Stock Futures Analysis: November 2025 Market Opening with Sector Rotation Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Barron’s report [1] published on November 2, 2025, which indicated stock futures were drifting higher to kick off a new month of trading following October’s gains. The positive pre-market sentiment aligns with current futures data showing major indices positioned for an upward opening [2].

- Technology Sector Weakness:The -1.74% decline in technology [0] could signal broader growth concerns if this trend continues, potentially dragging down the Nasdaq and growth-oriented portfolios.

- Elevated Volatility:The VIX increase of +3.13% [2] indicates underlying market nervousness despite positive futures, suggesting potential for sudden market reversals.

- Policy Uncertainty:China’s gold policy impact [1] demonstrates how quickly regulatory changes can affect commodity markets, creating additional uncertainty for related sectors.

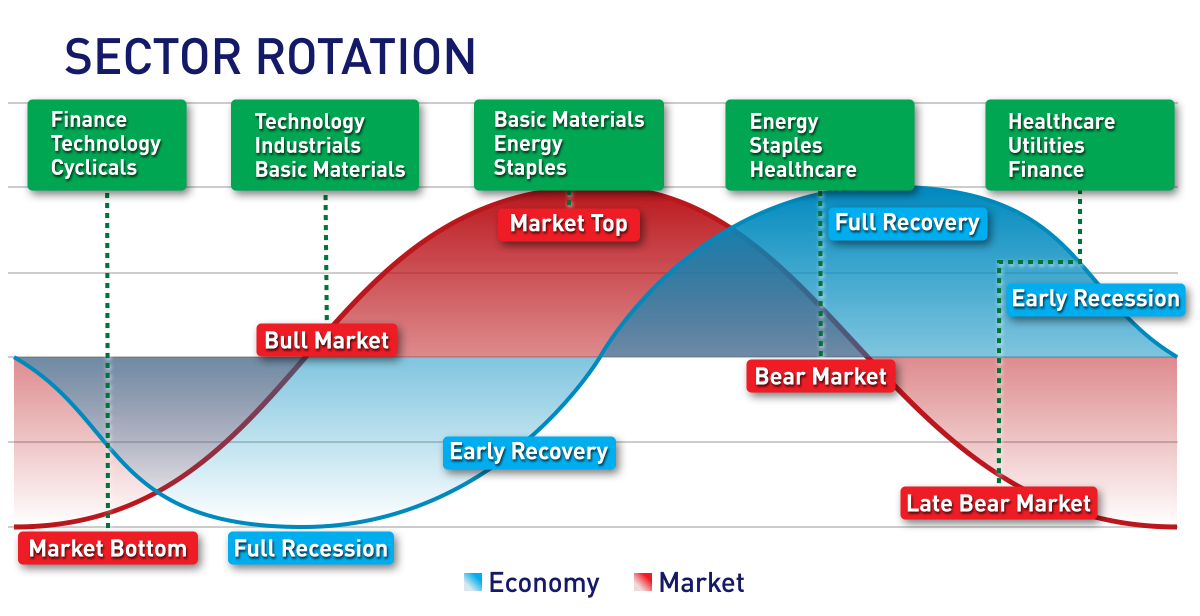

- Value Rotation:The outperformance of energy (+2.81%) and financial services (+1.38%) [0] suggests opportunities in value-oriented sectors as investors rotate away from extended growth stocks.

- Momentum Carry-over:October’s strong S&P 500 performance (+2.63%) [0] and positive futures indicate potential for continued market strength in early November.

- Commodity Plays:Oil price strength (+0.68%) [2] combined with energy sector leadership could provide opportunities in energy-related investments.

The November 2025 market opening is characterized by positive futures momentum building on October’s gains, but with significant underlying sector rotation and elevated volatility. Major index futures show modest gains (S&P 500 +0.29%, Dow +0.23%, Nasdaq +0.32%) [2], supported by strong performance in energy (+2.81%) and financial services (+1.38%) sectors [0]. However, technology weakness (-1.74%), utility declines (-2.00%), and a rising VIX (+3.13% to 17.44) [2] suggest selective rather than broad-based market participation. The gold market’s reaction to China’s policy changes [1] highlights the importance of monitoring regulatory developments and their commodity market impacts. Investors should focus on sector allocation decisions and upcoming economic data releases to navigate the early November trading environment effectively.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.