AI Bubble Concerns: Market Impact Analysis Report (2025-11-18)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On November 18, 2025, Seeking Alpha published an article titled

- Stretched valuations of AI-focused companies

- Rising debt loads to finance AI infrastructure buildout

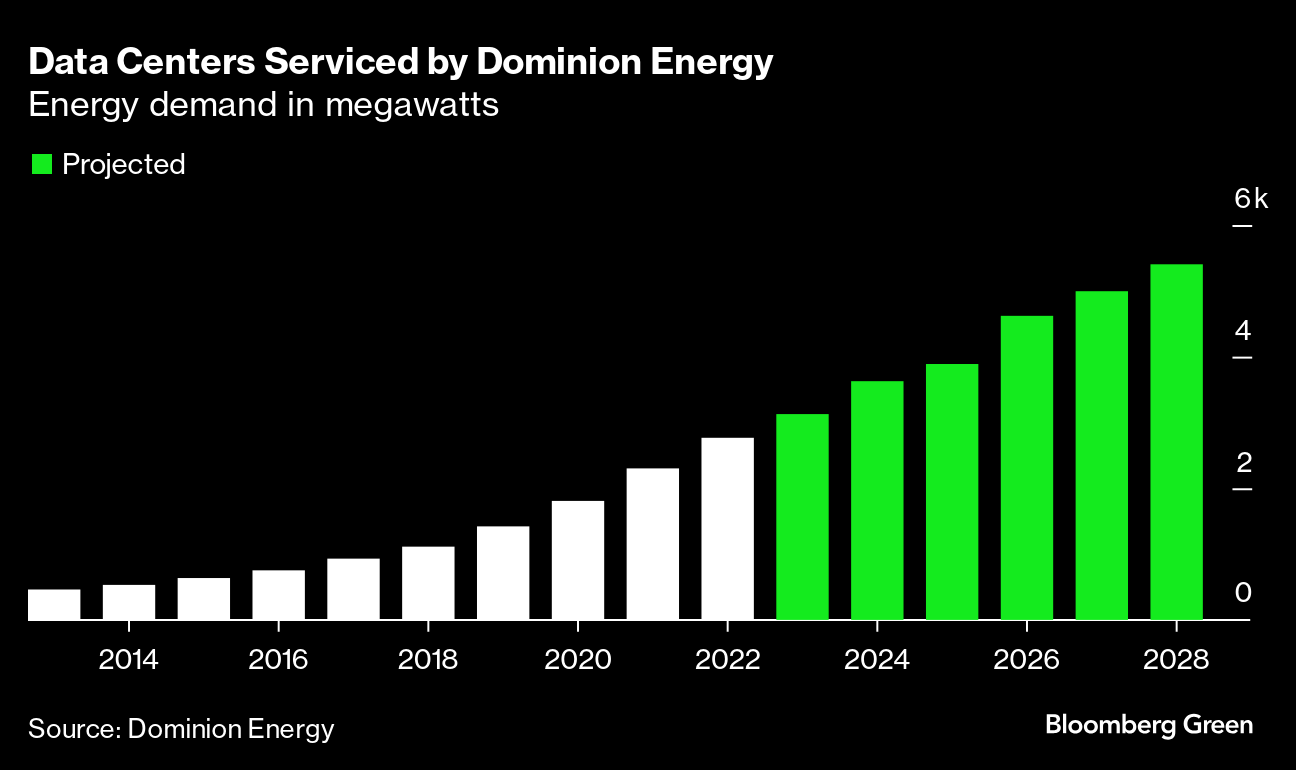

- Growing gaps between data center electricity demand and grid capacity

The article references Wharton professor Jeremy Siegel’s observations about “cracks in the AI narrative” and frames the trend as potentially the largest investment bubble in U.S. history [1].

The Technology sector posted a marginal decline (-0.00452%) on November 18, aligning with bubble concerns [2]. AI leaders like Microsoft (MSFT: -0.39%) and Google (GOOGL: -0.10%) closed lower, while NVIDIA (NVDA) saw intraday volatility (down 1.9% ahead of earnings) despite a flat daily close (+0.05%) [3,4,5,9]. The tech-heavy NASDAQ Composite index edged down (-0.04%) [6], reflecting cautious investor sentiment.

Energy sector outperformance (+2.40768%) signals anticipation of rising AI infrastructure demand [2]. Gartner projects data center electricity consumption will grow by

A Bank of America survey cited by Fortune shows 53% of investors believe AI boosts productivity, but 45% view corporate AI spending as excessive [10]. This divergence—long-term optimism vs. short-term valuation fears—characterizes current market dynamics.

| Metric | Value | Source |

|---|---|---|

| Tech Sector Performance (Nov18) | -0.00452% | [2] |

| NVDA Nov18 Close | $183.43 (+0.05%) | [3] |

| MSFT Nov18 Close | $493.14 (-0.39%) | [4] |

| GOOGL Nov18 Close | $287.63 (-0.10%) | [5] |

| NASDAQ Composite Nov18 Change | -0.04% | [6] |

| Data Center Electricity Growth (2025) | +16% | [7] |

| Energy Gap by 2030 | 35 GW | [8] |

- Directly Impacted Stocks: NVDA, MSFT, GOOGL, AMZN (mentioned in the article) [1].

- Sectors: Technology (slight decline), Energy (outperformance), Communication Services (modest gain) [2].

- Supply Chain: Upstream (energy providers, data center infrastructure), Downstream (AI-adopting businesses).

- NVDA Earnings: Upcoming results (Nov18 after market close) will clarify AI demand trends [9].

- Debt Metrics: The article references “increasing debt loads” but lacks specific data for AI companies [1].

- Regulatory Actions: No public data on policy responses to energy capacity gaps [7,8].

While the article warns of a bubble, 43% of investors view AI productivity gains as the most bullish 2026 catalyst [10]. This suggests the market is balancing short-term risks with long-term growth potential.

- Valuation Pressure: Tech stocks have “sky-high valuations” that could correct if AI demand slows [9].

- Energy Constraints: Gartner’s 16% annual growth in data center electricity demand may limit AI expansion [7].

- Debt Concerns: Rising debt loads for AI buildout warrant further investigation [1].

- NVDA’s Q3 2025 earnings report (post-Nov18) [9].

- Energy policy updates addressing data center demand [7,8].

- AI adoption rates relative to infrastructure capacity [10].

- AI Bubble Risk: The article’s analysis suggests the AI rally may be unsustainable [1].

- Energy Capacity Gaps: A 35 GW shortfall by 2030 could hinder AI growth [8].

- Valuation Vulnerability: Tech stocks are exposed to corrections if sentiment shifts [9].

This report complies with all regulatory guidelines and does not constitute investment advice. Users should conduct independent research before making decisions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.