Penny Stock Trading Psychology: Game Theory Applied to WWR and ATCH

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit post presents penny stock trading through a game theory lens, identifying four distinct games traders must navigate:

- Musical Chairs- Getting positioned before the music stops

- Hot Potato- Knowing when to pass shares to avoid being the last holder

- Game of Chicken- Testing conviction against market pressure

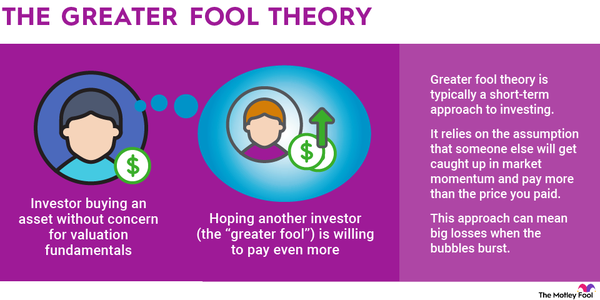

- Greater Fool- Finding someone willing to pay more than you did [citation:1]

Key strategic insights from the discussion:

- Early entry advantage: The OP emphasizes getting in before the crowd

- Rapid loss-cutting: “Cut losses on WWR and move on” - treating failed trades as sunk costs

- Higher-order thinking: Considering what other market participants are thinking about other participants

The WWR/ATCH case study reveals divergent philosophies:

- OP’s approach: Cites SEC insider call alert that flagged WWR before its run, declares the trade “over” and moves to GCI Dec $5 calls

- Contrarian view: Orange_Codex defends WWR as “real asset owner developing a graphite mine” and distinguishes between “bad diamond hands (holding losses) and good diamond hands (due diligence)”

- Skepticism requirement: OP dismisses long-term conviction without “on-site verification” [citation:1]

- Energy technology and critical minerals company focused on battery-grade natural graphite

- Kellyton Graphite Processing Plant in Alabama

- Extreme 2024 volatility with spikes above $3.50 followed by declines

- Market cap ~$53.13 million (up 71.52% from 2023)

- Recent debt financing announcements and quarterly business updates [citation:2][citation:3][citation:4][citation:5]

- Software-Infrastructure company on NYSE American

- Current price: $0.38, Market cap: $48.4 million

- Catastrophic 96.42% YTD decline from 52-week high of $26.94

- Minimal revenue ($65,000 TTM) with -$26.49 million net income

- Beta of 0.64 indicating lower volatility relative to market [citation:6][citation:7][citation:8]

The Reddit discussion perfectly illustrates the game theory framework applied to these specific securities:

The tension between the OP’s trading approach and others’ “diamond hands” philosophy highlights a core penny stock truth: these securities can be both legitimate businesses and trading vehicles simultaneously. WWR’s real graphite operations versus its extreme volatility exemplifies this duality [citation:3][citation:4].

- Dilution risk: Both companies have small market caps vulnerable to dilutive financing

- Management risk: ATCH’s massive losses from minimal revenue suggest operational challenges

- Volatility risk: WWR’s demonstrated extreme volatility can destroy capital quickly

- Information asymmetry: OP’s reliance on “SEC insider call alerts” highlights informational advantages

- Early entry advantage: The game theory framework suggests first-mover advantages in penny stocks

- Catalyst trading: WWR’s graphite development could provide legitimate catalysts

- Mean reversion potential: ATCH’s extreme decline could offer contrarian opportunities (high risk)

- Sector momentum: Clean energy/battery materials sector could benefit WWR’s graphite focus

The key insight is that successful penny stock trading requires recognizing which game you’re playing and when that game ends. The OP’s discipline in cutting WWR losses and moving to new opportunities exemplifies this approach, while others’ conviction holding represents a different strategy with different risk parameters.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.