Beyond Win Rate: Advanced Trading Metrics for Performance Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The r/Daytrading community post argues that win rate and basic risk/reward ratios are superficial metrics that can mislead traders about their actual performance[6]. The post recommends tracking several deeper performance measures:

- Gain-to-Pain Ratio: Measures total gains relative to total losses

- Average holding times: Comparing duration of winning vs. losing trades

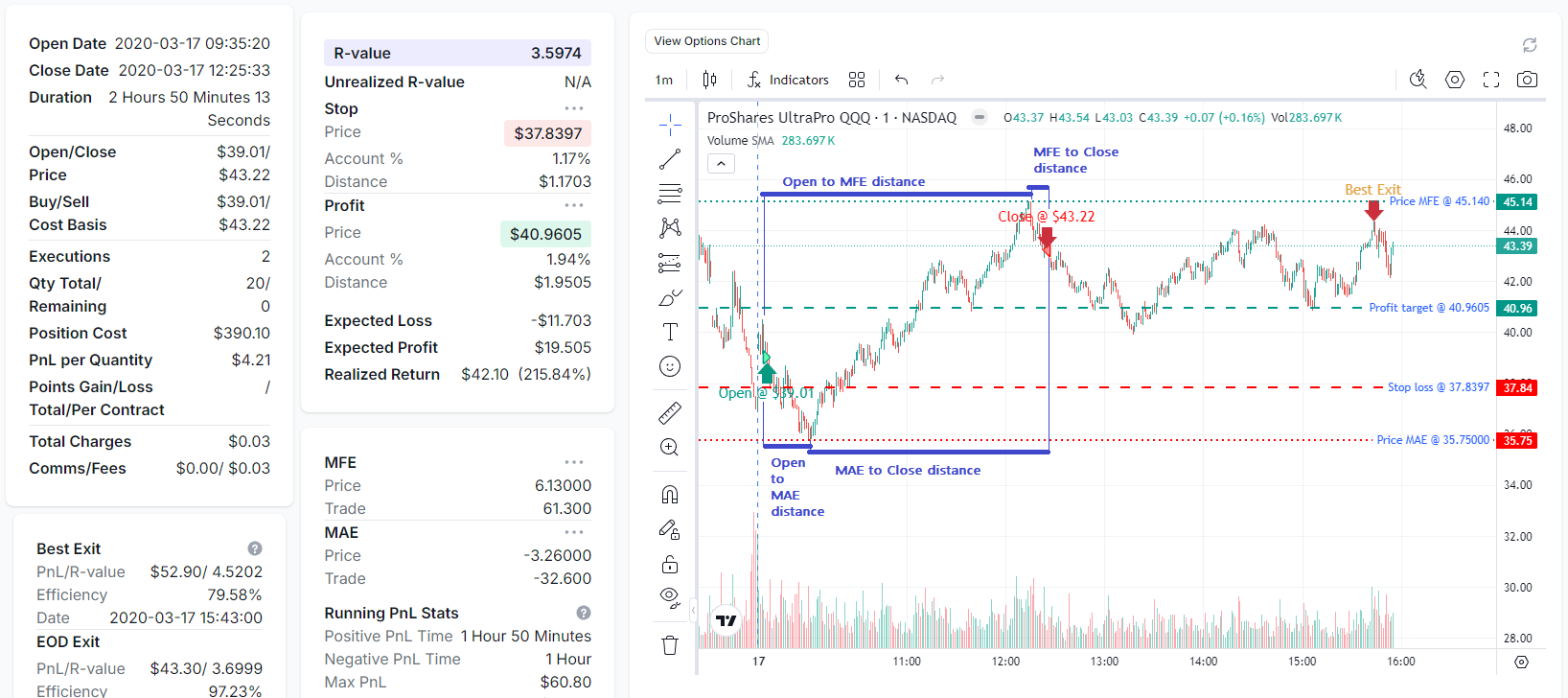

- MAE/MFE: Maximum Adverse Excursion and Maximum Favorable Excursion analysis

- Max consecutive losses: Helps identify tilt and psychological breakdown points

- Outliers: Maximum drawdown and largest losing trade

Community feedback was notably positive, with user Substantial_Monk_918 highlighting MAE & MFE as “the most important metric pair,” while Mr-FD noted the post’s unusual utility and authenticity compared to typical trading content[6].

Professional trading analysis confirms that win rate alone is insufficient for measuring trading performance and can be misleading[1][2][4]. Key insights include:

- Expectancy over Win Rate: Professional traders emphasize expectancy (average profit per trade) as the superior performance metric[2]

- Risk-Reward Synergy: The combination of win rate and risk-reward ratio determines actual profitability, with high win rates potentially resulting in losses if risk-reward is poor[3][4]

- Advanced Metrics: Professional traders use comprehensive metrics including Sharpe ratio, profit factor, drawdown, and expectancy[1]

The research validates the Reddit community’s emphasis on Gain-to-Pain Ratio, MAE, MFE, and Maximum Drawdown as metrics that provide deeper insights into trading skill versus luck by focusing on risk management and trade quality[1].

Both Reddit traders and professional analysis converge on the conclusion that win rate is a vanity metric. The alignment is striking:

- Consensus on Advanced Metrics: Both sources identify Gain-to-Pain Ratio, MAE/MFE, and drawdown analysis as superior to simple win rates

- Psychological Component: Reddit’s emphasis on “tilt-driven blowouts” aligns with professional understanding that psychological factors impact performance metrics

- Skill vs. Luck: Both perspectives emphasize that advanced metrics help distinguish consistent trading skill from lucky outcomes

The Reddit community provides practical, trader-focused insights while professional research offers systematic validation and broader context including additional metrics like Sharpe ratios and expectancy calculations.

- Traders relying solely on win rate may develop false confidence in losing strategies

- Poor risk management practices masked by high win rates can lead to catastrophic drawdowns

- Psychological biases may go undetected without proper metric tracking

- Implementing advanced metrics can significantly improve trading discipline and performance

- MAE/MFE analysis can help identify optimal exit points and improve trade execution

- Tracking consecutive losses and drawdowns can prevent psychological breakdown and preserve capital

The convergence of community wisdom and professional validation suggests that traders who adopt these advanced metrics gain a significant competitive advantage over those relying on superficial performance indicators.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.