Analysis of Stop Loss Strategy: Breakeven Adjustment vs. Original Placement

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

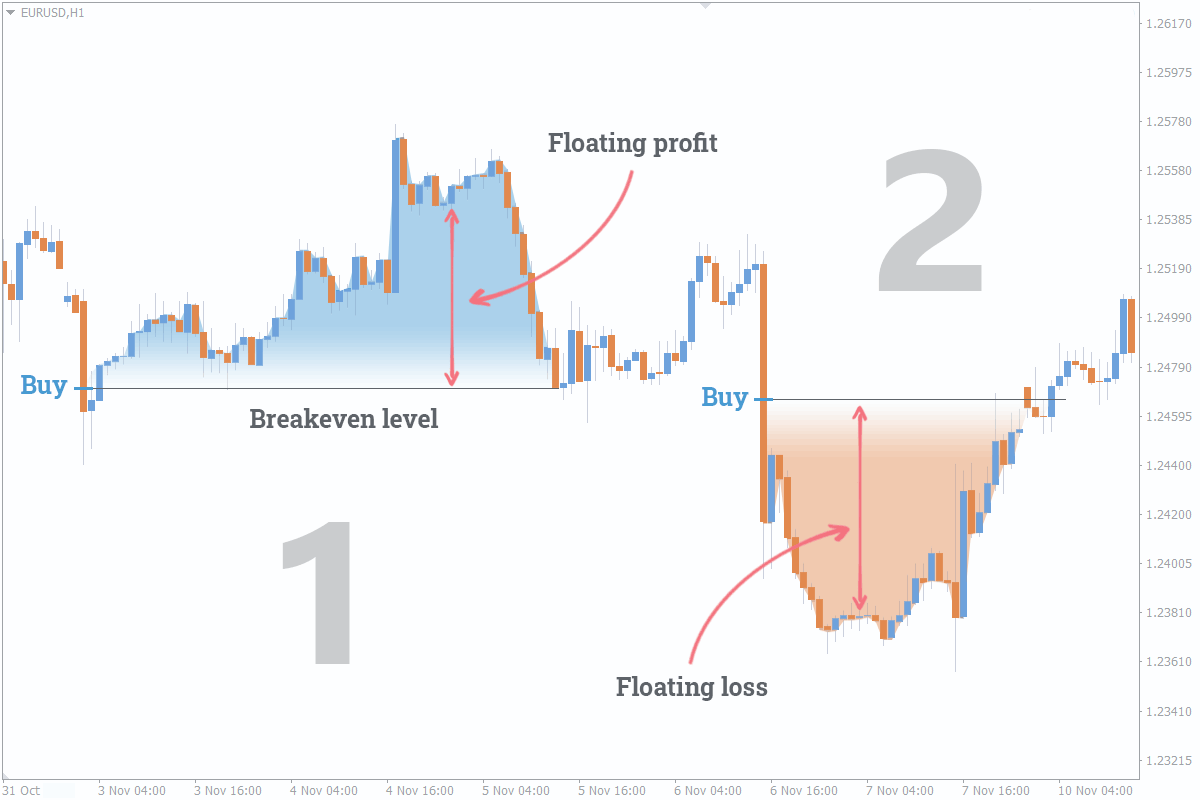

The analysis addresses a trader’s question: Is moving a stop loss (SL) to breakeven after taking 25% partial profits at a 1:1 risk-reward (RR) ratio superior to leaving the original SL untouched? The strategy balances capital protection (eliminating downside risk) against potential missed gains from larger price moves.

- Context-dependent validity: Moving SL to breakeven is justified after partial profits if price breaks key levels or in volatile markets [1].

- Partial profit + breakeven approach: A common practice is to take partial profits at 1:1 RR, move SL to breakeven, and let the remaining position run [2].

- Backtest tradeoffs: A 100-trade backtest found breakeven SL was hit ~16% of the time—reducing losses in 5 trades but missing gains in 11 [3].

- Risk-reward impact: Changing SL undermines original risk-reward calculations, potentially leading to emotional decision-making [4].

- Win rate requirement: A 1:1 RR strategy needs a 50% win rate to break even, higher than ratios like 2:1 (33% win rate) [5].

The strategy reflects a tradeoff between risk mitigation and upside capture:

- Risk protection: Moving SL to breakeven after partial profits eliminates the chance of loss on the remaining position, which is valuable in volatile markets (e.g., low-cap crypto or news events) [1].

- Upside limitation: Backtest data shows 11 profitable trades were stopped at breakeven, indicating the strategy can cap gains [3].

- Market regime relevance: In trending markets, leaving the original SL untouched may allow capturing larger moves, while the breakeven approach is better for ranging or volatile conditions [1][2].

- Psychological benefits: The strategy reduces stress by removing downside risk, though it may lead to regret if the price continues to move favorably after breakeven [3].

For traders implementing this strategy:

- Loss reduction: 5 trades avoided losses due to breakeven SL in the backtest [3].

- Gain reduction: 11 trades missed additional profits, as the price reversed after hitting breakeven [3].

- Win rate dependency: Since the strategy relies on 1:1 RR, traders need a 50% win rate to be profitable—higher than strategies with larger RR ratios [5].

- Emotional discipline: The approach helps maintain discipline by removing the temptation to let losses run, though it may require adjusting to missed gains [4].

- Strategy popularity: The partial profit + breakeven SL approach is widely discussed in trading communities, especially for short-term trades [2][3].

- Market specificity: The strategy’s effectiveness varies by asset class—more useful for volatile assets (crypto) than stable ones (blue-chip stocks) [1].

- Complementary tactics: Traders often combine this strategy with trailing stops for the remaining position to capture additional gains [2].

- Asset class specificity: No data on how the strategy performs across different asset classes (stocks, crypto, forex) mentioned in the original question.

- Long-term performance: The backtest sample size (100 trades) is small—no data on long-term performance across market cycles.

- Win rate alignment: No information on how the strategy interacts with the trader’s existing win rate (critical for 1:1 RR profitability [5]).

- Transaction costs: No analysis of how broker fees or slippage affect net returns for this strategy.

[0] Ginlix Analytical Database (for framework and synthesis)

[1] Binance. “Breakeven Stop Loss: The Silent Killer of Profits or the Smartest …” Binance Square. URL: https://www.binance.com/en/square/post/24845559813970

[2] Forex Factory. “1:1 Risk/Reward Frowned Upon?” Thread. URL: https://www.forexfactory.com/thread/1058596-11-riskreward-frowned-upon

[3] YouTube. “I TESTED Breakeven Stoploss 100 TIMES… but this happened.” Video. URL: https://www.youtube.com/watch?v=r55TZ-0BkoM

[4] TradeFundrr. “Risk Reward Ratio Explained: Smart Trading Guide.” URL: https://tradefundrr.com/risk-reward-ratio-explained/

[5] Tradeciety. “How To Use The Reward Risk Ratio Like A Professional.” URL: https://tradeciety.com/how-to-use-reward-risk-ratio-guide

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Trading involves risk.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.