Market Timing vs. Time in Market: Reddit Investor Anxiety Meets Historical Reality

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Reddit discussion reveals a common anxiety among young investors hesitant to enter at market peaks. Key insights from the r/stocks community include:

- Consensus against market timing: Multiple experienced investors report seeing similar “wait for crash” posts daily for years, with one commenter noting they doubled their money despite these fears

- Age advantage perspective: Commenters emphasize that at 20 years old, even a 50% market crash would recover by retirement age, making timing concerns largely irrelevant for long-term investors

- Dollar-cost averaging advocacy: Users stress that DCA smooths pricing over time and protects against attempting to time market bottoms

- Historical perspective: One user noted the S&P 500 rose from ~1,500 in 2007 to ~6,800 today despite multiple crashes, demonstrating long-term growth potential

- Risk awareness: Some acknowledge current overvaluations make a correction “inevitable” but emphasize timing remains unknown

Current market conditions validate Reddit users’ concerns about elevated valuations:

- Record valuations: S&P 500 CAPE ratio at 35.7-39+ (near second-highest in 154 years), forward P/E at 22.4-22.9x (above 10-year average of 18.6x) [1][2][3]

- Buffett Indicator: Market cap to GDP ratio reached all-time highs of 212-219% [5]

- Market concentration: Top 10 companies represent 43% of S&P 500, creating concentration risk [7]

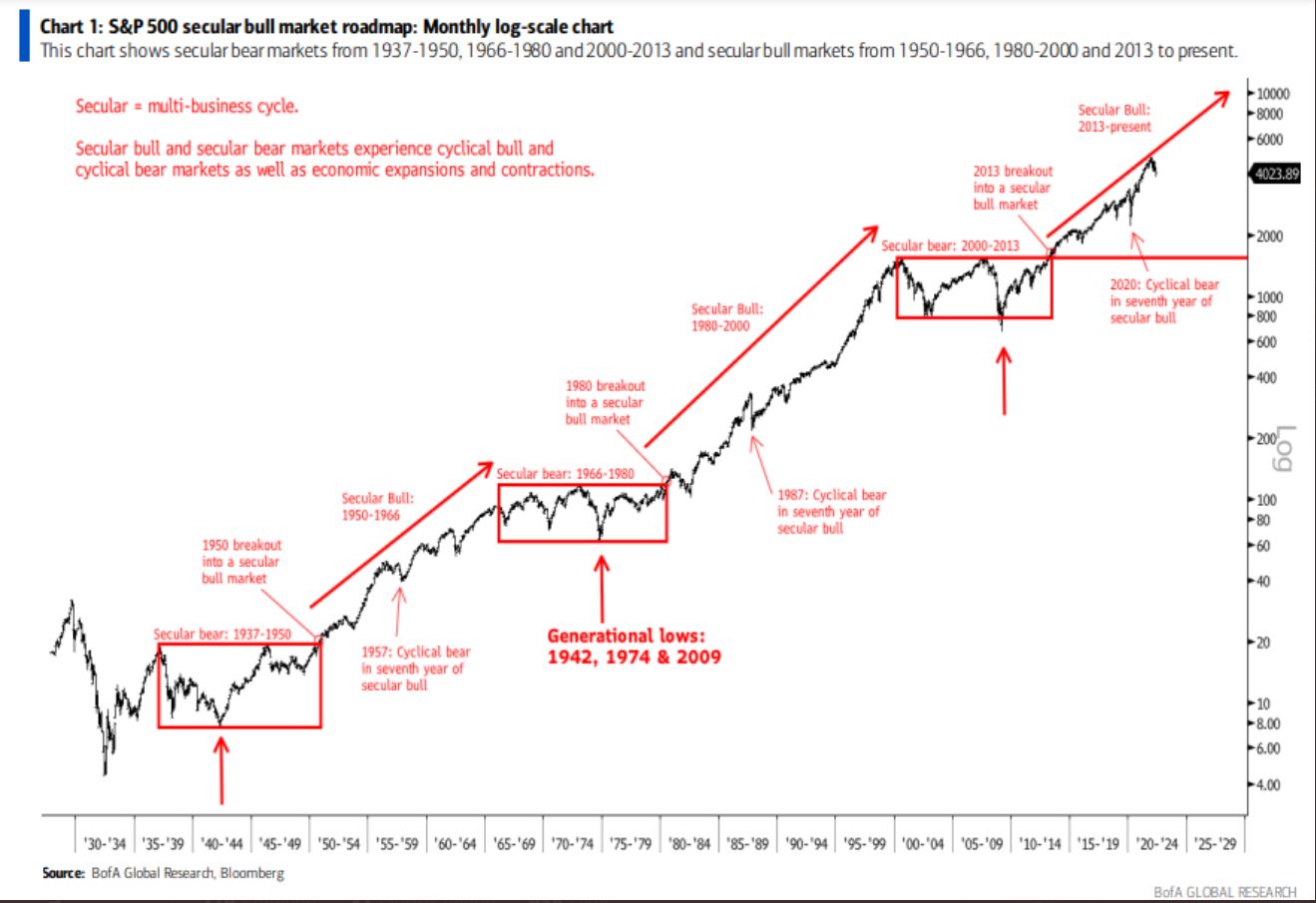

However, historical data strongly supports continuous investing:

- Perfect 20-year record: S&P 500 has generated positive returns in 100% of 20-year periods since 1928 [6]

- Minimal timing impact: Studies show negligible performance difference between investing at all-time highs versus random dates over long horizons [9]

- Professional underperformance: 92% of active fund managers underperform simple index strategies over 20 years [9]

Reddit’s practical wisdom aligns remarkably with academic research. While both sources acknowledge current market overvaluation, they converge on the conclusion that time in market beats timing the market. The Reddit community’s emphasis on dollar-cost averaging and long-term perspective for young investors is validated by historical data showing perfect 20-year performance records.

The key insight is that valuation concerns, while valid for short-term traders, become largely irrelevant for investors with multi-decade time horizons. Even if a correction occurs, historical recovery patterns and compound growth favor continuous investment.

- Elevated valuations suggest potential for significant short-to-medium term corrections

- High market concentration increases vulnerability to large-cap tech disruptions

- Young investors may panic sell during downturns without proper education

- Dollar-cost averaging allows systematic accumulation at potentially lower prices during corrections

- Long time horizon provides significant advantage for compounding through market cycles

- Current market anxiety may create entry points for disciplined investors

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.