Under-the-Radar Chip Stocks CRDO and ALAB: Growth Prospects & Risk Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

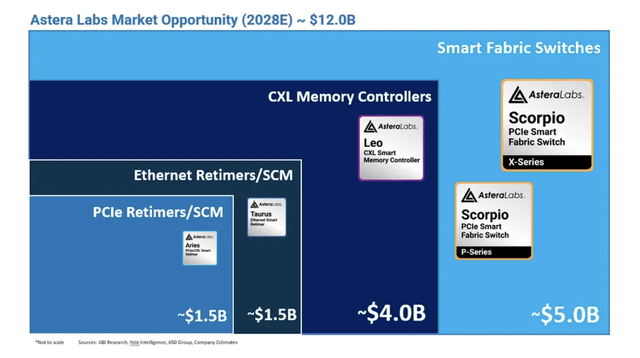

This analysis is based on a MarketWatch article [1] highlighting CRDO and ALAB as under-the-radar chip stocks with 2-year growth prospects. Internal data [0] shows CRDO closed at $133.49 (-0.92% 1-day) and ALAB at $141.80 (+1.80% 1-day) on the article’s release date. CRDO’s YTD growth (+88.2%) and 1-year returns (+191.21%) are exceptional, while ALAB’s YTD performance is muted (+5.33%) with a 3-month decline (-20.82%) [2][3]. Financial metrics include CRDO’s P/E (~183x) and net margin (~20.85%), ALAB’s P/E (~119x) and net margin (~27.50%) [4][5].

- Both stocks benefit from AI infrastructure demand but face valuation headwinds.

- CRDO’s strong historical growth contrasts with ALAB’s recent consolidation.

- Insider selling (CRDO CTO, ALAB executives) [2][3] may signal executive concerns about current valuations.

- Risks: High P/E ratios (well above market averages), recent insider selling, short-term volatility (CRDO 5-day -5.99%, ALAB 5-day -2.46%) [0][2][3].

- Opportunities: Analyst consensus upside (CRDO +23.6%, ALAB +41%) [2][3] and AI sector growth.

Critical data points include analyst BUY ratings (CRDO:91.7% Buy, ALAB:80% Buy), target prices ($165 for CRDO, $200 for ALAB) [2][3]. Upcoming events: CRDO’s Q3 report (Dec 1) and ALAB’s next earnings update [4][5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.