Dollar Rebound Analysis: Market Impact and Yen Weakness Trends

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Bloomberg Television report [1] titled “Dollar Rebound to Gain Momentum: 3-Minutes MLIV” published on November 3, 2025, featuring Guy Johnson, Kriti Gupta, Lizzy Burden, and Mark Cudmore analyzing key market themes for investors and analysts.

The Bloomberg analysis identifies gaining momentum in dollar strength, which is confirmed by current market data showing the U.S. Dollar Index trading at $99.87, up 0.06% on the day with a range of $99.71-$99.94 [0]. This rebound occurs despite the Federal Reserve’s recent 25-basis point rate cut to 3.75%-4.00% at its October 2025 meeting [2], suggesting markets may be pricing in a more hawkish stance going forward.

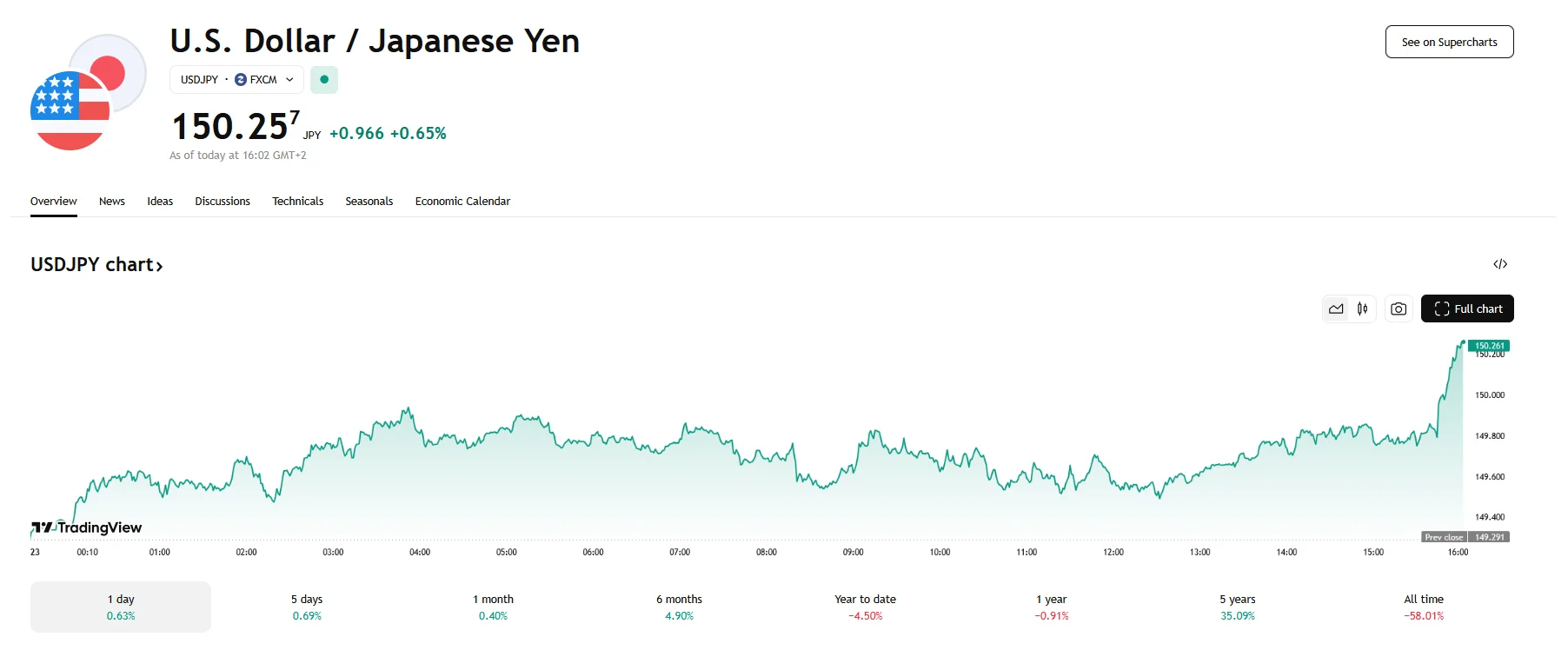

The Bloomberg segment highlights continued yen weakness, which is substantiated by USD/JPY trading at 154.16, up 0.14% and approaching the day’s high of 154.28 [0]. The pair is nearing its 52-week high of 158.86, reflecting what the analysis describes as “very strong structural reasons for yen depreciation” despite potential verbal intervention from Japanese officials [1]. This weakness is primarily driven by significant interest rate differentials between the U.S. Federal Reserve and the Bank of Japan’s ultra-loose monetary policy.

The Bloomberg discussion of “bond market ripple effects” is evidenced by the 10-year Treasury yield rising to 4.10%, up 0.20% on the day [0]. Higher yields are contributing to dollar strength and tightening financial conditions, creating cross-asset impacts that affect both traditional and alternative investments.

The dollar rebound and higher yields are creating significant pressure across asset classes:

- Gold (GLD): Down 0.53% to $368.18, reflecting pressure from higher real yields [0]

- Bitcoin: Down 2.44% to $107,840.07, showing sensitivity to stronger dollar and tighter financial conditions [0]

- U.S. Equities: Recent mixed performance with S&P 500 down 0.57%, NASDAQ down 0.91%, and Dow Jones down 0.20% [0]

Sector performance reveals notable divergence, with Energy (+2.81%) and Financial Services (+1.38%) leading gains, while Technology (-1.74%) and Utilities (-1.99%) underperformed [0].

The Bloomberg MLIV (Most Important Lessons and Views) segment typically represents sophisticated market sentiment, indicating that professional investors are positioning for continued dollar strength despite recent Fed rate cuts [1]. This suggests that structural factors may be outweighing cyclical monetary policy considerations in current market pricing.

The yen weakness underscores the persistent impact of interest rate differentials in currency markets. While the Fed has been cutting rates from historically high levels, the Bank of Japan’s continued ultra-loose policy creates substantial carry trade opportunities that maintain downward pressure on the yen.

The current market dynamics reflect significant monetary policy divergence between major central banks. This divergence is creating cross-border capital flows that benefit the dollar while pressuring the yen, with potential spillover effects on emerging market currencies and global trade patterns.

- Policy Intervention Risk: Japanese authorities may intervene in currency markets if yen weakness accelerates, potentially causing sharp reversals in USD/JPY [1]

- Market Positioning Risk: Overcrowded dollar strength positions could trigger rapid unwinding if Fed policy shifts unexpectedly

- Economic Data Sensitivity: Upcoming U.S. employment and inflation data could significantly impact Fed expectations and dollar momentum

- Emerging Market Pressure: Prolonged dollar strength historically creates pressure on emerging market currencies and capital flows

- Fed Communications: Changes in Fed rhetoric regarding future rate policy [2]

- Japanese Official Statements: BOJ and Ministry of Finance comments on yen levels

- Technical Levels: USD/JPY approaching 155-156 levels could trigger intervention concerns

- Cross-Asset Correlations: Dollar strength impacts on emerging markets and commodity prices

Users should be aware that prolonged dollar strength combined with yen weakness has historically led to increased pressure on emerging market currencies, capital flow reversals from emerging markets, potential trade tensions between major economies, and financial tightening effects on global growth.

Current market data confirms the Bloomberg analysis of dollar rebound momentum and yen weakness [0][1]. The USD Index shows modest gains at $99.87 (+0.06%), while USD/JPY at 154.16 (+0.14%) approaches 52-week highs. The 10-year Treasury yield at 4.10% (+0.20%) reflects bond market ripple effects discussed in the Bloomberg segment [0][1]. Alternative assets face significant pressure, with gold down 0.53% and Bitcoin down 2.44% amid tighter financial conditions [0]. The analysis suggests professional investors are positioning for continued dollar strength despite recent Fed easing, driven by structural factors and persistent interest rate differentials between the U.S. and Japan [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.