Meta Andromeda Algorithm Claim Analysis: Impact on Stock and Advertiser Sentiment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

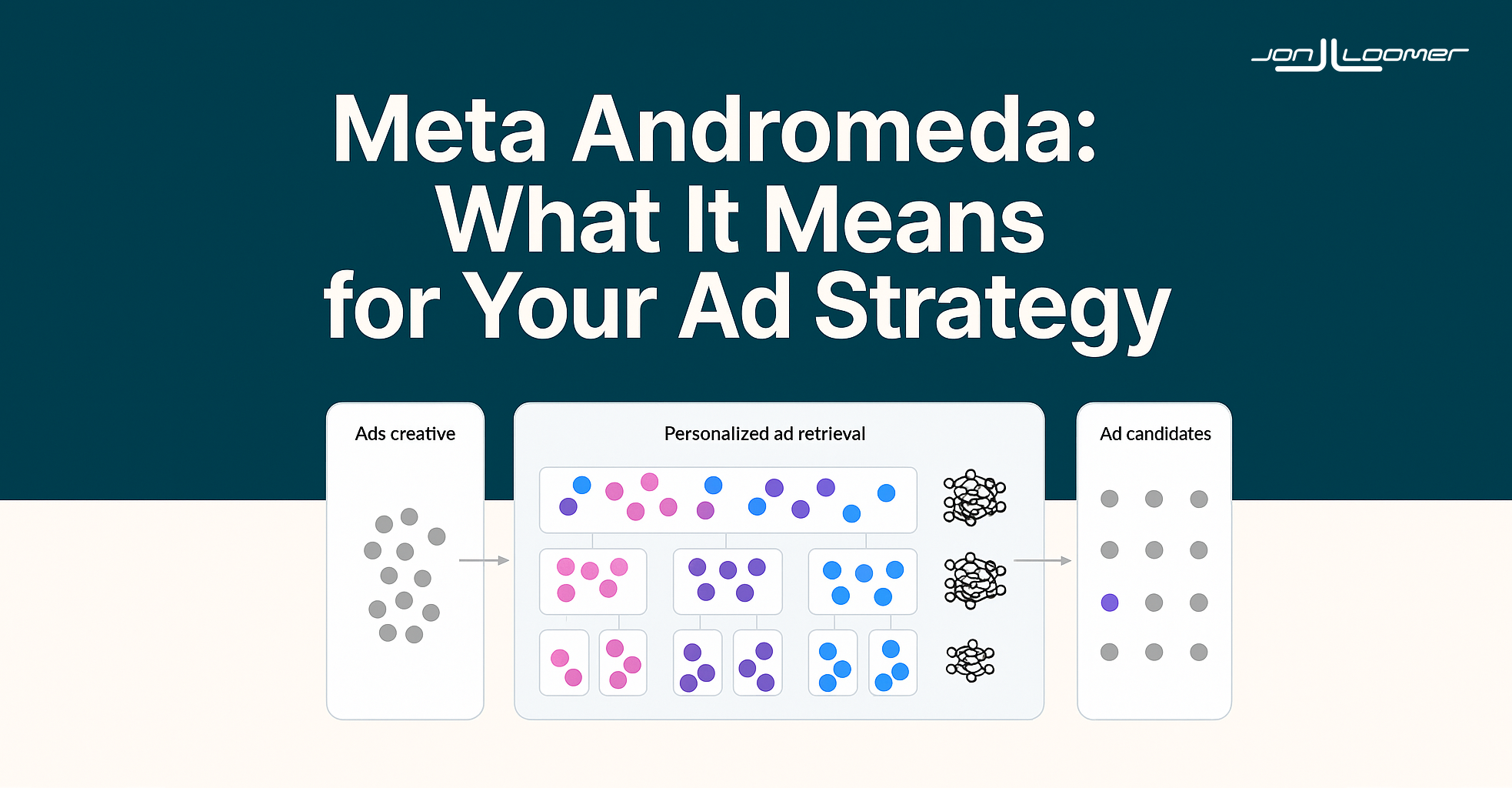

An advertiser/investor claimed Meta’s new “Andromeda” ad algorithm is broken, citing frequent outages, budget waste without results, and potential advertiser pullback. The claim also mentioned threats of lawsuits over lack of transparency and unauthorized changes, advising against investing in Meta.

Meta’s (META) stock price dropped 0.72% on the event day (2025-11-19) to $597.69, despite the Communication Services sector rising 0.97% that day [0]. This suggests a mild negative reaction to the claim, though not a significant sell-off.

Meta’s 1-month performance is -16.63%, but analysts maintain a “Buy” consensus with an average target price of $840 (40.5% above current levels) [0]. The event introduces new uncertainty, but existing analyst sentiment remains positive.

The claim contrasts with Meta’s Q3 2025 earnings call, where the company reported a 14% increase in ad quality on Facebook surfaces due to Andromeda improvements [0]. This creates a divergence between advertiser complaints and Meta’s official stance.

| Metric | Value | Source |

|---|---|---|

| META Current Price | $597.69 | [0] |

| 1-Day Change | -0.72% | [0] |

| Market Cap | $1.51T | [0] |

| Analyst Target Price | $840 | [0] |

| Andromeda Quality Improvement (Q3 2025) | +14% | [0] |

| Advantage+ Automation ARR | $60B | [0] |

- Directly Impacted:Meta Platforms (META)

- Related Sectors:Communication Services, Technology

- Upstream/Downstream:Ad agencies, advertisers using Meta’s platform, and AI infrastructure providers (e.g., NVIDIA, given Andromeda’s reliance on their hardware [1]).

- Meta’s official response to this specific advertiser claim (no direct statement found as of 2025-11-19 [2]).

- Actual lawsuits related to Andromeda (existing class actions focus on impersonation ads, not algorithm performance [3]).

- Meta’s Stance:Andromeda is a core improvement driving ad quality and automation [0].

- Advertiser Claim:Algorithm is broken, leading to budget waste and transparency issues [user input].

- Third-Party Evidence:Reddit threads and marketing blogs have reported Andromeda-related performance issues since mid-2025 [1, 2].

This development raises concerns about potential advertiser dissatisfaction and legal risks related to Meta’s Andromeda algorithm. Users should monitor:

- Meta’s official response to the claim.

- Further advertiser complaints or legal actions targeting Andromeda.

- Changes in analyst sentiment or target prices.

- Meta’s Q4 2025 earnings call (for updates on Andromeda performance).

- Advertiser retention rates and ad spend trends on Meta’s platform.

- Regulatory scrutiny of algorithm transparency and accountability.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.