WSJ Tariff Comfort Analysis: Auto & Cocoa Sectors Benefit from Relief (2025-11-22)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 22, 2025, The Wall Street Journal published an analysis of 5,000 earnings calls showing U.S. CEOs have grown more comfortable with tariffs, citing targeted relief measures for auto parts and cocoa sectors [1]. The report highlights that while tariffs remain a business challenge, recent policy adjustments have reduced uncertainty and cost pressures for key industries.

-

Stock Price Moves: Key companies in affected sectors saw positive gains on November 22:

- Ford Motor Company (F): +3.43% to $12.83 [3]

- General Motors (GM): +3.37% to $70.33 [3]

- Hershey Company (HSY): +1.83% to $186.00 [3]

- Vita Coco Company (COCO): +4.54% to $48.32 [3]

-

Sector Performance:

- Industrials (includes auto manufacturing): +1.52% [2]

- Consumer Cyclical (auto retail): +1.37% [2]

- Consumer Defensive (food/confectionery): +0.50% [2]

- Auto Sector: U.S. manufacturers benefit from the import adjustment offset program (3.75% of MSRP relief for U.S.-assembled vehicles in 2025-2026) [6][7]. This helps offset the 25% tariff on auto parts imposed in May 2025 [6].

- Cocoa/Food Sector: Hershey expects a $200 million improvement in 2026 cocoa costs due to tariff cuts from 17% to 2% [5]. Vita Coco’s coconut water products are exempt from reciprocal tariffs as of November 13, 2025 [5].

| Metric | F | GM | HSY | COCO |

|---|---|---|---|---|

| Market Cap | $50.21B | $65.61B | $37.72B | $2.75B |

| P/E Ratio | 10.86x | 22.24x | 27.80x | 40.27x |

| EPS (TTM) | $0.45 | $2.80 | $6.69 | $1.20 |

| 1-Day Change | +3.43% | +3.37% | +1.83% | +4.54% |

Source: [3][4]

- Auto: Ford (F), General Motors (GM)

- Food/Beverages: Hershey (HSY), Vita Coco (COCO)

- Industrials (auto manufacturing)

- Consumer Cyclical (auto retail)

- Consumer Defensive (confectionery, non-alcoholic beverages)

- Upstream: Auto parts suppliers (for F/GM), cocoa farmers/exporters (for HSY), coconut producers (for COCO)

- Downstream: Auto dealers, retail food chains

- Full details of the WSJ’s 5,000 earnings call analysis (crawling the article was unsuccessful)

- Long-term sustainability of tariff relief programs (e.g., auto offset expires in 2027 [6])

- Exact compliance costs for USMCA thresholds (85% domestic content by 2026 [6])

- Positive: Companies with strong U.S. manufacturing presence (F, GM) benefit from relief programs, while food companies (HSY, COCO) see reduced input costs.

- Neutral: Non-U.S. suppliers may face competitive disadvantages due to tariffs.

- Negative: Smaller manufacturers may struggle to meet USMCA compliance thresholds, limiting their access to relief.

- 2026 earnings reports to verify if cost savings from tariff relief materialize

- Policy updates on tariff extension/modification (e.g., auto offset program)

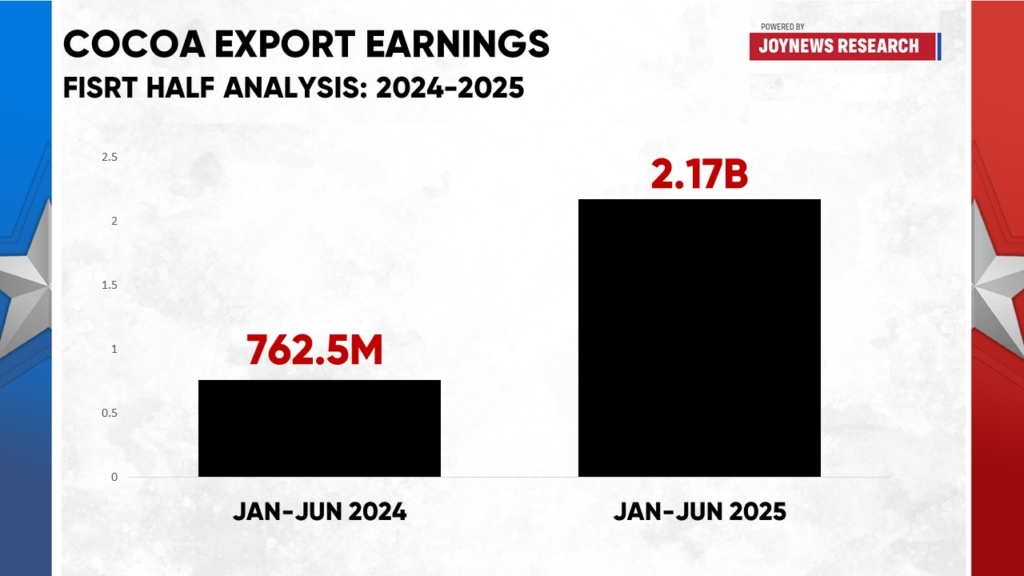

- Global supply chain changes (e.g., cocoa production trends in Nigeria [3])

- Temporary Relief: Auto offset program expires in 2027 [6], potentially renewing cost pressures for manufacturers if not extended.

- Supply Chain Risks: Cocoa production drops (e.g., Nigeria’s projected 11% decline [3]) may offset tariff savings for food companies.

- Compliance Risks: USMCA’s 85% domestic content threshold (by 2026 [6]) may be challenging for some auto manufacturers, limiting their access to relief benefits.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.