Deep Analysis of Mengtian Home Furnishing (603216) Strong Performance: Balancing Transformation Expectations and Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

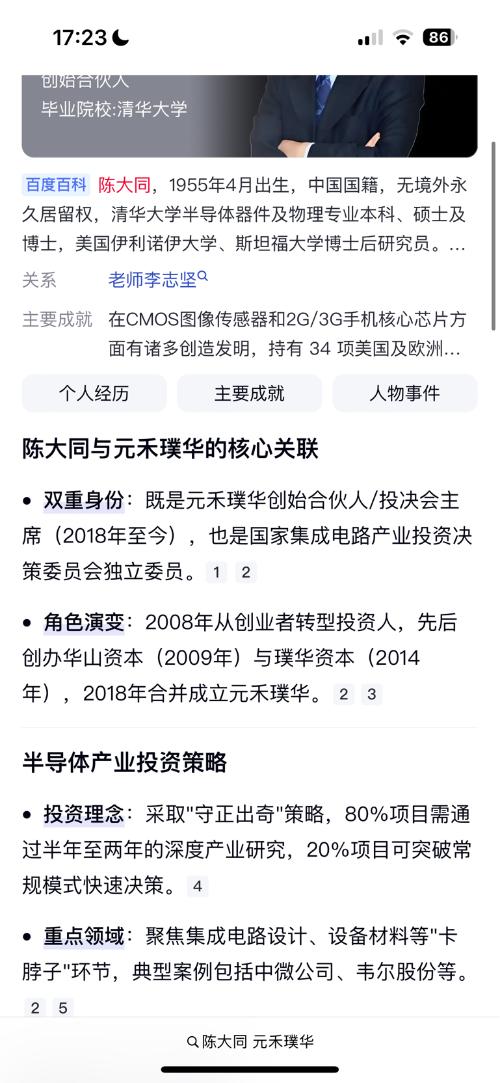

Mengtian Home Furnishing (603216)'s recent strong performance is mainly driven by semiconductor transformation expectations and binding with top investment teams [1]. The company’s traditional home furnishing business faces continuous pressure, with three consecutive years of performance decline from 2022 to 2025. In the first three quarters of 2025, revenue decreased by 12.3% year-on-year and net profit decreased by 28.5% [3]. To seek transformation, the company introduced semiconductor investment teams like Yuanhe Puhua through equity transfer [1]. Although the acquisition of Chuantu Microelectronics was terminated, the capital market’s imagination of its future semiconductor asset injection still pushed the stock price to a three-year high [3].

- Transformation Expectation is the Core Driver: The stock price rise is not based on existing semiconductor business contributions, but the market’s expectation of the company’s future integration of semiconductor resources.

- Binding with Investment Teams Enhances Credibility: Cooperation with top institutions like Yuanhe Puhua has improved market recognition of the transformation strategy [1].

- Fundamentals and Valuation Diverge: Current stock price gains have deviated from traditional business fundamentals, and attention should be paid to the risk of valuation bubbles [4].

- Opportunities: Layout in the semiconductor track opens up new growth space for the company. If asset injection or business synergy is implemented subsequently, it is expected to achieve valuation reconstruction.

- Risks:

- The company clarified that there are no plans for control transfer or asset restructuring [2], so the transformation implementation has uncertainty;

- The traditional home furnishing business is under continuous pressure due to the real estate downturn [3];

- Excessive short-term stock price gains, there is a risk of correction [2][4].

Mengtian Home Furnishing (603216)'s strong performance reflects the market’s enthusiasm for traditional enterprises transforming into emerging tracks, but we need to rationally view the gap between transformation expectations and actual implementation. Investors should pay attention to the company’s subsequent semiconductor business progress and fundamental improvement, and avoid blind chasing of high prices.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.