AI Stocks Correction and Healthcare Sector Momentum: Market Analysis (2025-11-21)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

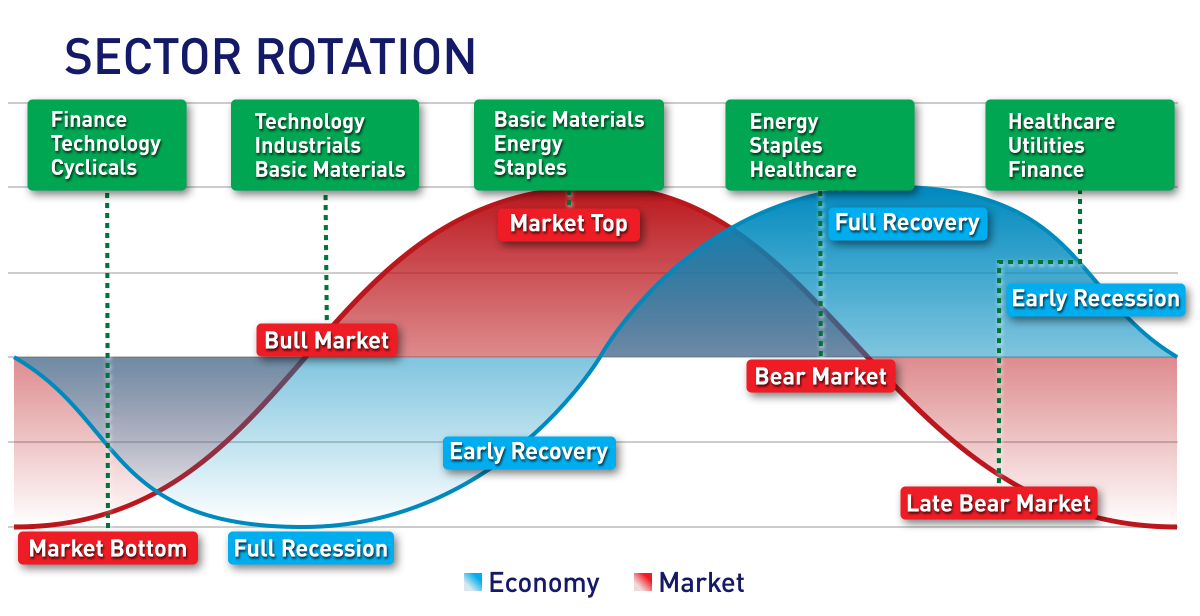

Key AI stocks such as AMD (-11.47% on Nov20), NVDA (-7.81% on Nov20), MSFT (-2.9% on Nov20) and GOOGL (-4.96% on Nov20) experienced sharp declines, reflecting investor concerns over valuation excesses and supply chain constraints [0][2]. Conversely, the healthcare sector saw a +2.256% gain on Nov21, with the Healthcare Select Sector SPDR Fund (XLV) up ~6% month-to-date [0][3]. This sector rotation from tech/AI to defensive healthcare is driven by attractive valuations (healthcare’s 20x forward P/E vs higher tech multiples) and defensive positioning amid market uncertainty [3].

Cross-domain analysis reveals that the AI correction and healthcare surge are linked to broader market themes: investors shifting from high-growth, high-valuation stocks to defensive sectors with more stable earnings [1][2]. The partial recovery of GOOGL (+1.67% on Nov21) indicates mixed sentiment, suggesting some investors are still holding onto quality AI stocks [0]. The healthcare sector’s momentum is supported by M&A activity and defensive fundamentals, making it an attractive alternative to tech [3].

Risks for AI stocks include valuation correction risks due to excessive multiples and supply chain disruptions [2]. For healthcare, drug pricing regulations and regulatory scrutiny remain key concerns [3]. Opportunities lie in defensive healthcare stocks with strong fundamentals and M&A potential [3]. The mixed performance of AI stocks (e.g., GOOGL’s recovery) suggests selective opportunities in quality AI names [0].

The analysis highlights significant declines in AI stocks (AMD, NVDA, MSFT) and a surge in healthcare (XLV, LLY, AMGN). Sector rotation trends, valuation metrics (healthcare’s 20x forward P/E), and supply chain constraints are critical context for decision-makers. The data indicates a shift towards defensive sectors, but mixed AI sentiment suggests caution in broad generalizations [0][1][2][3].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.