Updated US Mega-Cap Tech Net Income & Market Cap Analysis (2025 Q3)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

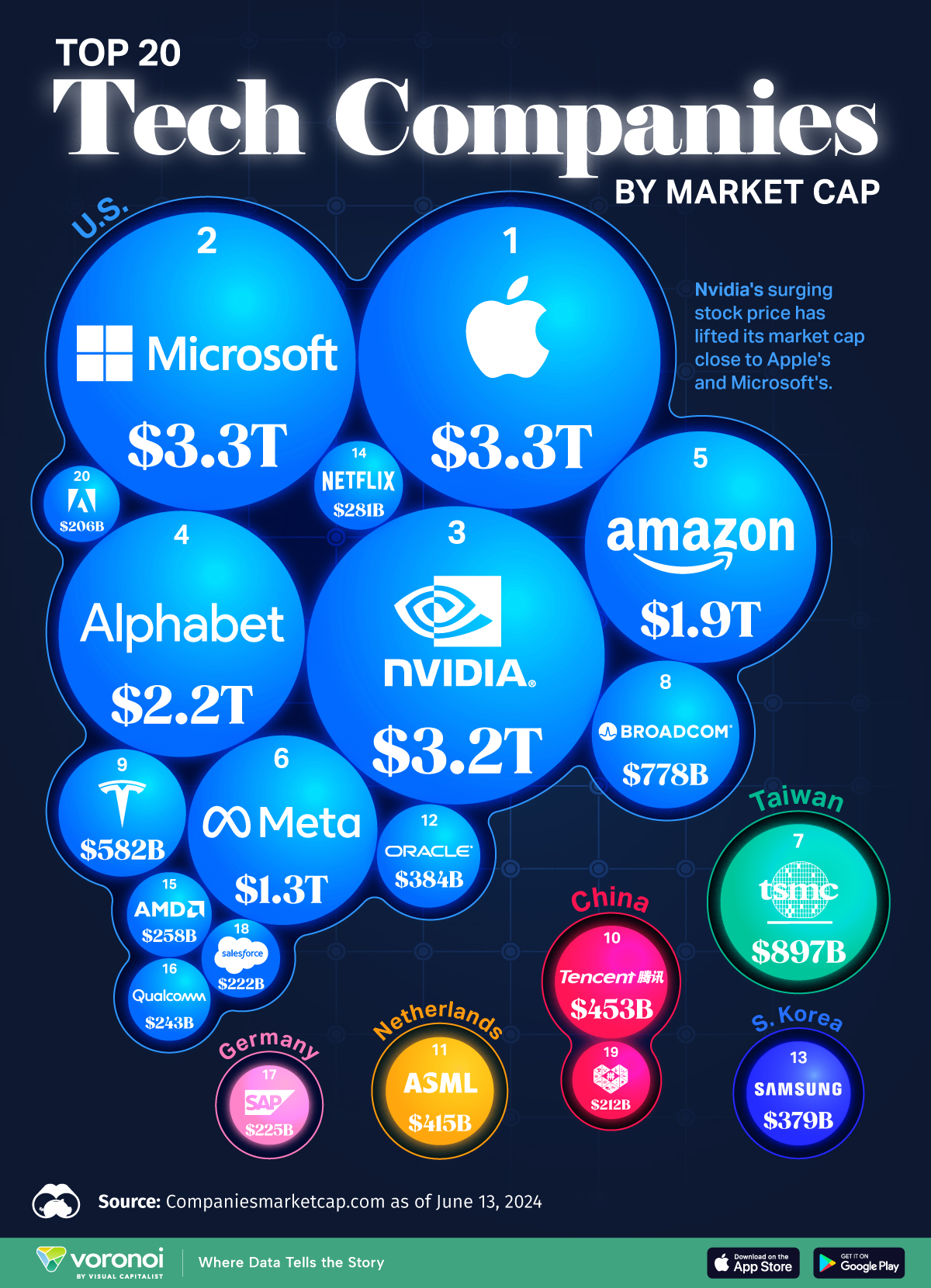

This analysis is based on a Reddit post [4] presenting updated net income comparisons for US mega-cap tech companies. Internal data [0] confirms Broadcom (AVGO) has overtaken Meta (META) in market cap ($1.60T vs $1.50T). Net income rankings (Q3 2025) show Alphabet (GOOGL) leading at ~$33B, followed by Nvidia (NVDA) at ~$30.2B and Microsoft (MSFT) at ~$27.7B [0]. Sector trends indicate AI-driven semiconductors (NVDA, AVGO) are outperforming social media (META) and some software firms (ORCL) [0].

Cross-domain connections reveal AI demand is a primary driver of semiconductor profitability (NVDA’s 94% YoY revenue growth [3]). Social media firms like Meta face growth slowdowns (1-month decline of -18.97% [0]), while software giants MSFT and GOOGL maintain consistent performance. The overtaking of Meta by Broadcom signals a shift in investor preference towards AI infrastructure over consumer-facing tech.

Net income rankings (Q3 2025): 1. GOOGL (~$33B), 2. NVDA (~$30.2B),3. MSFT (~$27.7B),4. AAPL (~$27.6B),5. AMZN (~$19.9B),6. META (~$15.8B),7. AVGO ($8.4B [1]),8. ORCL (~$3.15B),9. TSLA (~$1.56B),10. AMD ($1.24B [2]),11. PLTR (~$0.33B). Market cap rankings: NVDA ($4.36T) > AAPL ($4.01T) > GOOGL ($3.62T) > MSFT ($3.51T) > AMZN ($2.36T) > AVGO ($1.60T) > META ($1.50T) [0]. Note: Some net income figures are approximations using revenue and margin data.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.