Fed Rate Cut and Quantitative Tightening End Boost Nasdaq-100 High Income ETF Appeal

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Benzinga report [2] published on November 3, 2025, examining the Federal Reserve’s monetary policy decisions and their impact on Nasdaq-100 high income ETFs.

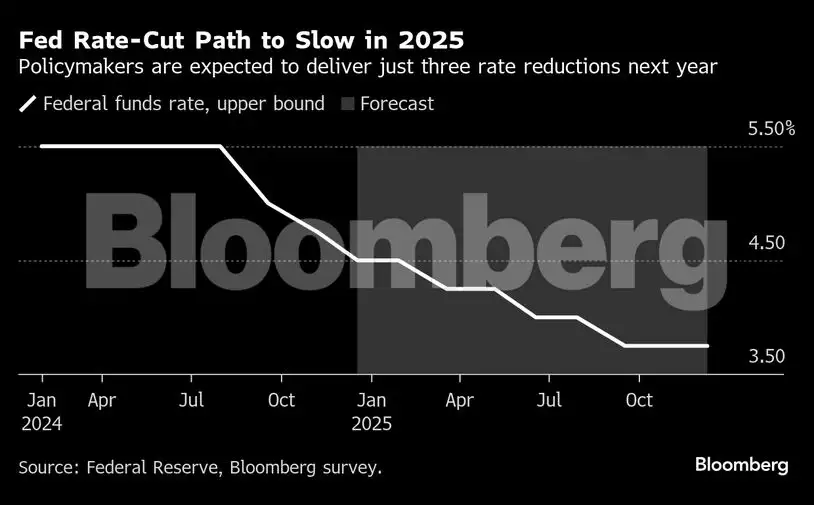

The Federal Reserve implemented its second consecutive 25-basis point rate cut on October 29, 2025, reducing the benchmark federal funds rate to a target range of 3.75%-4.00% [1][2]. More significantly, the Fed announced it will halt the runoff of its security holdings starting December 1, 2025, effectively ending the quantitative tightening program that began in mid-2022 [1][2]. This policy pivot came “quite a bit sooner than many had expected” according to Reuters analysis [1].

The market response revealed clear sector divergence. Technology stocks declined -1.74% on November 3, 2025, with the NASDAQ Composite closing at 23,724.96 (-0.91%) [0]. However, broader market indices showed resilience, with the S&P 500 at 6,840.20 (-0.57%) and Dow Jones at 47,562.87 (-0.20%) [0]. Energy (+2.81%) and Financial Services (+1.38%) led gains, while defensive sectors like Utilities (-2.00%) lagged [0].

The rate cut environment has significantly enhanced the appeal of covered call strategies by reducing competition from risk-free Treasury yields. Two major Nasdaq-100 covered call ETFs demonstrate different approaches:

- Upside Limitation:Both ETFs sacrifice potential upside for income generation and will underperform during strong market rallies [2][3]

- Distribution Sustainability:High current yields depend on maintaining adequate volatility levels; prolonged low-volatility periods could significantly reduce monthly distributions

- Counterparty Risk:IQQQ’s use of total return swaps introduces counterparty risk not present with direct options writing [2]

- Market Correlation:Despite income focus, both funds maintain high correlation to Nasdaq-100 movements and can suffer significant losses during market downturns [2]

- Rate Cut Cycle Positioning:With the Fed signaling potential for further easing in 2026, income-focused strategies may benefit from continued yield compression [1]

- Volatility Harvesting:The end of quantitative tightening reflects liquidity concerns that could benefit options-based strategies thriving in volatile environments [1]

- Yield Compression Benefits:Lower Treasury yields make the 13.17% trailing yield from covered call strategies increasingly competitive [3]

The Federal Reserve’s dual policy moves of rate cuts and quantitative tightening termination have created a favorable environment for Nasdaq-100 high income ETFs. The ProShares Nasdaq-100 High Income ETF (IQQQ) has demonstrated strong performance with +26% returns over 6 months, benefiting from its daily covered call replication strategy [2]. The reduced risk-free rates make the income generated from option premiums more attractive relative to Treasury yields, with QYLD offering a 13.17% trailing 12-month distribution [3].

However, investors should be aware that these strategies perform best in sideways to moderately rising markets with elevated volatility. Sustained bull markets will result in significant underperformance relative to the underlying index [2][3]. The Fed’s earlier-than-expected policy pivot suggests concerns about market liquidity that could create both opportunities and risks for covered call strategies [1].

Key monitoring factors include Federal Reserve policy trajectory, Nasdaq-100 volatility levels, distribution yield sustainability, and counterparty credit quality for swap-based strategies like IQQQ [2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.