Taoping Inc. Strategic Acquisition of Skyladder Group: Market Analysis and Investment Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Taoping Inc. (Nasdaq: TAOP) has announced a transformational all-stock acquisition of Skyladder Group Limited valued at RMB 152 million ($21.36 million), strategically positioning the company in the smart elevator market. The deal includes aggressive performance-based targets through 2029, projecting revenue growth of 143.7% and a transition to 12.3% net profitability. However, the transaction carries significant execution risks, as evidenced by TAOP’s recent 37.9% stock decline and current negative profit margins. This acquisition represents a high-risk, high-reward opportunity that could fundamentally reshape Taoping’s business model if successfully executed.

- Transaction Value: RMB 152 million ($21.36 million)

- Payment Method: All-stock transaction

- Target: 100% equity of Skyladder Group Limited

- Strategic Focus: Entry into smart elevator and IoT sector

- Announcement: September 30, 2025

The acquisition represents a strategic pivot for Taoping, diversifying beyond its current cloud platform focus into the rapidly growing smart building market. The all-stock structure, while creating dilution concerns, aligns shareholder interests by tying consideration to performance achievement.

The transaction includes a sophisticated earnout structure with specific targets through 2029:

| Year | Revenue Target | Net Profit Target | Growth Rate |

|---|---|---|---|

| 2026 | RMB 74.14M | RMB 3.80M | Baseline |

| 2027 | RMB 101.98M | RMB 7.74M | +37.5% |

| 2028 | RMB 135.06M | RMB 14.90M | +32.4% |

| 2029 | RMB 180.66M | RMB 22.14M | +33.7% |

This framework provides protection for shareholders while incentivizing management to achieve aggressive growth targets.

- Stock Performance: TAOP declined from $3.40 to $2.11 (37.9% drop) between October 8-17, 2025

- Trading Volume: Spike to over 1.4M shares on October 17 (4.3x average)

- Investor Sentiment: Negative reaction driven by dilution concerns and execution risk

- Current Market Cap: $4.11M (small-cap status)

- Revenue TTM: $36.67M

- Profit Margin: -4.96% (currently unprofitable)

- EPS: -$8.67

- 52-Week Range: $2.70 - $25.50 (high volatility)

The acquisition price represents 5.2x Taoping’s current market cap, indicating significant market skepticism about the transaction’s value proposition.

-

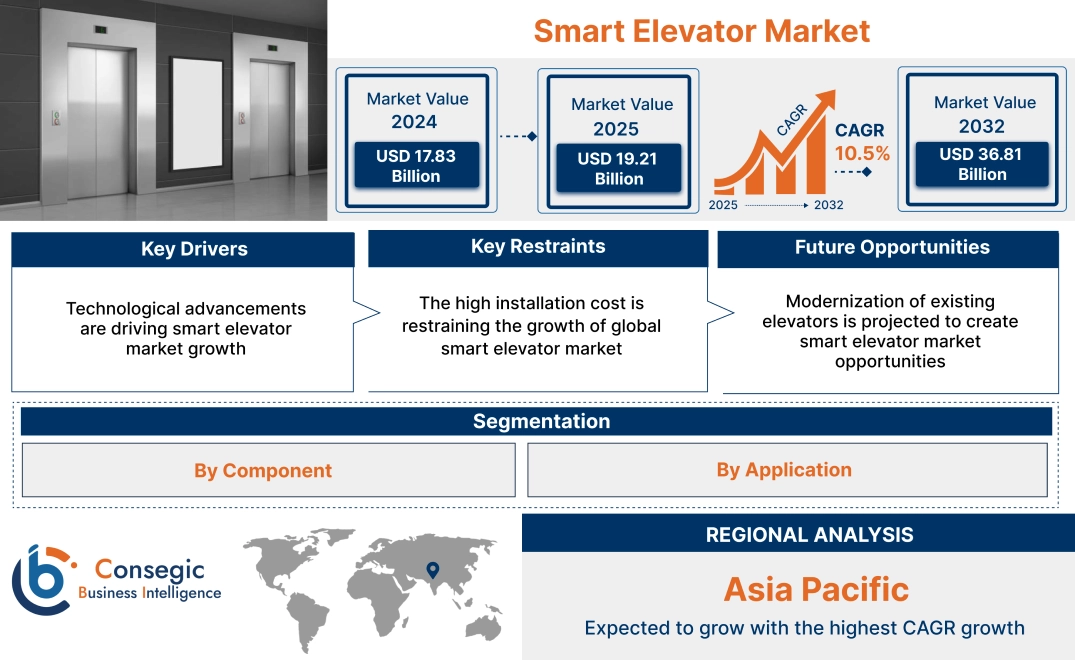

Market Entry: The acquisition provides immediate entry into the $50B+ global smart elevator market, a sector with strong growth prospects driven by urbanization and IoT adoption.

-

Revenue Scale: Projected 2026 revenue of RMB 74.14M represents a 20.2% increase over current TTM revenue, potentially doubling the company’s revenue base within four years.

-

Technology Synergy: Taoping’s AI expertise could accelerate Skyladder’s smart elevator platform development, creating competitive advantages in the IoT space.

- Execution Risk: Aggressive 143.7% revenue growth target over four years

- Integration Complexity: Merging different business models and technologies

- Financial Strain: Current negative profitability may limit growth investments

- Market Competition: Established players in smart elevator sector

- Performance-Based Structure: Share issuance contingent on achieving targets

- Strategic Alignment: Complementary to existing IoT and AI focus

- Market Timing: Smart building sector experiencing accelerated growth

If successful, the acquisition could transform Taoping from a small-cap cloud company to a significant player in the smart building IoT ecosystem. The projected transition to 12.3% net margins by 2029 would represent a fundamental improvement in profitability and sustainability.

- Revenue Growth: Potential 143% increase over four years

- Margin Expansion: Transition from -4.96% to +12.3% net margins

- Valuation Upside: Current P/S ratio of 0.112 suggests significant undervaluation if targets are achieved

- Strategic Positioning: Early mover advantage in AI-enhanced smart elevator market

- Q4 2025 earnings call providing integration roadmap

- 2026 Q1 results showing initial revenue contribution

- Successful product launches and market adoption

- Achievement of early performance targets

- Execution Failure: Missing performance targets could trigger significant share price decline

- Dilution Impact: Additional shares could depress existing shareholder value

- Competitive Pressure: Established elevator manufacturers may limit market penetration

- Financial Sustainability: Current negative cash flow may constrain growth investments

- Performance-based earnout structure protects against overpayment

- Phased integration approach reduces operational disruption

- AI technology leverage creates differentiation potential

- Q4 2025 Integration Progress: Early indicators of execution capability

- 2026 Q1 Revenue Contribution: Validation of acquisition value

- Competitive Landscape Response: Market positioning sustainability

- Technology Synergy Realization: AI integration benefits

- Market Expansion: Geographic and product line extensions

- Strategic Partnerships: Potential collaborations with building developers

The Taoping-Skyladder acquisition represents a classic high-risk, high-reward transformation opportunity. While the strategic rationale for entering the smart elevator market is sound, the execution challenges are substantial given Taoping’s current financial position and the aggressive growth targets. The performance-based transaction structure provides some protection, but investors should maintain cautious optimism and monitor quarterly progress closely.

- Integration progress updates in Q4 2025 earnings call

- 2026 Q1 revenue contribution and margin performance

- Competitive developments in smart elevator market

- Achievement of performance-based milestones

Analysis based on market data as of October 19, 2025. This report is for informational purposes only and should not be considered investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.