Tesla Crash Risk Analysis: Reddit Sentiment vs. Valuation Reality

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Reddit discussions reveal strong concerns about Tesla’s crash potential, with consensus that the stock trades on “irrational hype/Musk narrative rather than metrics”[citation:0]. Key Reddit insights include:

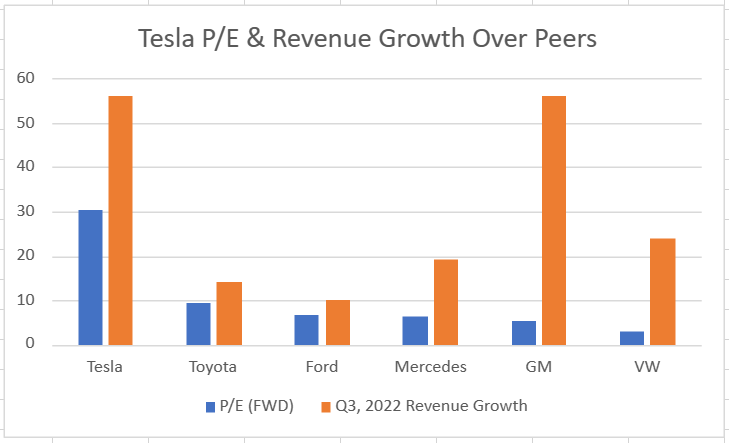

- Valuation Concerns: Multiple commenters warn Tesla is “fundamentally overvalued” with P/E ratios far exceeding traditional automakers

- Execution Risk: Users cite missed Musk promises on robot targets and autonomous driving as major red flags

- Shorting Dangers: Several experienced traders caution that “betting against irrational sentiment can lead to losses”[citation:0]

- Crash Triggers: Reddit identifies potential catalysts including Musk departure/death, failure to deliver on robots/FSD, or broad market downturn

- Volatility History: Some note Tesla has already experienced significant drops and may only crash alongside the broader market

- Tesla’s P/E ratio of 181.1x TTM represents a massive premium over automotive peers (Ford 14.7x, GM 8.9x, Toyota 9.1x, Volkswagen 6.0x, BMW 8.6x)[citation:1][citation:2][citation:3][citation:4][citation:5]

- P/S ratio of 13.2x dramatically higher than peer range of 0.16x-0.81x

- Automotive sector median P/E is only 8.1x, highlighting Tesla’s extreme premium[citation:0]

- Optimus humanoid robot production delayed from 2024 to late 2025/early 2026[citation:6]

- Robotaxi unveiling postponed from August 8 to October 2024 due to prototype development needs[citation:7][citation:8]

- Full Self-Driving continues to face regulatory scrutiny and safety investigations[citation:9]

- Cybertruck production hampered by quality issues including windshield wiper problems and accelerator pedal recalls[citation:10]

- Tesla’s cheaper Model 2/next-generation vehicles delayed to 2025 with slower than expected ramp-up[citation:11][citation:12]

- Company missed earnings expectations in Q2 2024 despite beating revenue estimates[citation:13]

Reddit sentiment and research findings align closely on Tesla’s fundamental risks. Both sources confirm extreme valuation disconnect from traditional automotive metrics and significant execution challenges. However, Reddit provides crucial nuance about market psychology - Tesla may maintain elevated valuations despite fundamentals if belief in future potential persists.

The key tension is between rational valuation metrics (suggesting crash risk) and irrational market sentiment (supporting continued premium). Reddit correctly identifies that Tesla’s valuation hinges on “future potential (robots/FSD) and Musk’s influence; delays may not derail the stock if belief persists”[citation:0].

- Valuation correction if growth expectations falter

- Further delays or failures in robot/FSD initiatives

- Musk departure or reduced influence

- Regulatory crackdown on autonomous driving claims

- Broad market downturn affecting high-multiple stocks

- Successful delivery on delayed robot/FSD promises could justify premium

- Market leadership in EV technology and charging infrastructure

- Potential for autonomous driving breakthroughs

- Expansion into energy storage and AI applications

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.