Retail Trader Strategy Distribution: Technical Analysis Dominance Among Active Users

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

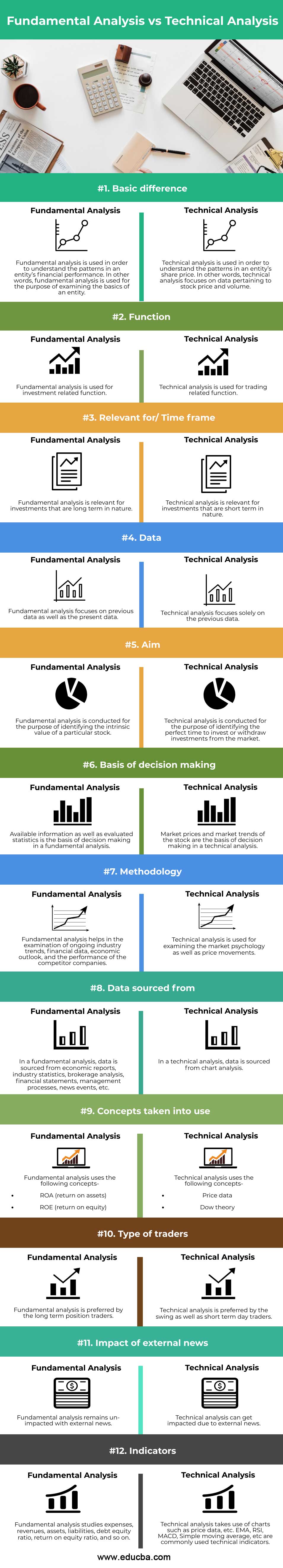

The analysis of retail trader strategy distribution relies on a large-scale Purdue University and CUNY study [1] examining 77 million StockTwits messages and Robinhood trading data. Key findings include:

- Strategy Misalignment: Only ~20% of self-identified fundamental investors actually apply fundamental metrics like earnings or valuation [1].

- Day Trading Dominance: ~85% of active day traders use pure technical analysis (chart patterns, indicators) [1].

- Long-Term Investor Behavior: >75% of self-proclaimed long-term investors on social media post exclusively about technical analysis [1].

Social media sentiment from StockTwits directly influences Robinhood trading volume [1], linking technical discourse to real-world trading activity.

- Social Media Impact: Technical analysis discussions on platforms like StockTwits drive retail trading decisions, contributing to short-term volatility [1].

- Performance Gap: Retail traders’ technical “buy” picks lost ~40% over 10 years, while “sell” picks gained ~30% [1], showing systematic underperformance correlation.

- Educational Disconnect: The gap between self-identification (fundamental) and actual strategy (technical) indicates limited understanding of fundamental analysis [1].

- Risks: Systematic underperformance from overreliance on technical analysis [1]; short-term volatility from social media-fueled technical trading [1].

- Opportunities: Improved outcomes via integrating fundamental theses with technical execution (as noted by swing traders [0]); educational initiatives to bridge strategy understanding gaps.

Technical analysis is the dominant strategy among active retail traders (especially social media users). The study’s data is robust but focuses on U.S. social media-active traders, leaving gaps in global perspective and full brokerage client base data [1][2][3][4]. No prescriptive recommendations are made, but findings highlight limitations of overreliance on technical analysis alone.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.