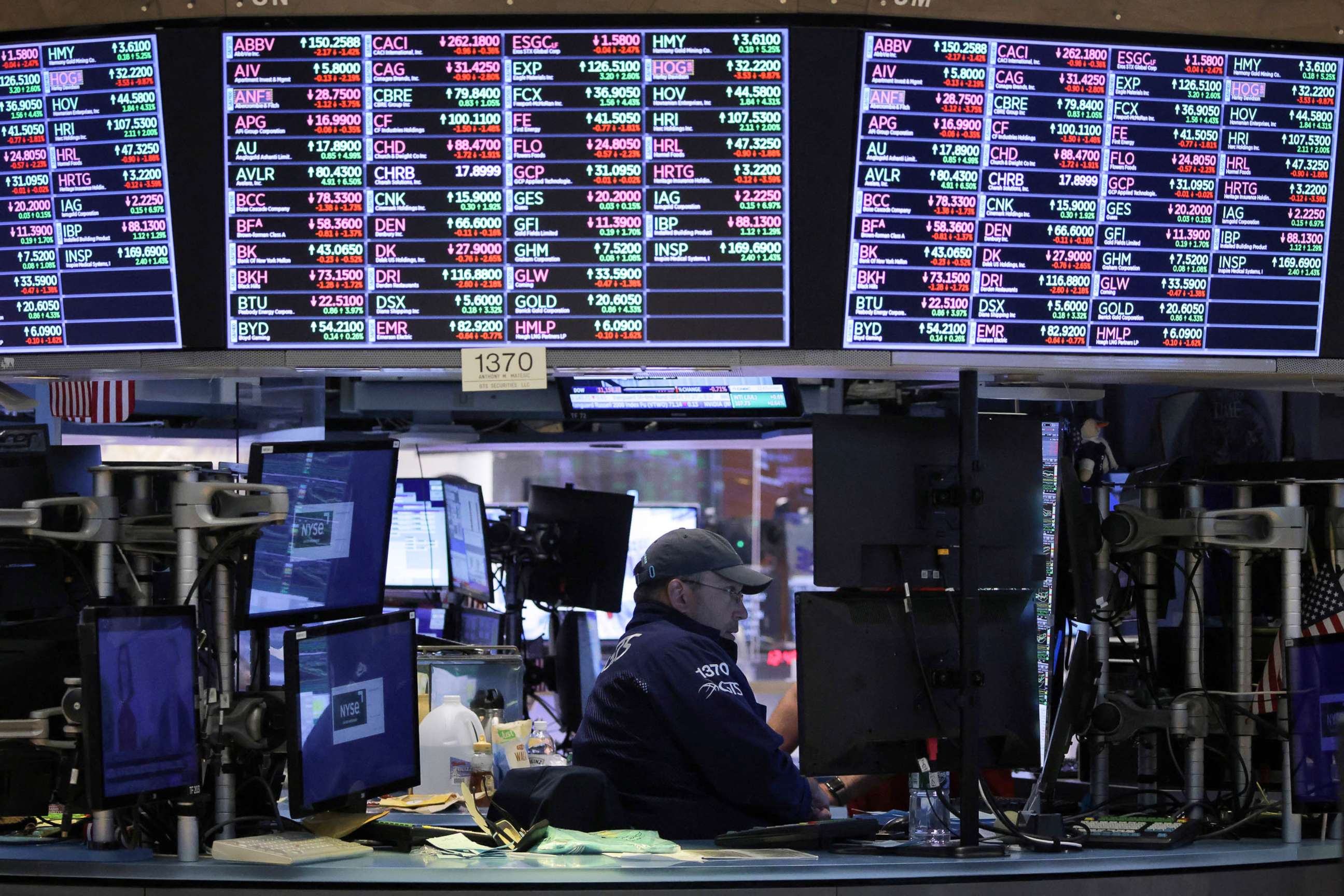

Intraday Market Overview - November 21, 2025 (12:00 PM EST)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

U.S. equities are higher mid-session, with the Dow Jones Industrial Average leading gains (+1.27%) followed by the S&P 500 (+0.99%) and Nasdaq Composite (+0.69%) [0]. Sector rotation is prominent: Basic Materials (+1.45%) and Healthcare (+0.98%) outperform, while Utilities (-2.03%) and Technology (-1.04%) lag [0]. Key catalysts include Eli Lilly’s historic $1 trillion market cap milestone (boosting Healthcare), Meta’s entry into electricity trading (AI infrastructure play), and unusual options activity in NVIDIA [1][2][4].

- Dow Jones Industrial Average: +1.27% (open:45,808.65 → current:46,392.58) [0]

- S&P 500: +0.99% (open:6,555.77 → current:6,620.77; intraday range:6,521.92–6,622.71) [0]

- Nasdaq Composite: +0.69% (open:22,162.83 → current:22,315.47) [0]

- Leaders: Basic Materials (+1.45%), Healthcare (+0.98%) [0]

- Laggards: Utilities (-2.03%), Technology (-1.04%) [0]

- Rotation Note: Investors are shifting from rate-sensitive sectors (Utilities) and recent AI leaders (Tech) to cyclical (Materials) and defensive-growth (Healthcare) sectors [0].

-

Eli Lilly’s $1 Trillion Milestone: Eli Lilly briefly crossed the $1 trillion market cap threshold, the first drugmaker to reach this milestone [1]. This drove Healthcare sector gains, as the company’s GLP-1 drugs continue to dominate the obesity and diabetes markets [1].

-

Meta’s AI Infrastructure Push: Meta Platforms entered electricity trading to accelerate construction of new U.S. power plants critical for its AI infrastructure buildout [2]. This move underscores the growing demand for energy to support AI data centers, though Tech sector performance remains weak today [0][2].

-

Unusual NVIDIA Options Activity: NVIDIA saw over 100,000 contracts traded on the Nov-21-25 200 Call by 11:00 AM ET, representing7.1% of all options traded on the stock [4]. Implied volatility dropped by54% after blowout earnings, indicating reduced uncertainty or profit-taking by traders [4].

-

Fed Afternoon Events: Key Fed-related events this afternoon include Beth Hammack speaking at12:20 PM ET, a30-year bond auction at1:00 PM ET, Treasury Statement at2:00 PM ET, and Fed Balance Sheet release at4:30 PM ET [6].

- Eli Lilly (LLY): Briefly hit $1 trillion market cap, a historic first for a pharmaceutical company [1].

- NVIDIA (NVDA): Unusual options activity with over100k Nov21 200 Call contracts traded [4].

- Applied Digital (APLD):71,000 calls traded, as investors position for upside from AI data center infrastructure [5].

- T-Mobile US (TMUS): Downgraded by Oppenheimer due to concerns over a looming industry price war [3].

- Fed speaker Beth Hammack (12:20 PM ET)

-30-year bond auction (1:00 PM ET) - Treasury Statement (2:00 PM ET)

- Fed Balance Sheet (4:30 PM ET) [6]

- S&P500: Resistance at6,622.71 (intraday high), support at6,550 (morning open level) [0]

- Nasdaq: Watch if it can hold above22,300 (current level) to confirm upside momentum [0]

- Fed Comments: Any hawkish remarks on interest rates could reverse gains.

- Bond Auction Demand: Weak demand for30-year bonds may signal investor concern over long-term rates.

- Sector Rotation: Further Tech weakness could weigh on Nasdaq performance.

[0] Ginlix Analytical Database

[1] MarketWatch - Is GLP-1 the new AI? Drugmaker Eli Lilly briefly joined the $1 trillion market cap club

[2] Techmeme - Meta enters electricity trading to help accelerate the construction of new US power plants critical for its AI infrastructure buildout

[3] SeekingAlpha - Oppenheimer thinks T-Mobile US to be hurt by looming industry price war; lowers rating

[4] MarketChameleon - NVDA 200 Calls See Over100,000 Contracts Traded as Implied Volatility Drops

[5] Yahoo Finance - Unusual Options Activity Shows71,000 Calls Hit the Tape for Applied Digital Stock

[6] Econoday - 2025 Economic Calendar

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.