605389 (Changling Hydraulics) Limit-Up Analysis: Driven by Control Change and Performance Growth

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The controlling shareholders Xia Jifa and Xia Zemin have completed the transfer of 29.99% of shares to Wuxi Hexin Tingtao and Chenglian Shuangying via agreement. Hexin Polang intends to acquire 12% of shares via tender offer, and the actual controller will change to Hu Kangqiao [2]. Hexin Interconnect, an associated asset of the new shareholder, is one of the domestic enterprises with the most complete signal chain product system, covering 11 categories of products and over 1500 part numbers [2].

In 2025, the company’s total operating revenue increased by 37.08% year-on-year, and net profit increased by 72.70% year-on-year, showing excellent profitability [2].

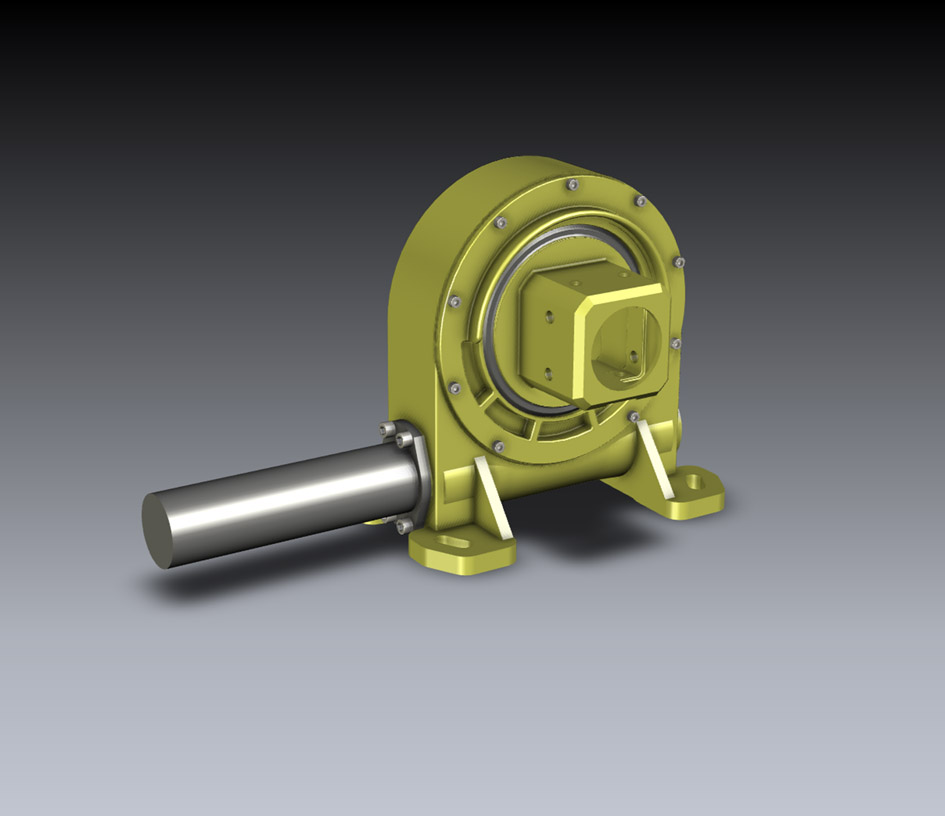

- Construction Machinery: Rotary reducers are supplied in bulk to XCMG Firefighting and Sany Heavy Machinery [2]

- Photovoltaics: Rotary reducers are undergoing testing and verification with leading manufacturers [2]

- Robotics: Small-batch supply of AGV/AMR slewing bearings to Hikvision Robotics and others [2]

On November 18, the stock price hit the limit-up to 67.76 yuan, with 8 limit-ups accumulated this year and a turnover rate of 1.37% [2].

The construction machinery industry had a gross profit margin of 25.48% and a net profit margin of 9.88% in the first three quarters of 2025, and is in a recovery channel [6]. Hydraulic components have high technical barriers, a better competitive landscape, and weaker cyclicality than complete machines [2].

Market analysis suggests that the stock may have continued upward momentum in the future [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.