Jinyuan Co., Ltd. (000546) Limit-Up Analysis: Market Enthusiasm Driven by Takeover Concept and New Energy Transformation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

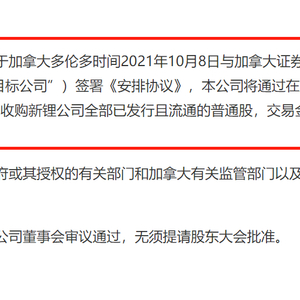

Jinyuan Co., Ltd. (000546) has recently seen consecutive limit-ups, with a 2-day 2-board gain of 10.03% and classified as a takeover concept stock [0]. Its main business is solid waste resource comprehensive utilization (accounting for 97.84%) and it is transforming towards new energy materials [0]. This limit-up is driven by multiple factors:

- Takeover Concept Speculation: Market expectations of potential equity changes have pushed up the stock price [0];

- New Energy Transformation Expectations: The company’s lithium carbonate products are in the trial production phase, benefiting from new energy sector rotation and rising lithium carbonate price expectations [0];

- Market Sentiment Impact: The recent activity of environmental protection and new energy sectors has boosted related stocks [3].

Financially, the company’s first three quarters’ revenue increased by 50.17%, but net profit lost 102 million yuan [0]. The controlling shareholder has pledged nearly 70% of its shares (69.01%), a high rate attracting market attention [4].

- Concept and Transformation Resonance: The叠加 effect of takeover concept and new energy transformation is the core driver of this price movement, though fundamentals remain unimproved;

- Risks and Opportunities Coexist: High pledge rate brings both attention and potential liquidity risks;

- Sector Rotation Feature: The stock price is highly correlated with the new energy sector trend, reflecting funds’ pursuit of hot topics [3].

- Performance Loss: Negative net profit in the first three quarters, insufficient fundamental support [0];

- High Pledge Risk: 69.01% pledge rate of the controlling shareholder may trigger liquidation risk [4];

- Transformation Uncertainty: Lithium carbonate business is still in trial production, with mass production and profit prospects to be verified [0].

- New Energy Track Dividend: Smooth progress of lithium carbonate business is expected to benefit from industry growth [0];

- Sector Rotation Opportunity: Continuous activity of environmental protection and new energy sectors may bring short-term trading opportunities [3].

Jinyuan Co., Ltd. (000546)'s limit-up trend is mainly driven by takeover concept, new energy transformation expectations, and market sector rotation. Although current performance is poor and high pledge risks exist, the potential value of new energy business and market sentiment still support short-term enthusiasm. Investors should pay attention to transformation progress, pledge risks, and sector trends to rationally evaluate investment value.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.