Nvidia Earnings Expectations vs. Market Rally Claim Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

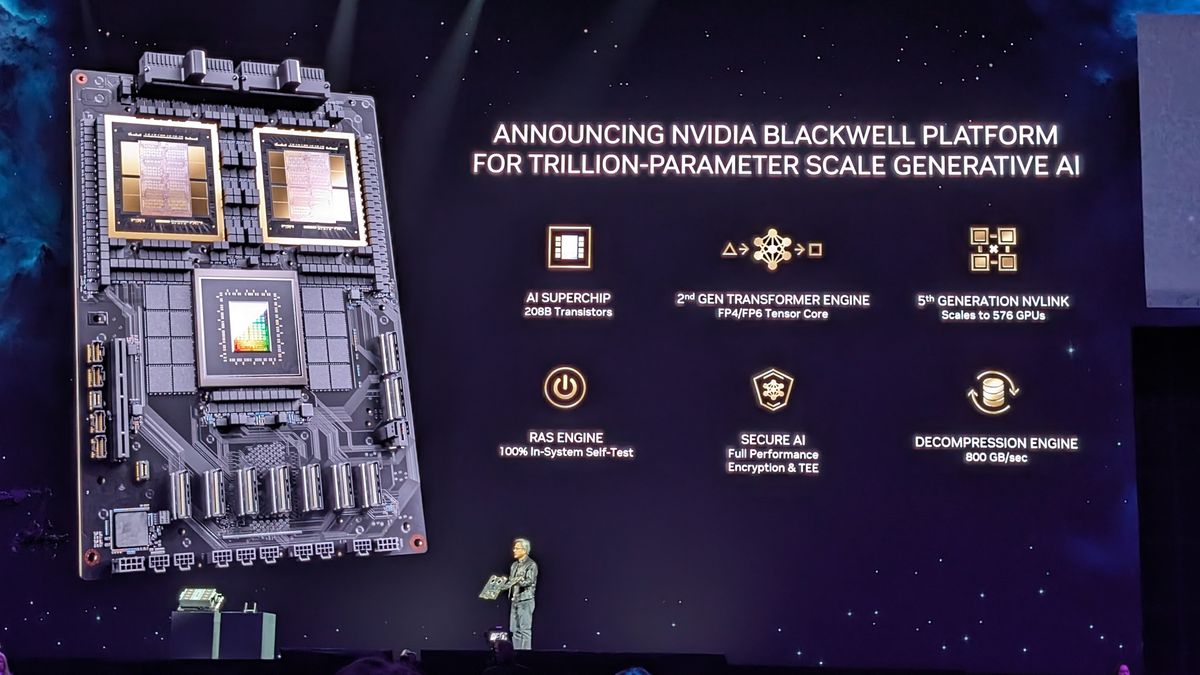

The original event claims the market is green due to Nvidia’s expected earnings beat, citing a $500B order book for Blackwell chips [1]. This claim is partially supported by external sources confirming Nvidia’s $500B backlog for Blackwell and Rubin chips through 2026 [2][3][4]. However, key data contradicts the direct causal link:

- Nvidia Stock Performance: NVDA closed at $178.88 on 2025-11-21, down 1.3% despite positive indices (S&P500 +0.72%, NASDAQ +0.5%) [0].

- Sector Contribution: Tech rose only 0.15%—far behind Healthcare (1.73%) and Industrials (1.52%)—indicating it was not the rally leader [0].

- Broader Market Trend: Russell 2000 (small caps) led with a 2.72% gain, showing the rally was driven by broader factors [0].

Long-term optimism from the backlog is balanced by short-term volatility: NVDA’s 10-day range ($172.93-$195.95) reflects uncertainty [0].

- Contradiction of Causal Claim: The market rally was not driven by Nvidia, as NVDA declined while indices rose [0][1].

- Broader Dynamics: Small caps outperformed, suggesting factors beyond tech/AI chips fueled the rally [0].

- Backlog Context: 30% of the $500B backlog is shipped, leaving $350B over 5 quarters—sustained demand but no immediate gains [4].

- Regulatory: Chip smuggling case raises export control concerns [1][2].

- Volatility: NVDA’s 7.81% drop on 2025-11-20 shows sensitivity to news [0].

- Supply: Hyperscalers face power/grid constraints delaying GPU deployment [2].

- Long-Term AI Demand: $500B backlog confirms sustained need for Blackwell/Rubin chips [2][3][4].

- Confirmed Data: $500B AI chip order backlog through 2026 [2][3][4].

- Price Trends: NVDA declined 1.3% on 2025-11-21 while indices rose [0].

- Sector Performance: Tech not the rally leader; Healthcare/Industrials outperformed [0].

- Monitoring Points: Post-earnings guidance, hyperscaler spending, regulatory updates, supply constraints [1][2][4].

This summary provides objective context without prescriptive recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.