Analysis of Far-Out Futures Trading Practices and Market Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis draws from a Reddit post [1] exploring far-out futures trading practices. Three core user groups emerge:

- Commercial Entities: Use far-out futures to lock in commodity prices (e.g., cereal companies for wheat, oil firms for crude) as a risk management tool [2][3].

- Individual Traders: Utilize them for long-term exposure without roll costs (e.g., gold traders) despite lower liquidity [4][5].

- Market Makers: Hedge options positions with far-out futures to maintain delta-neutrality, especially for long-dated options [10][11].

Cross-domain correlations:

- Contango markets increase upfront costs for both commercial and individual users [8].

- Liquidity constraints affect all groups but are most pronounced for individual traders [6][7].

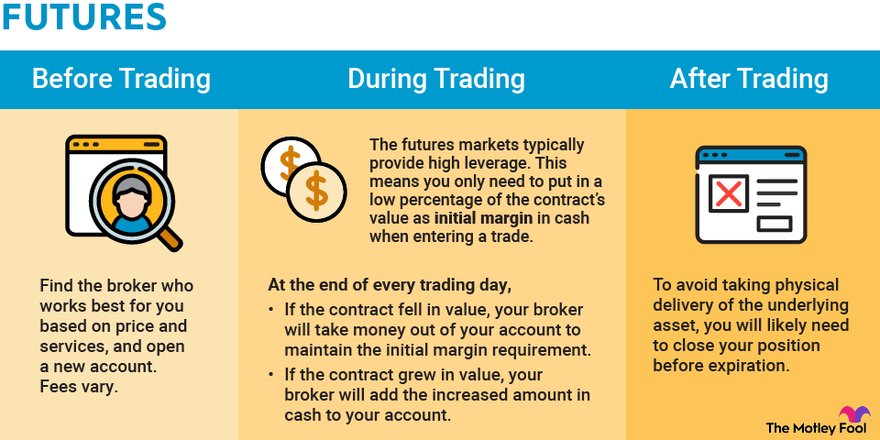

- Leverage amplifies risks across participants, particularly individuals [9].

- Risks: Low liquidity leading to execution challenges [6][7], high leverage amplifying losses [9], contango-driven higher upfront costs [8].

- Opportunities: Commercial price stability [2][3], individual roll cost savings [4][5], market maker risk management [10][11].

Far-out futures serve diverse needs but involve trade-offs. Critical data points: lower liquidity than front-month contracts, higher upfront costs in contango, significant leverage. No prescriptive recommendations are provided.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.