Google DeepMind Robotics Initiative: Strategic Hire of Boston Dynamics' Former CTO

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

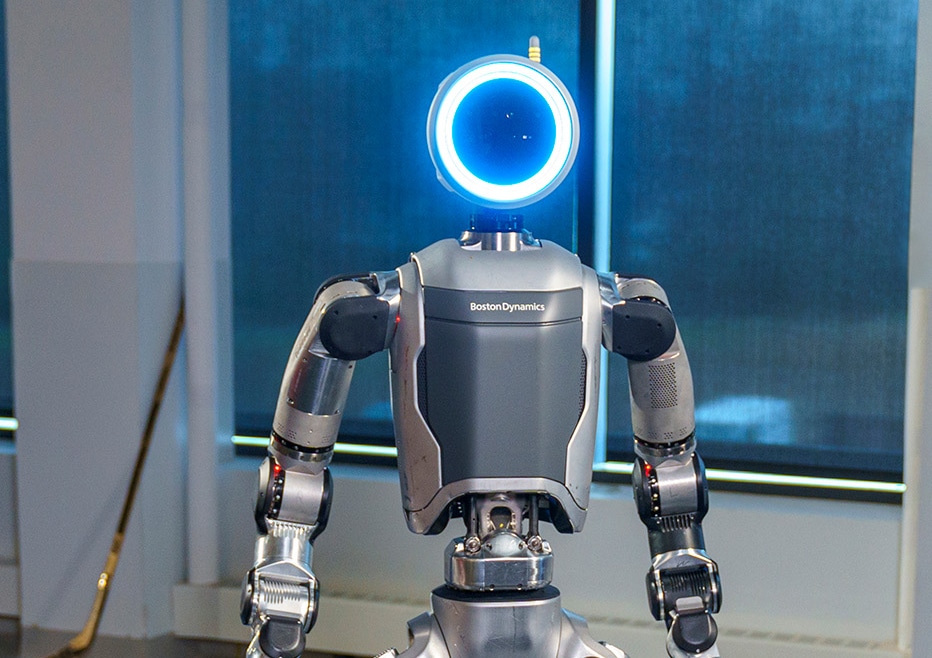

On 2025-11-21, Google DeepMind hired Aaron Saunders—former CTO of Boston Dynamics—as VP of Hardware Engineering to advance its robotics ambitions [1][2][3]. Saunders brings 22 years of expertise in developing advanced robots like Atlas and Spot, adding credibility to DeepMind’s goal of building a Gemini AI-powered universal OS for robots, similar to Android’s mobile dominance [2][5]. The announcement drove positive market reaction: GOOGL closed up 1.09% on the event day and 3.53% by 2025-11-23, outperforming the tech sector’s 0.146% gain [0]. Alphabet’s strong financials (32.23% net profit margin, $3.62T market cap) support long-term investment [0].

- Platform Ecosystem Potential: DeepMind’s Gemini-based robot OS leverages Alphabet’s Android track record, targeting platform dominance in robotics [2][5].

- Revenue Diversification: This initiative could reduce reliance on search (56.6% FY2024 revenue) and cloud (12.4%) via new licensing/service streams [0].

- Credibility Boost: Saunders’ Boston Dynamics tenure fills DeepMind’s hardware expertise gap [1][2].

- Platform leadership in the growing robotics market [3].

- Long-term growth beyond core segments [0].

- Execution complexity in AI-hardware integration [3][5].

- Competition from Tesla Optimus, Amazon Robotics, Hyundai [2][4].

- Regulatory hurdles for robot safety/ethics [5].

- Resource diversion impacting short-term margins [0][3].

Google DeepMind’s strategic hire of Aaron Saunders marks a significant robotics entry, aiming for a Gemini-powered OS. GOOGL outperformed the tech sector, with Alphabet’s strong finances enabling long-term investment. Critical gaps include investment timelines and use cases, while execution/regulatory risks require monitoring.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.