UTime Limited Crisis: Unauthorized Press Release and Market Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

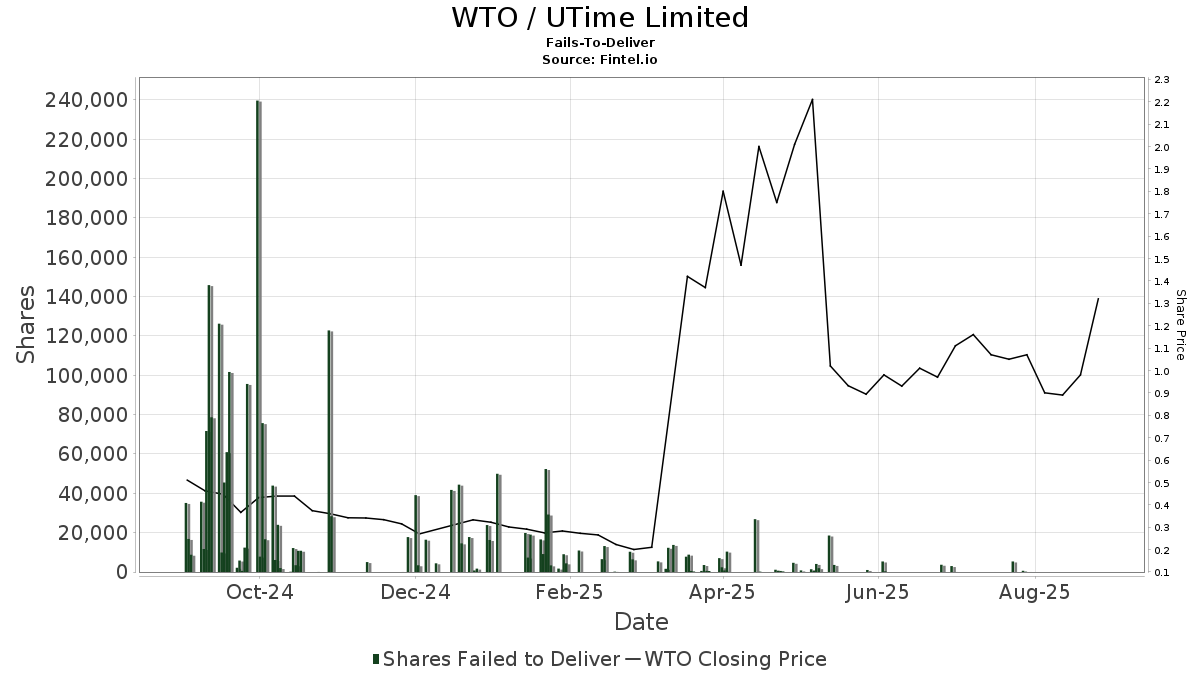

UTime Limited (NASDAQ: WTO), a Chinese mobile device manufacturer, faced a critical corporate governance incident on September 11, 2025, when fraudulent press releases were issued claiming false leadership changes and board resignations. The unauthorized communications, published by a former employee who previously managed investor relations, triggered extreme market volatility with the stock surging 64.84% in after-hours trading before plummeting 47.99%. The company has confirmed that CEO Hengcong Qiu and the entire board remain intact, but faces significant regulatory, legal, and reputational challenges that threaten its market position and operational stability.

The crisis originated from a deliberate attempt by a former employee to interfere with business operations by exploiting previous access to company communication channels. The fraudulent press releases were distributed overnight through unauthorized channels, immediately impacting NASDAQ trading and triggering a cascade of market reactions.

- Stock Volatility: Extreme price swings from 64.84% surge to 47.99% decline

- Current Valuation: Stock price at $0.07, market cap reduced to $1.47M

- Trading Disruption: Significant after-hours and regular session volatility

- Investor Confidence: Severely compromised with potential long-term trust issues

The incident exposed critical vulnerabilities in UTime’s internal controls and communication protocols:

- Access Control Failure: Former employee retained system access capabilities

- Communication Security: Lack of multi-factor authentication for corporate communications

- Investor Relations Management: Insufficient oversight of external communications

- Board Stability: Despite false claims, leadership remains intact but credibility challenged

- Internal Control Deficiencies: The incident revealed significant gaps in employee offboarding procedures and system access management

- Market Sensitivity: UTime’s low market cap and stock price make it particularly vulnerable to manipulation and misinformation

- Regulatory Exposure: The company faces potential SEC investigation for market manipulation concerns

- Reputational Damage: Beyond financial impact, the incident threatens business relationships and customer trust

- Competitive Disadvantage: Rivals may exploit the uncertainty to gain market share

- Customer Concern: Business partners may question company stability and continuity

- Employee Morale: Internal uncertainty could affect workforce retention and productivity

- Financial Instability: Recent $25M registered direct offering completion may be jeopardized

- SEC Investigation: Potential formal investigation into market manipulation

- Shareholder Lawsuits: Class action risk from investors affected by volatility

- Nasdaq Compliance: Potential delisting risk if corporate governance concerns persist

- Financial Collapse: Current market cap of $1.47M suggests severe financial distress

- Legal Liability: Criminal charges possible against perpetrator, civil liability for company

- Reputational Damage: Long-term impact on brand and business relationships

- Competitor Exploitation: Market share loss during period of uncertainty

- Customer Attrition: Business partners seeking more stable suppliers

- Employee Turnover: Key talent departure due to uncertainty

- Governance Enhancement: Implement stronger internal controls and security measures

- Transparent Communication: Rebuild investor trust through regular, accurate updates

- Legal Action: Pursue charges against former employee to deter future incidents

- Market Education: Use incident to demonstrate crisis management capabilities

- CEO & Chairman: Hengcong Qiu (Position secure)

- Board Members: Minfei Bao, Xiaoqian Jia, Hailin Xie, Yanzhi Wang (All positions secure)

- Management Team: Fully intact and operational

- ✅ SEC notification filed regarding fraudulent submissions

- ✅ Official public statement issued confirming leadership stability

- ✅ Former employee access to company systems terminated

- Regulatory Compliance: Full cooperation with SEC investigation

- Security Enhancement: Implementation of multi-factor authentication protocols

- Investor Relations: Direct outreach to major shareholders and institutional investors

- Market Surveillance: Monitoring for additional unauthorized releases

UTime Limited faces a defining moment in its corporate history. While the immediate leadership crisis has been resolved with confirmation that all executives and board members remain in place, the incident has exposed fundamental weaknesses in corporate governance and internal controls. The company’s survival depends on transparent communication with regulators and investors, swift implementation of security enhancements, and successful navigation of potential legal challenges. With the stock trading at $0.07 and market cap at $1.47M, UTime must demonstrate operational stability and governance reform to restore market confidence and avoid delisting risks.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.