Analysis of the Limit-Up Reason and Market Impact of Huaci Co., Ltd. (001216)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

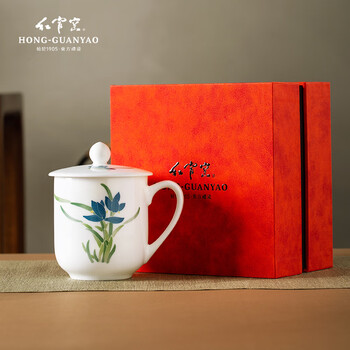

Huaci Co., Ltd. (001216) hit the limit-up today, marking its strong short-term market performance [0]. As a leading enterprise in China’s daily-use ceramic industry [2], the company has multiple national-level honors, including ranking first in the 2023 Hurun China Daily-Use Ceramic Enterprises list [0], and successively becoming an authorized manufacturer for large-scale events such as the Beijing Olympics and Shanghai World Expo [2]. Recently, the company’s core brand “Hongguanyao” was selected into the first batch of China Consumer Famous Brands list by the Ministry of Industry and Information Technology in April 2025 [0], significantly enhancing brand value. On November 21, the net inflow of institutional funds reached 21.803 million yuan [1], driving the stock price up by 10% with a turnover rate of 13.62%, and it ranked among the top three strong stocks in the Shanghai and Shenzhen markets on that day [0].

- Brand Honor and Institutional Attention Linkage: National-level brand recognition has strengthened institutional confidence, which is directly reflected in capital inflows [0][1].

- Industry Leadership Position Consolidated: The company’s long-term industry accumulation (such as customers in over 40 countries worldwide and more than 500 R&D personnel) provides support for its market performance [2].

- Short-term Capital Driven Significantly: High turnover rate (13.62%) indicates active short-term trading; attention needs to be paid to the sustainability of subsequent funds [3][4].

- The increase in brand value is expected to drive product premium and market share growth [2].

- Institutional capital inflow shows recognition from professional investors, which may attract more attention [1].

- The large short-term increase may lead to profit-taking pressure [3].

- Intensified industry competition may affect future performance growth [0].

- Need to be alert to stock price fluctuations caused by institutional capital outflows [1].

The limit-up event of Huaci Co., Ltd. (001216) reflects the market logic of the joint effect of brand honors and institutional funds. As a leader in the ceramic industry, the company has strong fundamental support, but active short-term trading brings certain volatility. Investors should combine their own risk preferences and pay attention to the subsequent brand implementation effects and changes in capital flow directions [0][1][2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.