Analysis: Trump Administration Considers Allowing Nvidia H200 Chip Sales to China

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

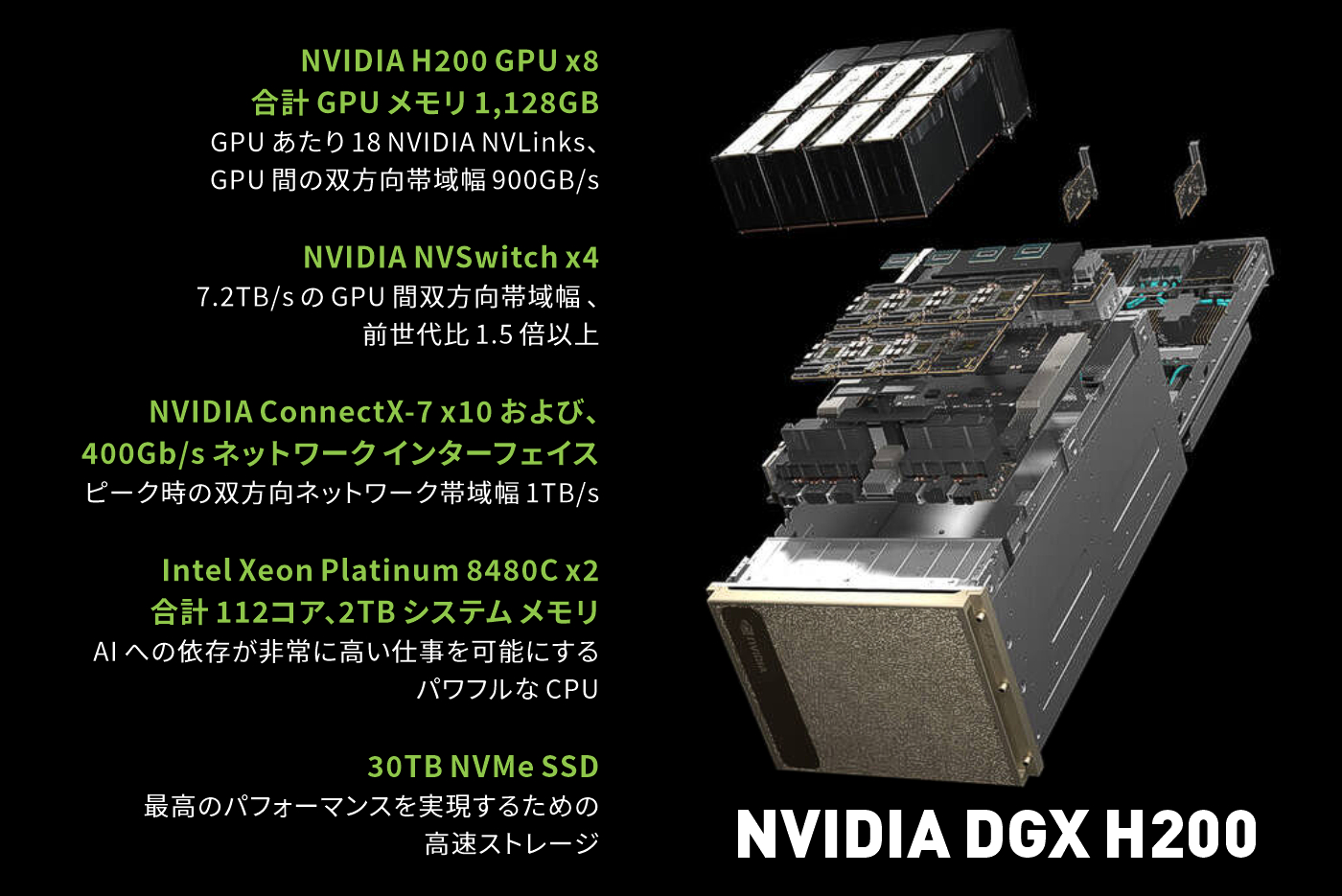

The Trump administration’s internal discussion about allowing Nvidia (NVDA) to sell H200 AI chips to China emerged on November 21, 2025, via Bloomberg and Reuters reports [1][2]. The H200 chip—twice as powerful as the permitted H20—features enhanced high-bandwidth memory for faster data processing [5]. NVDA spiked to an intraday high of $184.56 (coinciding with the news at ~1:49 PM EST) before closing at $178.88 (down 1.3%), with trading volume reaching 343.47 million shares (1.8x average) [0][4]. This reflects initial positive sentiment followed by profit-taking due to uncertainty about final approval [1].

Nvidia’s CEO Jensen Huang met with Trump earlier in the week, potentially influencing the discussion [1]. The company previously stated export controls left it unable to offer competitive products in China, ceding market share to Huawei’s Ascend chips [5][8].

- Geopolitical-Economic Balance: The discussion highlights tension between U.S. economic interests (Nvidia’s revenue growth) and national security concerns [1][3].

- Market Share Recovery: Approval could help Nvidia regain lost China market share (previously 95% before bans) from domestic competitors [8].

- Sector Ripple Effects: Related companies like TSMC (H200 manufacturer) and AMD (potential policy extension) may benefit if approved [0][2].

- Political Opposition: Senate Democrats criticized earlier chip deals over national security risks, which could derail H200 approval [3].

- Uncertainty: No timeline for a final decision or clarity on terms (e.g., revenue-sharing for H200) [1][2].

- Competition: Chinese chipmakers have gained share during Nvidia’s absence, limiting potential recovery [5][8].

- Revenue Boost: H200 sales could increase Nvidia’s China revenue (13.1% of FY2025 total, $17.11B) with higher-margin products [0][6].

- Analyst Optimism: Analysts maintain a “Buy” consensus with a $250 target price (39.8% upside) if approved [6][8].

- NVDA’s 2025-11-21 performance: High $184.56, Low $172.94, Close $178.88, Volume 343.47M [0][4].

- China revenue share (FY2025): 13.1% ($17.11B) [6].

- Analyst target price: $250 (39.8% upside) [6][8].

- Key risks: Political opposition, no clear timeline, competition from Chinese chips [3][5][8].

- Key opportunities: Revenue growth, market share recovery, sector ripple effects [0][8].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.