Strategies for Handling Early Price Target Hits on SPX and SPY Options

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

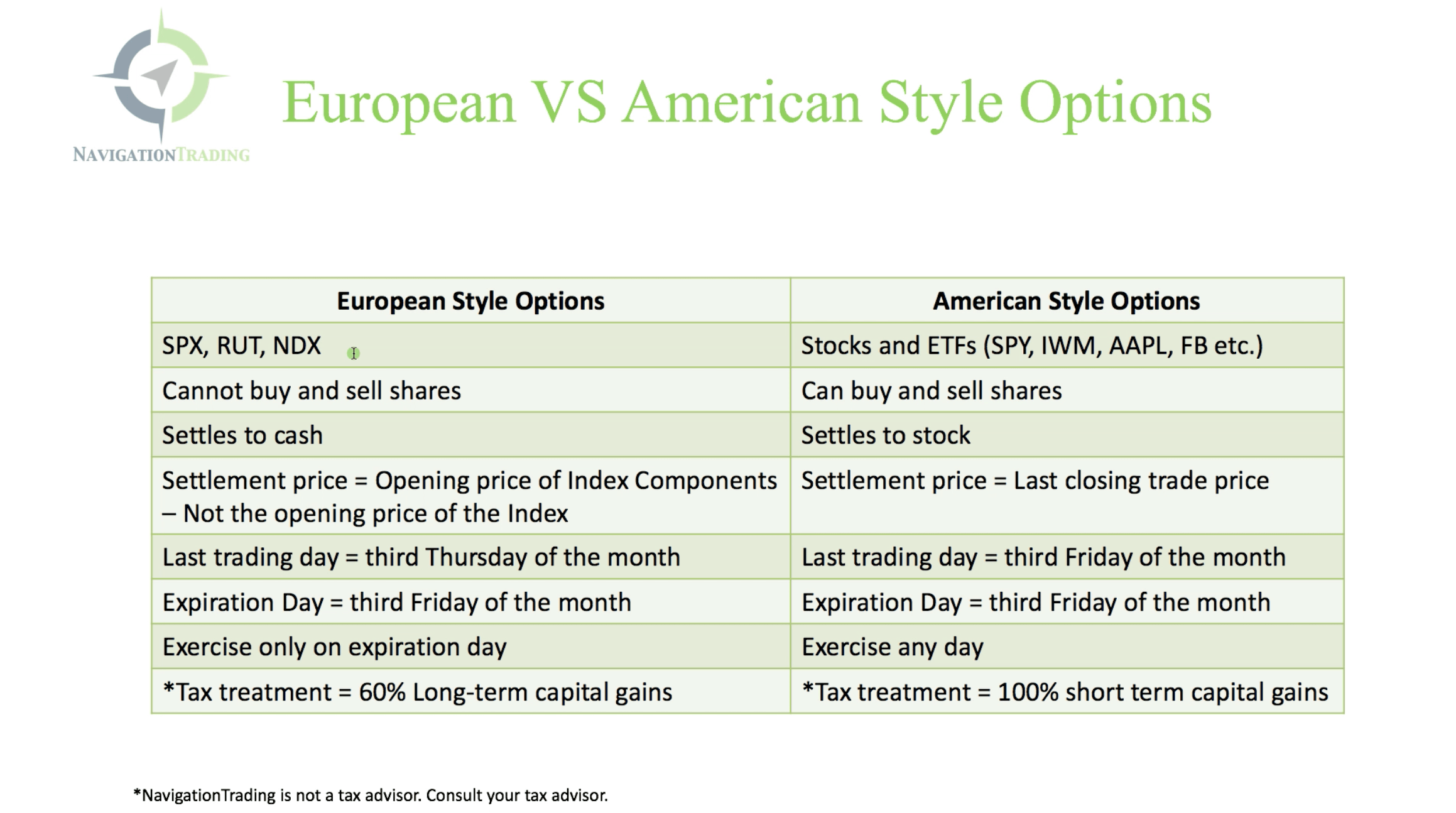

This analysis addresses a Reddit post (2025-11-19 EST) asking about strategies for handling early price target hits on dated options for SPX (S&P500 Index) and SPY (SPDR S&P500 ETF) [0]. Key instrument-specific considerations include:

- SPX Options: European-style (cash-settled, no early exercise) [3][5]. Traders face no assignment risk but must account for implied volatility (IV) decay and potential price reversal if holding beyond the target [1].

- SPY Options: American-style (physical delivery, early exercise allowed) [3][5]. Traders holding in-the-money (ITM) positions risk early assignment, requiring capital for physical settlement [4].

Strategy differences: Credit spreads benefit from early exit to lock profits [2], while directional trades use trailing stops to balance upside potential with risk protection [1].

Cross-domain correlations reveal:

- Tax Implications: SPX options enjoy 60/40 tax treatment (long/short-term gains split) versus standard capital gains for SPY [3][4], influencing exit timing decisions.

- Contract Size: SPX contracts ($100 × index value) are larger than SPY ($100 × share price), so early exits for SPX may yield more significant absolute profits [3][5].

- Risk-Reward Tradeoff: Holding SPX options post-target allows for further gains but exposes traders to IV decay; SPY holders face assignment risk alongside these factors [1][4].

- Risks:

- SPY traders: Early assignment risk for ITM positions, requiring immediate capital to settle 100-share contracts [4].

- Both instruments: Profit erosion from IV decay (especially for short-dated contracts) and price reversal [1].

- Opportunities:

- Trailing stops (e.g.,5% below current price) enable SPX traders to capture additional upside while protecting gains [1].

- Early exit for SPY ITM positions avoids assignment risk and locks in profits [4].

This analysis synthesizes data to support decision-making:

- Instrument Differences: SPX (European, cash-settled) vs SPY (American, physical) drive distinct exit strategies.

- Core Strategies: Lock profits immediately, use trailing stops, or exit early (for SPY ITM positions).

- Critical Factors: IV levels, market trends, and tax implications should guide decisions, with no one-size-fits-all rule applicable to all traders.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.