Trading Strategy Analysis: Win Rate vs Risk-Rward Ratio Debate

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The Reddit discussion from r/Daytrading reveals practical trader experiences with both approaches:

-

OP’s Success Story: The original poster found improved consistency and profitability by cutting targets to 1R after observing trades frequently reached ~1R but not 2R/3R, achieving ~75% win rates Reddit

-

Psychological Preference: Multiple traders emphasize the psychological benefits of high win rates. TimeToEndThis_Now reports hyper scalping with 90%+ win rate and 1:1.8 RR, preferring high win rate for psychological comfort Reddit

-

Hybrid Approaches: SanskrutiChaiBar runs both systems - high WR (75%, RR 1.5-3) to cover drawdowns of low WR (35%, RR 4-9), maintaining similar psychology across both Reddit

-

Account Type Matters: CupLower4147 notes cash accounts favor high RR for growth, while prop firms often require high WR/low RR due to consistency rules Reddit

-

Risk Management: ZanderDogz emphasizes that lower WR systems can return more R over time but with higher losing streak risk, while higher WR allows larger position sizing Reddit

Expert analysis provides mathematical and psychological frameworks:

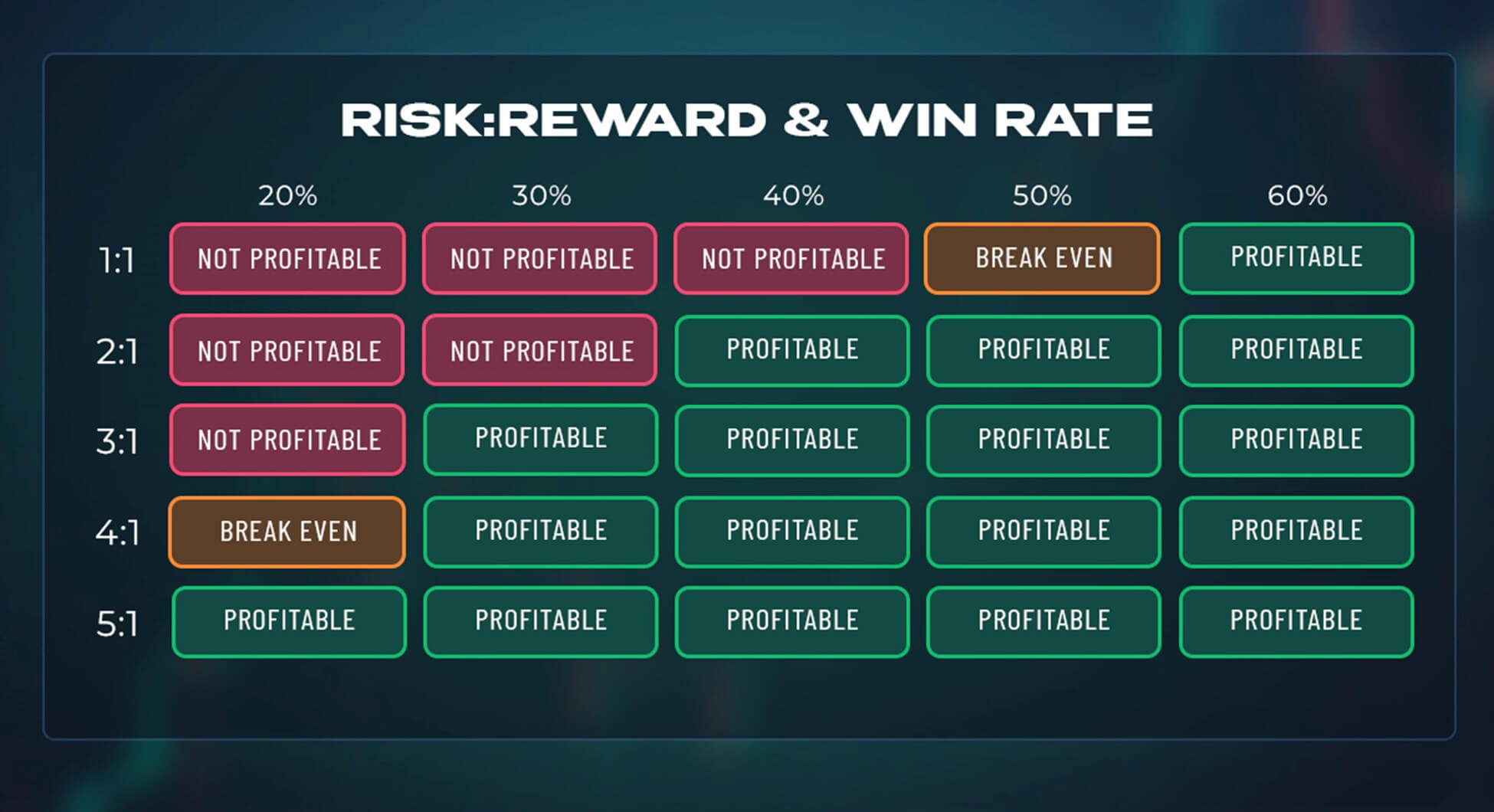

- 1:1 risk-reward ratios require 50%+ win rates to break even and 60%+ to be profitable LuxAlgo

- 2:1 risk-reward ratios need only 33% win rates to break even and 40%+ for profitability BajajFinserv

- 3:1+ ratios are considered ideal by many experts as they allow profitability with even lower win rates TradingView

- Frequent small wins create positive psychological reinforcement and build trader confidence ColibriTrader

- Consistent positive outcomes help traders maintain discipline and stick to their trading plans ForexRecon

- High win rates enable better emotional control as traders experience fewer devastating losses ColibriTrader

- Most professional traders aim for 1:2 to 1:3 ratios as the optimal balance OptionsTrading

- The combination of win rate and risk-reward ratio determines overall profitability, not either metric alone LuxAlgo

The Reddit discussion and expert research reveal both convergence and tension in the win rate vs risk-reward debate:

- Both sources acknowledge that neither metric alone determines success

- Psychological factors play a crucial role in strategy selection

- Personal trading style and risk tolerance should guide approach choice

- Reddit traders report practical success with 1:1 ratios and high win rates, while experts generally favor 2:1+ ratios

- The mathematical efficiency of higher risk-reward ratios conflicts with the psychological comfort of frequent wins

- High win rate strategies can lead to overconfidence and poor risk management during losing streaks

- Low win rate/high risk-reward approaches may cause psychological stress from frequent losses

- Copying others’ strategies without matching personality type often leads to failure

- Hybrid approaches can balance psychological comfort with mathematical efficiency

- Account type optimization (cash vs prop) can guide strategy selection

- Position sizing adjustments can compensate for different risk-reward profiles

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.