Analysis of Short-Term Stock Price Fluctuations of Longzhou Co., Ltd. (002682): Driving Factors of Limit-Up and Risk Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

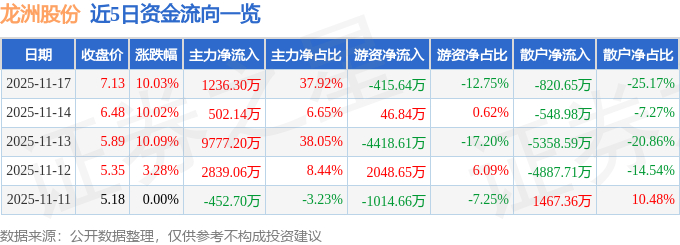

Longzhou Co., Ltd. (002682) has experienced significant short-term stock price fluctuations recently: it achieved a limit-up and entered the limit-up pool on November 18 [3], but plummeted by 9.95% the next day (November 19), with a net sell-off of 128 million yuan by main funds [2]. The company issued an announcement on abnormal stock trading fluctuations because the cumulative deviation value of the closing price increase exceeded 20% for two consecutive trading days [1,5].

The company’s business involves hot areas such as special-purpose vehicle manufacturing and new energy logistics [3], and it is also included in the AI concept stock list [8]. Benefiting from the market’s investment enthusiasm for related concepts, it has attracted short-term capital inflows.

The chase by short-term market capital drove the stock price to rise continuously, but then there were obvious signs of capital outflow [2,7], reflecting the characteristics of speculative trading.

The linkage effect of multiple stocks hitting limit-up in related sectors further pushed up the stock price of Longzhou Co., Ltd. [3].

According to internal analysis data [0], in the first three quarters of 2025, the company’s revenue was 1.825 billion yuan, a year-on-year decrease of 26.61%; the net profit attributable to shareholders was a loss of 95.64 million yuan, showing weak fundamentals.

The stock price has risen and fallen sharply in the short term, with a net sell-off of 128 million yuan by main funds on November 19 [2], indicating high volatility risk and strong speculation.

The company has issued multiple abnormal fluctuation announcements to remind investors to pay attention to investment risks [1,5].

The recent stock price fluctuations of Longzhou Co., Ltd. are mainly driven by concept speculation and short-term capital, lacking performance support. Investors should be alert to its high volatility risk, rationally view the short-term market brought by concept speculation, and pay attention to the improvement of the company’s fundamentals.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.