Bank of America Fund Manager Survey Highlights Market Risks Amid Bullish Positioning and Fed Rate Cut Uncertainty

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

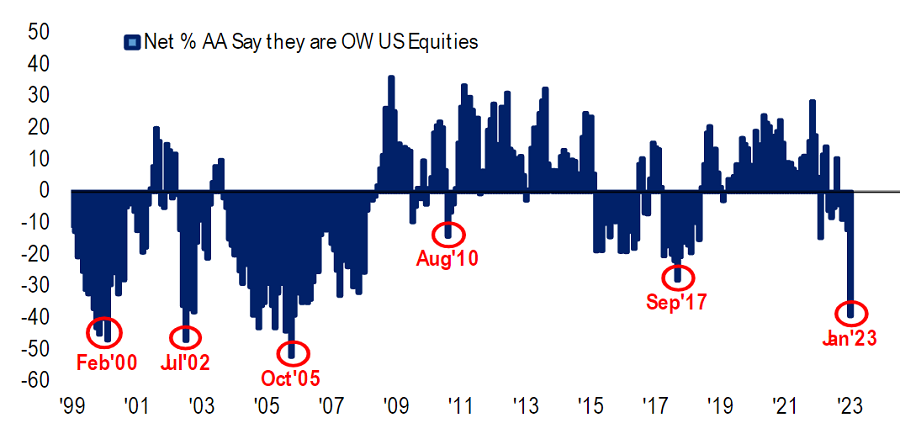

The November 2025 Bank of America fund manager survey [1][2] reveals investors are the most overweight stocks since February 2025, with portfolio cash levels at 3.7%—a threshold generating a technical sell signal [2]. This positioning is identified as a headwind for risk assets [1]. Market data [0] shows prior to the survey release (2025-11-17), major indices declined: S&P500 (-0.61%), NASDAQ (-0.35%), Dow Jones (-1.02%). On release day (2025-11-18), defensive sectors like Utilities (+0.84%) outperformed while risk-sensitive Financial Services (-2.41%) underperformed [0]. The survey covers 172 fund managers managing $475 billion in assets [2].

Cross-domain correlations include the link between Fed rate cut expectations and market stability—without a December cut, the survey warns of further corrections [2]. The most crowded trade (Long Magnificent7, 54% respondents [2]) and biggest tail risk (AI bubble,45% [2]) highlight concentration risk in tech stocks. Defensive sector outperformance (Utilities +0.84% [0]) indicates a shift toward safety amid uncertainty.

Major risks include technical sell signals from low cash levels [2], potential AI bubble burst [2], and financial sector vulnerability without Fed rate cuts [2]. Opportunities exist in defensive sectors like Utilities, which showed resilience amid market volatility [0]. Investors should monitor Fed December meeting outcomes as a critical catalyst for market direction [2].

The survey, conducted Nov 7-13 2025 [2], reflects bullish positioning but fragile market conditions. Key metrics: 3.7% cash levels (sell signal), 54% crowded trade in Magnificent7, and 45% tail risk from AI bubble [2]. Market data shows pre-survey index declines and post-survey defensive sector outperformance [0]. No prescriptive recommendations are provided—this summary supports decision-making with objective analysis.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.