Analysis of Multidimensional Driving Factors and Market Impact of Gree Electric (000651) Becoming a Hot Stock

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

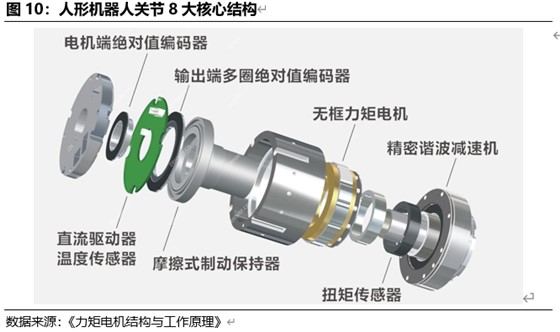

Gree Electric (000651) becoming a hot stock is driven by emerging technology layout, high dividend policy, management changes, and diversified sales channel expansion [0]. The company has made breakthroughs in core components of humanoid robots, having developed parts such as joint modules [1], injecting new growth momentum into traditional businesses. However, in the first three quarters of 2025, revenue decreased by 6.5% year-on-year, and net profit decreased by 2.27% year-on-year [0], putting short-term performance under pressure. Regarding management, Zhu Lei, the Marketing Director, was promoted to Executive Vice President [2], signaling rejuvenation and strategic transformation. In terms of stock price, there were large fluctuations in 2025, reaching a high of 52.73 yuan [3], reflecting market divergence on the company’s future.

- Balance between Technology and Traditional Business: The breakthrough in robot technology contrasts with the decline in traditional home appliance business, indicating that the company is actively seeking a second growth curve [0,1].

- Strategic Significance of Management Changes: Zhu Lei’s promotion may accelerate overseas market expansion and brand rejuvenation [2].

- Attractiveness of Dividend Policy: Cumulative dividends exceed 147.6 billion yuan, with an interim dividend of 5.585 billion yuan in 2025 [0], continuing to attract value investors.

Gree Electric currently presents a situation where short-term performance pressure coexists with long-term growth potential. Robot technology layout, management changes, and high dividend policy are the core points of market attention [0,1,2]. Although short-term financial data is not good, emerging businesses and shareholder return policies provide sustained market attractiveness for the company.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.