Eli Lilly Obesity Pipeline Update: Key Assets and Market Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

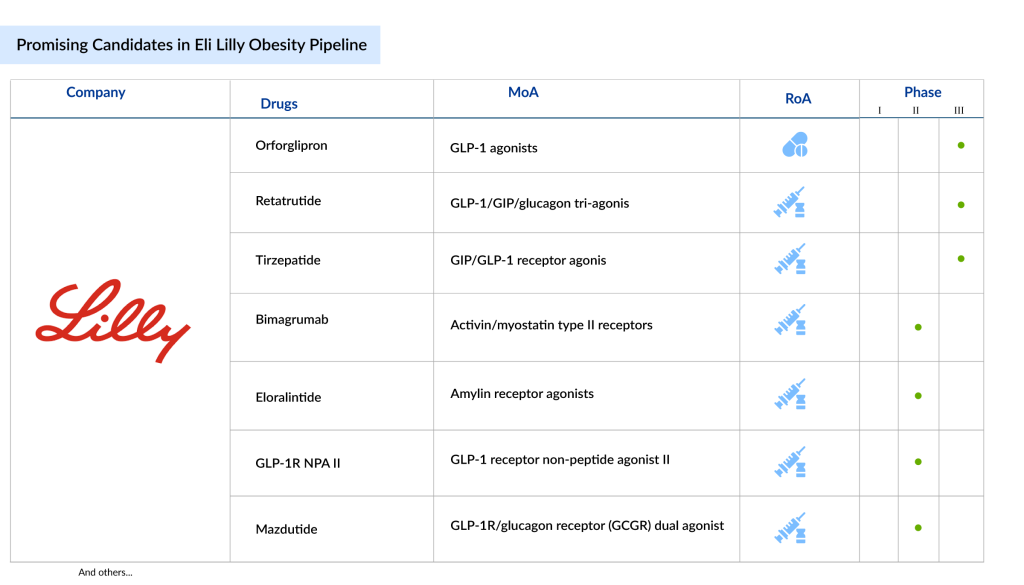

Eli Lilly (LLY) maintains a robust obesity pipeline highlighted by orforglipron (oral small-molecule GLP-1) and retatrutide (triple agonist) [3]. Orforglipron is positioned for high-volume sales via TrumpRx/Medicare at $50/month starting April2026 [1][2], while retatrutide targets biologic classification for 12-year exclusivity with Phase3 data pending in H22026 [3]. Additional assets include eloralintide (amylin agonist), mazdutide (AUD/MASH expansion), brenipatide (early-phase), and bimagrumab (muscle-retention combo) [3].

LLY’s stock closed at $1030.05 on Nov18, 2025, up +1.58% (outperforming healthcare sector’s +0.85% gain) [0]. The company’s market cap reached a record $973.8B [5], with exceptional returns: +28.30% (1mo), +46.48% (3mo), +32.39% (YTD) [0]. Financial metrics show a strong net profit margin of 30.99% but a high P/E ratio of50.18x [0].

- Pipeline-Sector Synergy: LLY’s pipeline strength contrasts with regulatory price cuts, creating a trade-off between expanded access and margin compression.

- Valuation Disconnect: The consensus target price ($889, -13.7% from current levels) indicates investor expectations may be overextended [0].

- Competitive Landscape: Novo Nordisk (NVO) remains a key competitor, co-participating in TrumpRx price agreements [2][6].

- Valuation Risk: High P/E ratio (50.18x) and consensus target below current price signal potential downside if pipeline milestones are delayed [0].

- Margin Compression: TrumpRx price cuts for orforglipron may reduce per-unit revenue even as volume increases [1][2].

- Regulatory Risk: Delays in FDA approvals for Orforglipron or Retatrutide could impact growth projections [3].

- Competitive Risk: Novo Nordisk’s GLP-1 therapies and emerging players in the obesity space pose threats [6].

- Expanded Access: TrumpRx agreements will increase patient access to LLY’s obesity drugs, driving volume growth [1][2].

- Pipeline Diversification: Broad pipeline assets reduce reliance on single products, supporting long-term growth [3].

- Stock Performance: LLY delivered +28.30% (1mo), +46.48% (3mo), +32.39% (YTD) returns [0].

- Financial Metrics: Net profit margin of30.99% [0], market cap of $973.8B [5].

- Pipeline Milestones: Orforglipron FDA filing (late2025), Retatrutide Phase3 results (H22026) [3].

- Price Regulation: Orforglipron priced at $50/month for Medicare beneficiaries starting April2026 [1][2].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.