2020 Post-Pandemic Investment Paradigm Shift: Macro-Driven Strategies and Commodity Market Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

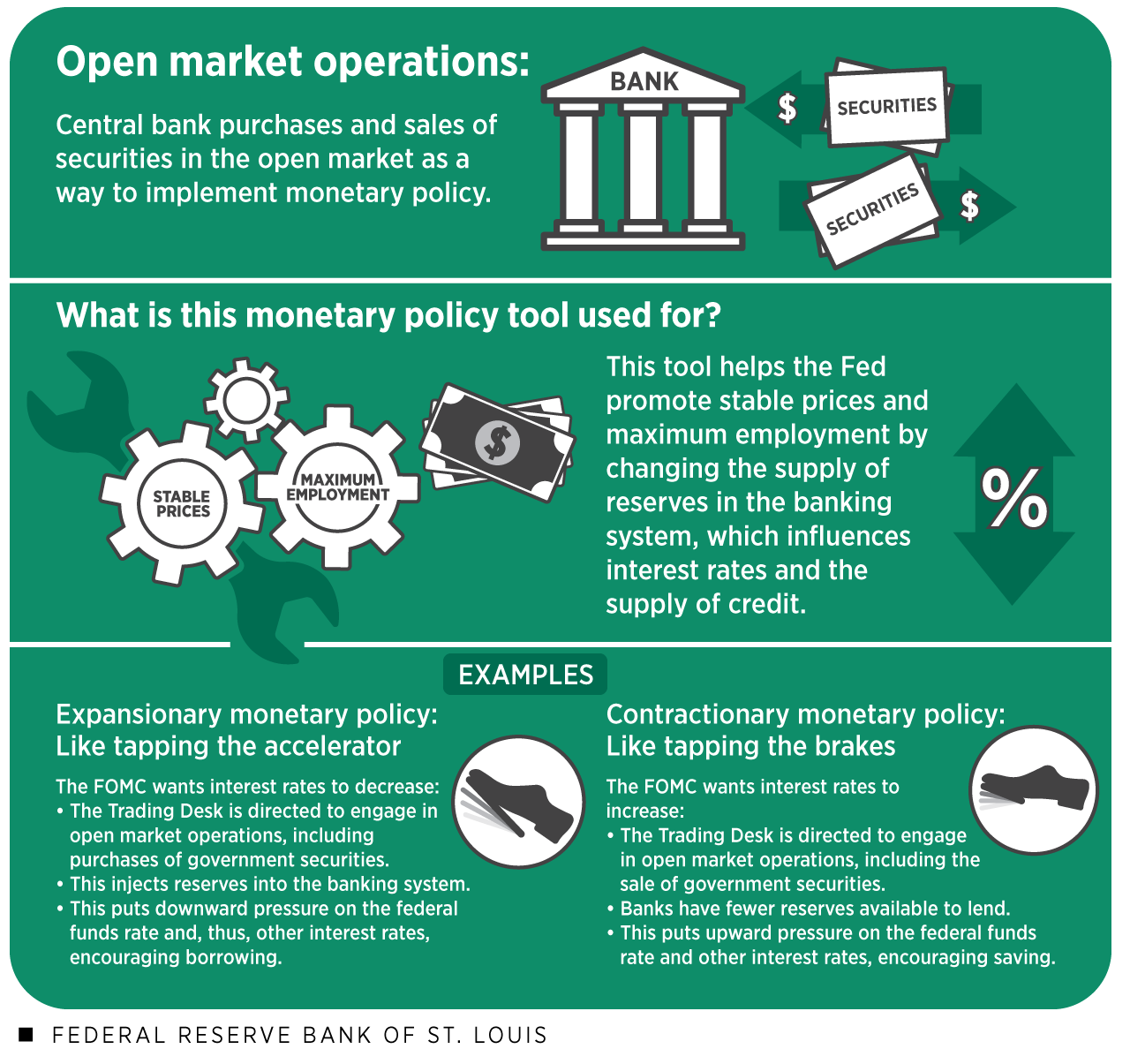

The 2020 pandemic triggered a shift from bottom-up individual stock research to top-down macro-driven investment strategies, driven by the Federal Reserve’s policy cycles (interest rate cuts/balance sheet expansion) and the trend of U.S. debt monetization [1][2]. Commodities are expected to enter a bull market, with recommended strategic rotation across precious metals (gold/silver), industrial metals (copper/aluminum), and energy (oil/coal) based on inflation stages [5].

- Fed Policy Cycle: From emergency rate cuts in March 2020 to aggressive hikes in 2022-23, then a shift to rate cuts in 2024 and a halt to balance sheet reduction in 2025 [1][2][3]. The Fed’s balance sheet peaked at ~$8.9T in 2022 and now stands at ~$6.6T [3].

- Commodity Performance: Gold has surged over 170% from 2020 to 2025 [6], silver is up 74% year-to-date [9], copper has gained over 20% [7], and aluminum ~10% [7]. Energy markets (WTI crude) saw high volatility with peaks in 2021-22 [8].

- Key Drivers: Inflation, geopolitical risks, and the global energy transition impacting commodity demand [5][6][7].

Social media insights align with research findings: both emphasize the macro-driven investment shift and commodity bull market. Research data validates the Fed policy cycle and commodity performance trends mentioned in social media [1][3][6][7].

- Opportunities: Strategic rotation across commodity sectors (precious metals → industrial metals → energy) [5][6][7][8].

- Risks: Unexpected Fed policy shifts [1][4], geopolitical tensions disrupting supply chains [5], and commodity price volatility [6][8].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.