PR=PE/ROE Strategy: Opportunities and Challenges in 2025 A-Share Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

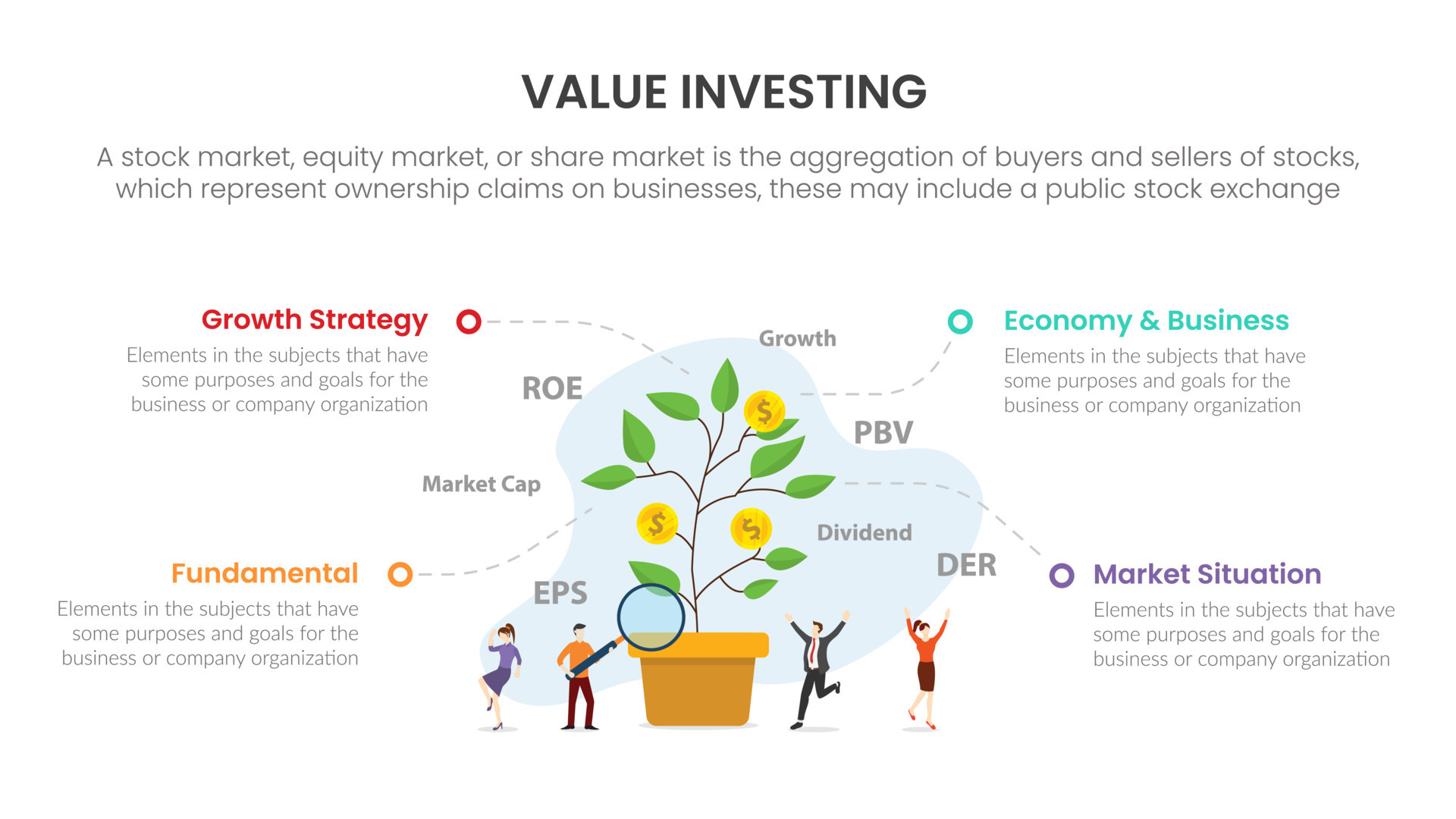

Key insights from the Xueqiu post on PR=PE/ROE strategy include:

- Core Metric:PR=PE/ROE as a value investment indicator combining valuation and profitability.

- Signals:Buy when PR ≤0.6 (deep value) with sufficient cash flow; sell when PR≥0.8 or fundamental deterioration occurs.

- Screening:Focus on stocks with stable ROE, transparent governance, and low capital expenditure.

- Dynamic Adjustment:Adapt to enterprise type, dividend policies, and interest rate environment to avoid value traps.

From social media analysis:

- Market Challenges:2025 A-share market is in a shock phase with frequent sector rotation and daily turnover below 2 trillion yuan (stock fund game phase).

- Strategy Adaptation:Traditional PR value strategy needs integration with growth strategies; ‘dumbbell’ allocation (value + growth) is recommended.

- Low Interest Rate Impact:Pros (enhanced equity asset appeal) and cons (high valuations leading to scarce traditional value targets).

- Quantitative Opportunities:Fundamental quant strategies have space but require AI to improve stock selection precision.

- Risk Mitigation:Prioritize ROIC vs WACC to avoid value traps; key risks include geopolitical conflicts, supply chain reconfiguration, and policy adjustments.

- Alignments:Both the Xueqiu post and research emphasize avoiding value traps and dynamic strategy adjustment.

- Contradictions:Theoretical PR strategy’s clear signals contrast with practical market volatility and sector rotation.

- Impact:Investors need to combine PR with AI-driven quant tools and mix value/growth assets to navigate current conditions.

- Opportunities:Low interest rates boost equity appeal; AI-enhanced quant strategies offer precision.

- Risks:Sector rotation disrupts value plays; high valuations limit traditional value targets; geopolitical/policy uncertainties.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.