Analysis of the Differentiation Between China and US AI Development Paths and the Long-Term Value of RMB Assets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The divergence in AI development paths between China and the U.S. is obvious: the U.S. takes a closed-source route with heavy investment, while China relies on cost advantages and an open-source ecosystem to reshape the industry’s cost structure; the heavy-asset model is subverting traditional high-margin software valuation logic, and current AI investments face bubble risks; China’s core barriers lie in low computing power costs, rich industrial application scenarios, and sound infrastructure; cost control and application implementation capabilities will be the decisive factors, which may lay the foundation for the long-term value of RMB assets.

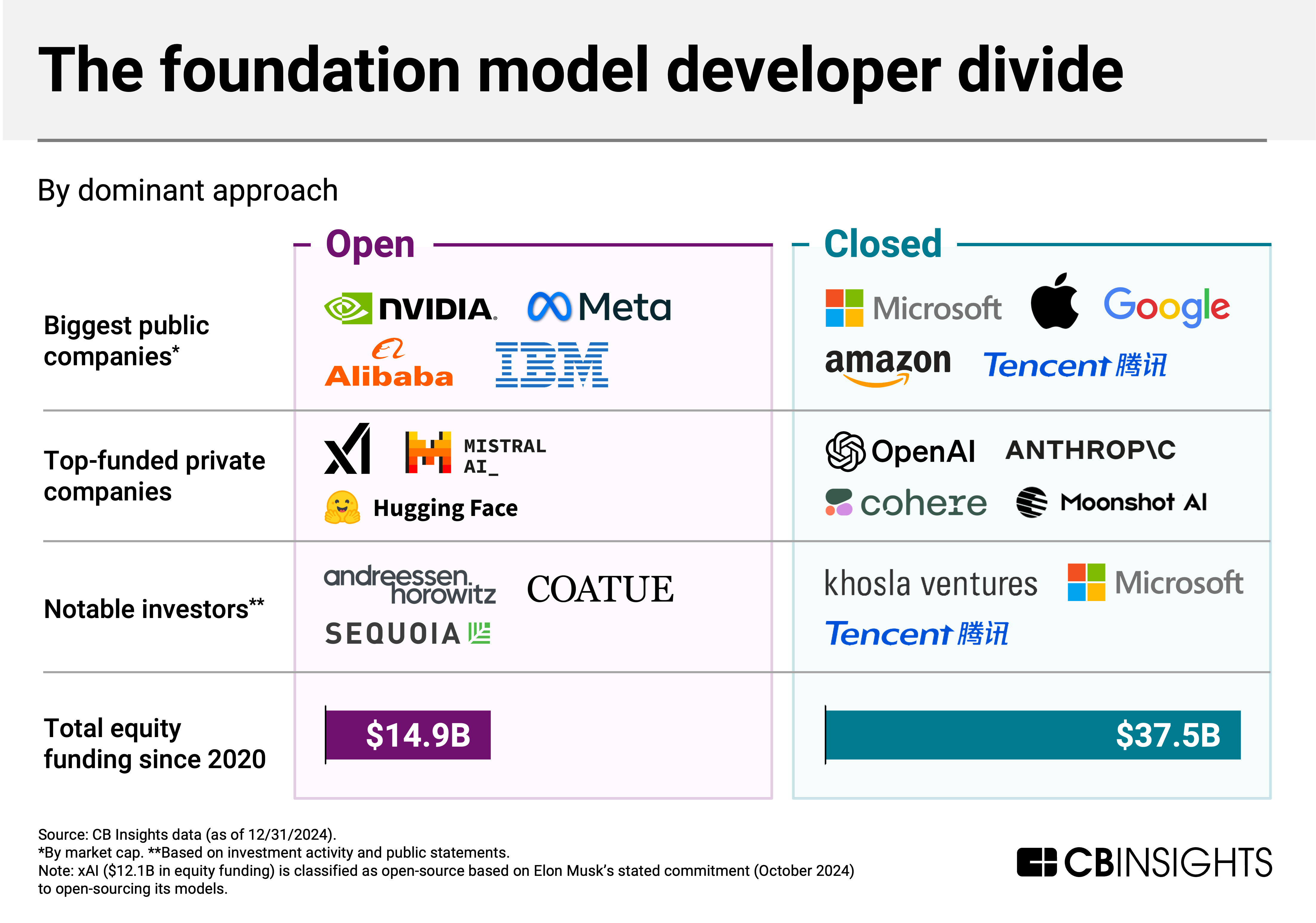

- Path Differentiation: By 2025, the divergence in AI paths between China and the U.S. will be significant. The U.S., represented by OpenAI and others, adopts a closed-source model with heavy investment, relying on huge capital and super computing clusters; China, represented by DeepSeek, Qwen, etc., uses an open-source low-cost strategy, reducing computing power requirements through engineering optimization.

- Investment Scale: In 2024, U.S. private AI investment reached $109.1 billion, while China’s was only $9.3 billion (a gap of about 12 times); U.S. tech giants’ 2025 AI infrastructure investment is approaching $400 billion, and OpenAI plans to invest $500 billion in the StarGate project.

- Cost Advantage: The training cost of China’s open-source models has been significantly reduced (e.g., DeepSeek only costs $4.6 million, with performance comparable to GPT-5); China’s total intelligent computing scale is 788 EFLOPS, ranking second globally, and its configuration is optimized through the “Eastern Data, Western Computing” project.

- Bubble Risk: Multiple Wall Street executives have warned of overheating AI investments; the five major tech giants’ AI capital expenditures are expected to reach $371 billion, but returns are questionable, and the heavy-asset model subverts traditional software valuation logic; Hong Kong stock valuations are at a historical low.

The differences in AI paths between China and the U.S. form a complementary competitive pattern: the U.S. leads in technology but faces high costs and large bubble risks, while China’s cost advantages and rich application scenarios may become long-term advantages; RMB assets are influenced by AI concepts but have low valuations, and their long-term value depends on cost control and implementation capabilities.

- Risks: The bursting of the U.S. AI bubble may spread globally, and the progress of technology commercialization is slow; rapid growth in capital expenditures does not match returns.

- Opportunities: China’s AI enterprises have prominent cost advantages and broad industrial application scenarios; RMB assets have great potential for valuation repair.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.