October 2025 Asset Class Performance: US Stocks Regain Leadership Amid Global Market Rotation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Seeking Alpha report [1] published on November 3, 2025, which reviewed October 2025 performance across major asset classes using ETF benchmarks.

The October 2025 performance data reveals a significant market rotation, with US stocks regaining leadership among major asset classes for the first time in five months [1]. This shift marks a notable departure from the sustained foreign market dominance that characterized much of 2025. Vanguard Total US Stock Market (VTI) gained 2.60% in October, outperforming both developed markets (VEA) at +1.28% and emerging markets (VWO) at +1.14% [0].

The domestic equity outperformance was driven primarily by large-cap technology stocks, with the NASDAQ Composite posting the strongest gain at +4.75%, followed by the S&P 500 at +2.30% and Dow Jones Industrial at +2.26% [0]. However, the Russell 2000’s slight decline of -0.15% indicates a divergence between large and small-cap performance, suggesting the rotation may be concentrated in specific market segments [0].

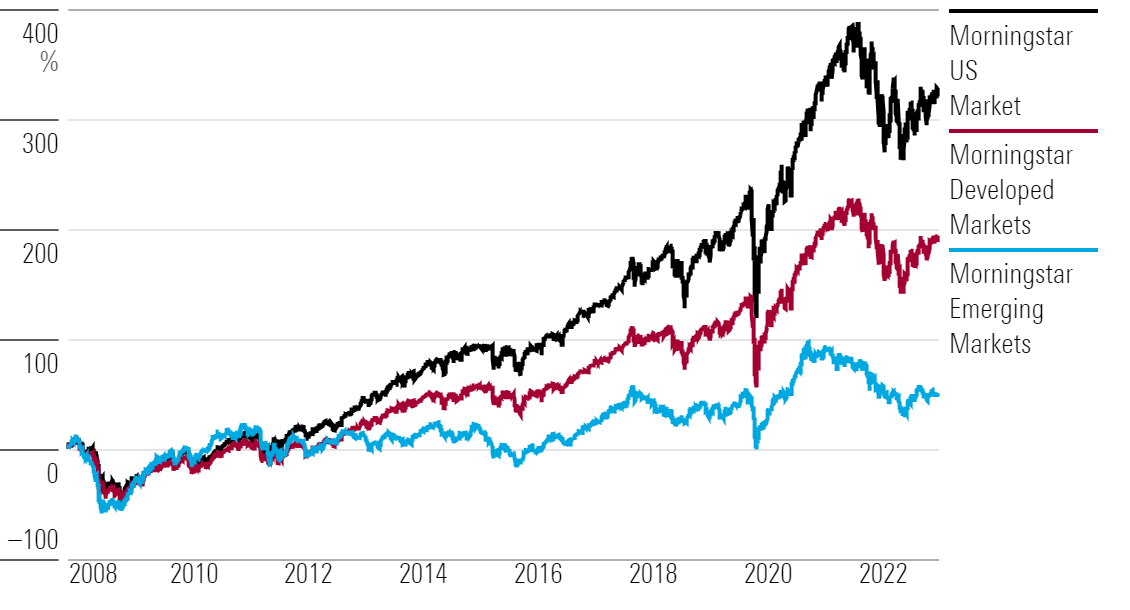

Despite October’s US stock leadership, foreign markets maintain commanding year-to-date leads through October 2025. Developed markets (VEA) lead with +27.20% gains, followed closely by emerging markets (VWO) at +24.96%, while US stocks (VTI) trail at +15.09% [0]. This substantial performance gap suggests that October’s US outperformance may represent a temporary rotation rather than a structural shift in market leadership.

The analysis reveals significant divergence across asset classes:

- Gold (GLD) showed robust October performance at +3.36%, with a year-to-date price range of 13.63% [0]

- US Bonds (BND) provided modest positive returns at +0.35% in October [0]

- US Real Estate (VNQ) continued its weakness with a -2.40% decline in October and minimal year-to-date gains of only 0.10% [0]

- Current sector performance shows broad weakness with 8 out of 11 sectors declining, led by Basic Materials (-2.19%) and Communication Services (-1.92%) [0]

Gold’s strong October performance (+3.36%) [0] alongside its substantial year-to-date range suggests investors are increasingly seeking safe-haven assets. This trend may reflect underlying concerns about market volatility, geopolitical tensions, or inflation expectations, potentially indicating a risk-off sentiment despite overall positive asset class returns.

The persistent underperformance of US real estate (VNQ) represents a significant anomaly in the otherwise positive 2025 market environment. With only 0.10% year-to-date gains [0] and continued monthly declines, the sector faces unique challenges potentially related to interest rate sensitivity, valuation concerns, or economic growth expectations.

The divergence between large-cap outperformance and small-cap underperformance, combined with current broad sector weakness (8 declining sectors) [0], raises questions about the sustainability of the October US stock rally. This narrow leadership suggests the market may be driven by specific factors rather than broad-based strength.

-

Real Estate Sector Exposure: The continued weakness in US real estate (VNQ) with only 0.10% year-to-date gains [0] presents significant risk for portfolios with substantial real estate allocations.

-

Small-Cap Vulnerability: The Russell 2000’s negative October performance (-0.15%) [0] indicates potential stress in small-cap stocks, which could signal broader market concerns.

-

Sector Concentration Risk: The heavy reliance on large-cap technology stocks for US market outperformance creates concentration risk, particularly if technology sector momentum reverses.

-

International Market Momentum: Foreign markets’ substantial year-to-date leads (developed +27.20%, emerging +24.96%) [0] suggest continued opportunities in international equities.

-

Safe-Haven Allocation: Gold’s strong performance (+3.36% in October) [0] indicates ongoing demand for defensive assets, potentially offering portfolio diversification benefits.

-

Relative Value Opportunities: The October rotation suggests potential relative value opportunities in US equities after months of underperformance relative to international markets.

The October 2025 asset class review reveals a complex market environment characterized by rotational dynamics rather than sustained leadership trends. While US stocks achieved monthly leadership with VTI gaining 2.60% [0], foreign markets maintain substantial year-to-date advantages. The market shows signs of narrow leadership with technology-driven large-cap gains contrasting with small-cap weakness and broad sector declines [0].

All major asset classes have posted positive returns in 2025, but performance varies significantly across categories. The persistent weakness in US real estate and the strength in safe-haven assets like gold suggest underlying market concerns despite overall positive returns [0]. The divergence between monthly and year-to-date performance patterns indicates that October’s US stock outperformance may represent tactical rotation rather than structural change.

Decision-makers should consider these rotational dynamics while monitoring the sustainability of current trends, particularly the divergence between large and small-cap performance and the ongoing challenges in the real estate sector.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.