility Risk: AI bubble chatter could lead to increased short-term volatility in NVDA and tech stocks [0].

- Sentiment Risk: The tech sector’s underperformance suggests broader investor caution toward AI-related assets [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.