CSAI Analysis: Reddit Hype vs. Reality - AI Security Microcap Faces Major Red Flags

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit community presents an extremely bullish case for Cloudastructure (CSAI), projecting significant upside based on contract wins and share buyback activity:

- Valuation Projection: Reddit author targets $96M-$120M valuation ($4.50-$6.00/share) using 8x-10x EV/Sales multiples, with potential acquisition scenario at $7.00-$9.00/share [1]

- Growth Thesis: Claims of 300% revenue growth over 12 months based on recent contract wins with top property management firms [1]

- Share Buyback: $5M share repurchase program highlighted as catalyst [1]

- Community Sentiment: Mixed reactions with some users holding significant positions while others question the growth narrative [1]

Notable skepticism from experienced Reddit users includes:

- LumpaLard: Questions revenue remaining under $2-3M with high cash burn, challenging 300% growth feasibility and 8x-10x EV/Sales multiple justification [1]

- Director Selling: NEO71011 raises concerns about frequent director stock selling [1]

- Buyback Execution: Concerns that microcap buybacks often go unexecuted [1]

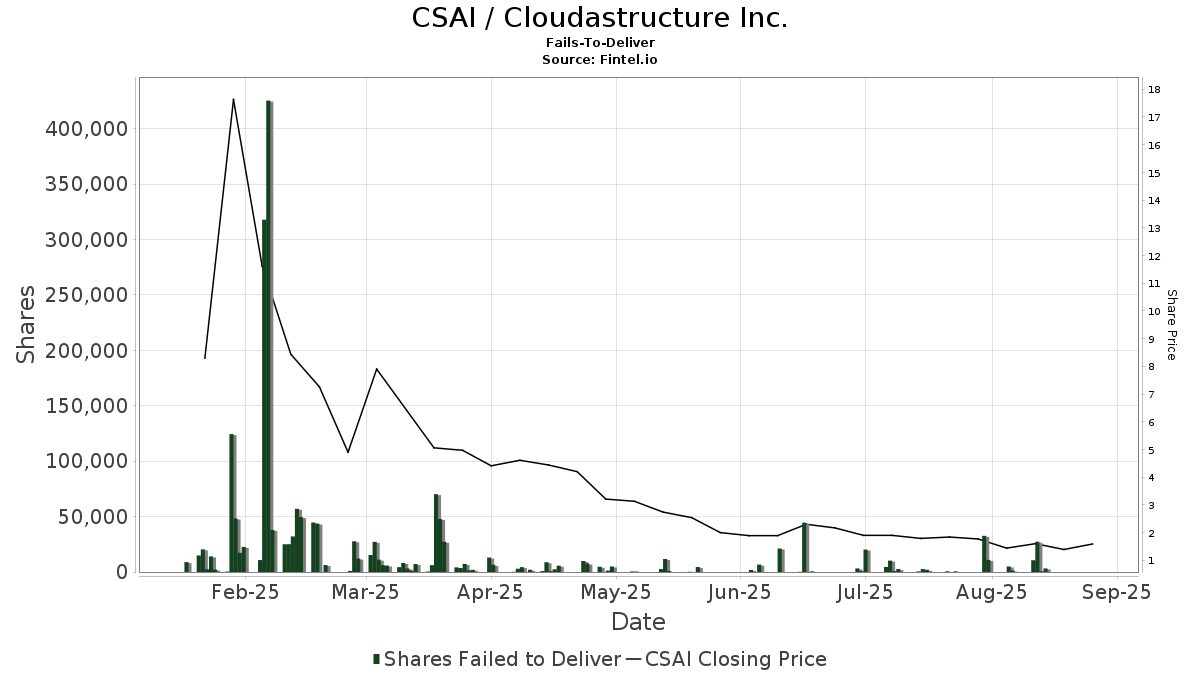

- Current Trading: CSAI trades at $1.47-$1.66 with $25-27M market cap [2]

- Buyback Confirmation: $5M share repurchase program officially announced October 16, 2025 [2]

- Revenue Reality: Trailing twelve-month revenue of only $65,000 according to Yahoo Finance [2]

- Listing: Stock trades on Nasdaq under ticker CSAI [2]

- Unverified Contracts: No official press releases, SEC filings, or company announcements confirming contracts with top property management firms [2]

- Revenue Discrepancy: Massive gap between claimed growth trajectory and current $65K TTM revenue [2]

- Source Reliability: 300% growth projection appears only in Reddit discussions as a modeled projection, not official company forecast [2]

- Lack of Official Support: Claims about contracts with five of the top 10 property management companies appear only in Reddit posts [2]

The analysis reveals a fundamental disconnect between Reddit-driven optimism and verifiable company fundamentals:

- $5M share buyback program is confirmed by both Reddit and official sources

- Current market cap and trading range are accurately reflected

- Revenue Reality vs. Projections: Reddit projects massive growth while verified TTM revenue is only $65K

- Contract Verification: Reddit claims major contracts with top property management firms, but no official verification exists

- Valuation Justification: Reddit’s $96M-$120M valuation target implies 1500%+ upside despite minimal current revenue

The Reddit narrative appears to be speculative optimism without fundamental support. While the buyback program provides some shareholder value, the growth thesis lacks verifiable evidence. The current valuation of $25-27M already reflects significant optimism given the $65K revenue base.

- Revenue Reality: Current $65K TTM revenue makes 300% growth projections appear unrealistic

- Unverified Catalysts: Contract wins mentioned only on Reddit, not confirmed officially

- Microcap Volatility: Small market cap and limited liquidity increase risk

- Cash Burn Concerns: Reddit comments suggest high cash burn rate relative to revenue

- Share Buyback: $5M repurchase program could support share price if executed

- AI Security Sector: Growing market demand for AI-powered security solutions

- Nasdaq Listing: Provides legitimacy and access to broader investor base

Investors should approach CSAI with extreme caution. While the Reddit narrative presents compelling upside potential, the fundamental disconnect between claimed growth opportunities and verified revenue reality creates significant investment risk. Wait for official company announcements confirming contract wins and revenue growth before considering exposure.

- Reddit Discussion - $CSAI: A deeper dive and a valuation based on contracts growth and shares buyback

- Research Analysis - Social Media and Financial Data Verification

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.